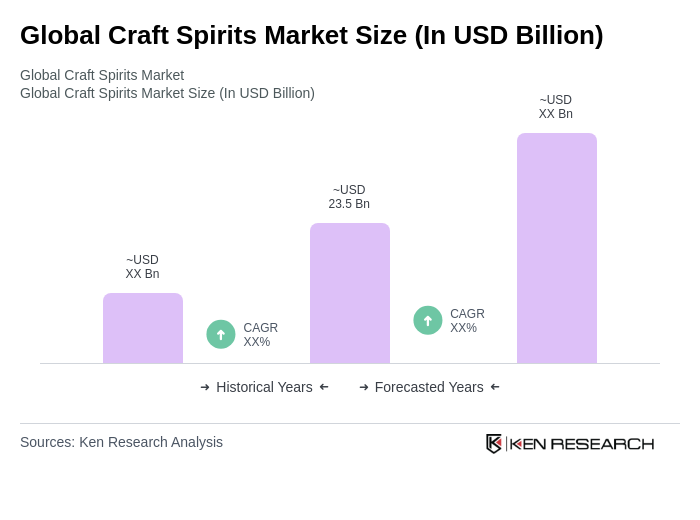

Global Craft Spirits Market Overview

- The Global Craft Spirits Market is valued at USD 23.5 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing consumer preference for artisanal and locally produced spirits, as well as the rising trend of premiumization in the beverage industry. The market has seen a significant shift towards craft distilleries, which offer unique flavors and experiences, appealing to a more discerning consumer base. Recent trends highlight the impact of millennials and Generation Z, who seek authentic brand stories and locally sourced ingredients, further accelerating market expansion. The proliferation of microbreweries and the surge in ready-to-drink cocktails also contribute to robust market growth .

- Key players in this market include theUnited States,United Kingdom, andGermany, which dominate due to their rich distilling traditions and a strong culture of craft beverages. The U.S. is particularly notable for its diverse range of craft spirits and innovative distilleries, while the UK and Germany benefit from a long-standing heritage in gin and whiskey production, respectively, fostering a robust craft spirits community. North America remains the largest revenue contributor, with Europe following closely due to its established craft beverage culture .

- In 2023, the U.S. government implemented new regulations aimed at promoting transparency in labeling for craft spirits. TheTTB (Alcohol and Tobacco Tax and Trade Bureau) Final Rule, 2023issued by the U.S. Department of the Treasury mandates that all craft spirits must clearly state their production methods and ingredient sourcing on the label. This regulation requires distillers to disclose whether ingredients are locally sourced and to specify production techniques, ensuring consumers are well-informed about the products they purchase. The initiative is designed to enhance consumer trust and support local distilleries through stricter labeling standards and compliance requirements .

