Region:Global

Author(s):Geetanshi

Product Code:KRAA2785

Pages:92

Published On:August 2025

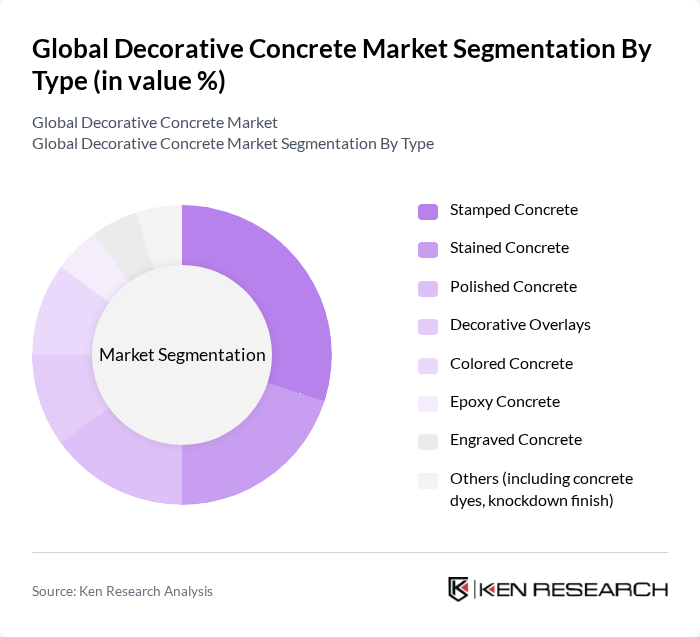

By Type:The decorative concrete market is segmented into various types, including Stamped Concrete, Stained Concrete, Polished Concrete, Decorative Overlays, Colored Concrete, Epoxy Concrete, Engraved Concrete, and Others (including concrete dyes, knockdown finish). Among these, Stamped Concrete is currently the leading sub-segment due to its versatility and ability to mimic natural materials like stone and wood, making it a popular choice for both residential and commercial applications. The trend toward customization and the use of advanced coloring and texturing techniques has further boosted the adoption of stamped concrete .

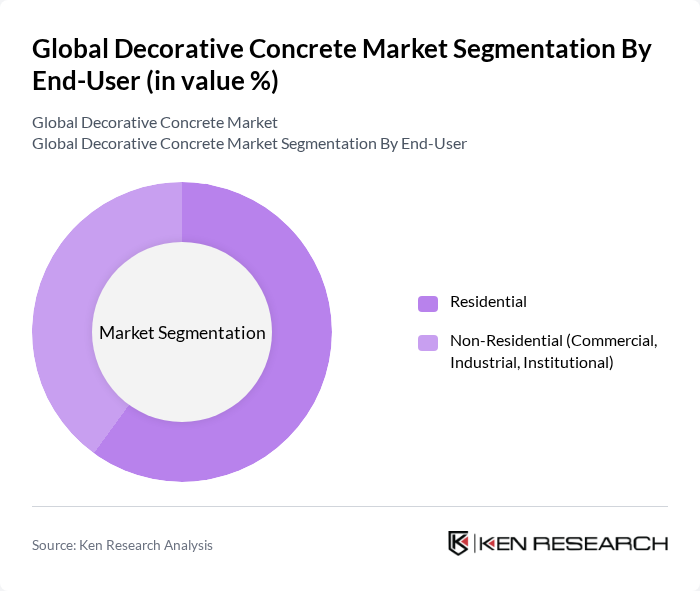

By End-User:The market is also segmented by end-user into Residential and Non-Residential (Commercial, Industrial, Institutional). The Residential segment is currently leading the market, driven by increasing consumer preferences for aesthetically pleasing and durable flooring options in homes. The trend towards home renovations and improvements, as well as the growing influence of interior design trends, has further fueled the demand for decorative concrete in residential applications .

The Global Decorative Concrete Market is characterized by a dynamic mix of regional and international players. Leading participants such as Sika AG, BASF SE, Holcim Ltd., The Sherwin-Williams Company, RPM International Inc., Boral Limited, CEMEX S.A.B. de C.V., Ardex Group, PPG Industries, Inc., The QUIKRETE Companies, Inc., Solomon Colors, Inc., Deco-Crete Supply, Valspar Corporation, TCC Materials, Tarmac contribute to innovation, geographic expansion, and service delivery in this space.

The future of the decorative concrete market appears promising, driven by increasing consumer awareness and a shift towards sustainable building practices. As more architects and designers embrace eco-friendly materials, the demand for decorative concrete is expected to rise. Additionally, the integration of smart technologies in construction will likely enhance the functionality and appeal of decorative concrete products. This evolving landscape presents opportunities for innovation and collaboration, positioning decorative concrete as a key player in the future of construction and design.

| Segment | Sub-Segments |

|---|---|

| By Type | Stamped Concrete Stained Concrete Polished Concrete Decorative Overlays Colored Concrete Epoxy Concrete Engraved Concrete Others (including concrete dyes, knockdown finish) |

| By End-User | Residential Non-Residential (Commercial, Industrial, Institutional) |

| By Application | Floors Walls Driveways & Sidewalks Patios Pool Decks Ceilings & Countertops Others |

| By Distribution Channel | Direct Sales Retail Outlets Online Sales Distributors |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Low Price Mid Price High Price