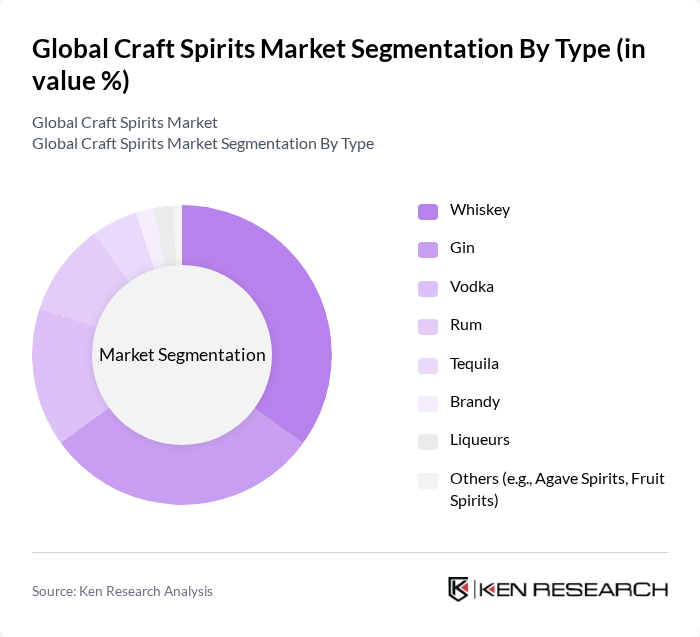

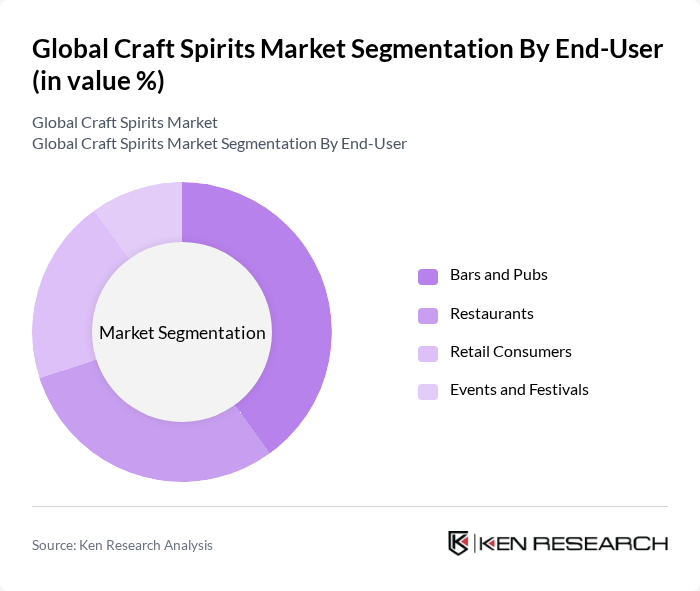

Global Craft Spirits Market Segmentation

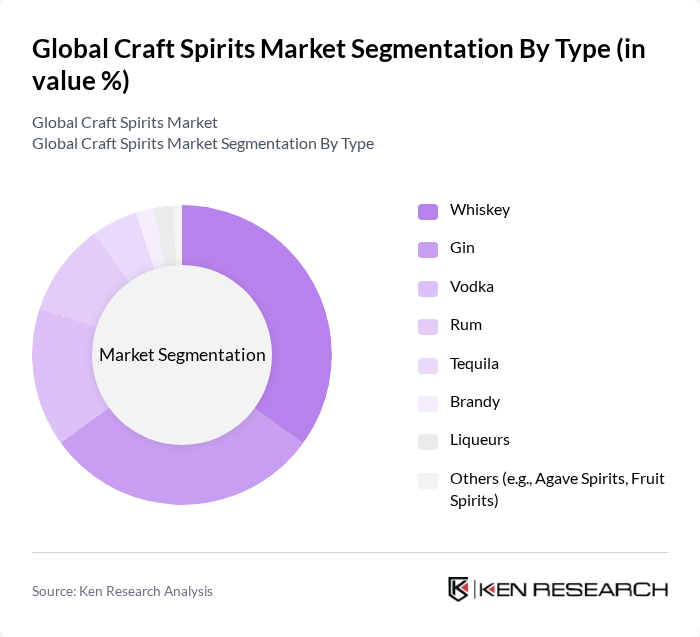

By Type:The craft spirits market is segmented into various types, including whiskey, gin, vodka, rum, tequila, brandy, liqueurs, and others such as agave spirits and fruit spirits. Among these,whiskeyandginare the most popular, driven by consumer trends favoring premium and artisanal products. Whiskey, particularly bourbon and single malt, has seen a resurgence in popularity, while gin's versatility in cocktails has made it a favorite among mixologists and consumers alike. The market is also witnessing growth in innovative flavors and fruit-infused spirits, reflecting evolving consumer preferences for unique taste profiles .

By End-User:The end-user segmentation includes bars and pubs, restaurants, retail consumers, and events and festivals.Bars and pubsare the leading end-users, as they serve as primary venues for craft spirits consumption, providing a platform for consumers to explore diverse offerings. The growing trend of craft cocktail culture and experiential marketing has further propelled demand in these establishments, making them pivotal in shaping consumer preferences. Restaurants and retail channels are also experiencing increased demand due to rising disposable incomes and urbanization, while events and festivals remain important for brand exposure and consumer engagement .

Global Craft Spirits Market Competitive Landscape

The Global Craft Spirits Market is characterized by a dynamic mix of regional and international players. Leading participants such as Diageo plc, Pernod Ricard SA, Brown-Forman Corporation, Bacardi Limited, Constellation Brands, Inc., Sazerac Company, Inc., William Grant & Sons Ltd., Campari Group, Edrington Group, The Distilled Spirits Council of the United States (DISCUS), St. George Spirits, High West Distillery, Westland Distillery, New Holland Brewing Company, Corsair Distillery, Suntory Holdings Limited, Heaven Hill Brands, Rémy Cointreau, Beam Suntory Inc., Rogue Ales & Spirits contribute to innovation, geographic expansion, and service delivery in this space. These companies drive market growth through product differentiation, strategic partnerships, and expansion into emerging markets .

Global Craft Spirits Market Industry Analysis

Growth Drivers

- Increasing Consumer Preference for Premium Products:The global demand for premium spirits has surged, with the craft spirits segment witnessing a 15% increase in sales volume in future, reaching approximately 12 million cases. This trend is driven by consumers' willingness to pay more for quality, with 60% of consumers prioritizing artisanal and locally produced options. The rise in disposable income, particularly in urban areas, further supports this shift towards premiumization, as consumers seek unique and high-quality drinking experiences.

- Rise of Craft Cocktail Culture:The craft cocktail movement has gained significant traction, with the number of craft cocktail bars increasing by 20% in major cities in future. This growth is fueled by a growing interest in mixology and unique flavor profiles, leading to a 30% increase in craft spirit usage in cocktails. As consumers seek innovative drinking experiences, craft spirits are becoming essential ingredients, driving demand and encouraging distilleries to expand their product offerings.

- Expansion of Distribution Channels:The craft spirits market has benefited from the expansion of distribution channels, with e-commerce sales growing by 25% in future. This shift allows consumers to access a wider variety of products, including local and niche brands. Additionally, partnerships with restaurants and bars have increased, with over 40% of craft distilleries reporting collaborations that enhance visibility and sales. This multi-channel approach is crucial for reaching diverse consumer segments and driving market growth.

Market Challenges

- Regulatory Compliance Issues:Navigating the complex regulatory landscape poses significant challenges for craft distilleries. In future, over 50% of craft producers reported difficulties in meeting local and federal regulations, which can vary widely by region. Compliance costs can reach up to $100,000 annually for smaller distilleries, impacting profitability. These challenges can hinder market entry for new players and limit the growth potential of existing brands, creating barriers to expansion.

- High Production Costs:Craft spirits production involves higher costs due to small batch sizes and premium ingredients. In future, the average production cost for craft distilleries was approximately $10 per bottle, compared to $3 for mass-produced spirits. This disparity can limit competitive pricing and profit margins, especially in a market where consumers are increasingly price-sensitive. As production costs rise, maintaining profitability while ensuring quality becomes a critical challenge for craft distillers.

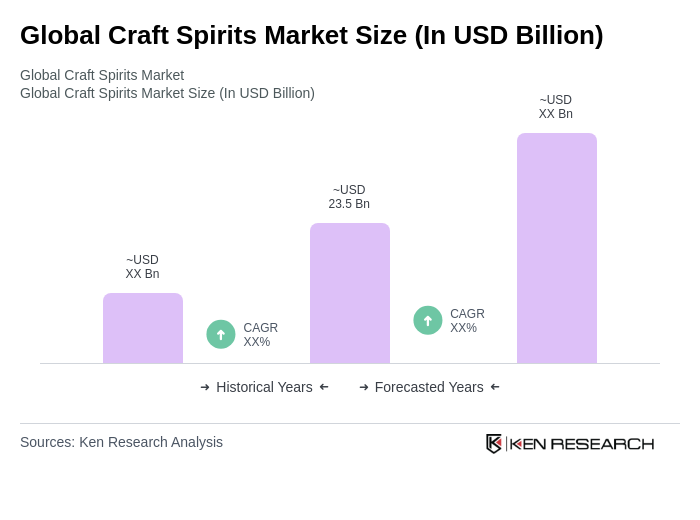

Global Craft Spirits Market Future Outlook

The craft spirits market is poised for continued growth, driven by evolving consumer preferences and innovative product offerings. As the trend towards premiumization persists, distilleries are likely to focus on unique flavors and sustainable practices. Additionally, the rise of e-commerce will facilitate broader access to craft spirits, particularly in emerging markets. Collaborations with bars and restaurants will further enhance brand visibility, creating a dynamic landscape that supports the growth of craft distilleries in the coming years.

Market Opportunities

- Growth in E-commerce Sales:The shift towards online purchasing presents a significant opportunity for craft spirits. E-commerce sales are projected to reach $1 billion in future, driven by consumer demand for convenience and variety. Distilleries that invest in robust online platforms can tap into this growing market, reaching consumers who prefer shopping from home and expanding their customer base significantly.

- Increasing Interest in Local and Sustainable Products:Consumers are increasingly prioritizing local and sustainable products, with 70% of buyers willing to pay more for environmentally friendly options. This trend presents an opportunity for craft distilleries to highlight their sustainable practices and local sourcing. By aligning with consumer values, distilleries can enhance brand loyalty and attract a dedicated customer base, driving sales growth in a competitive market.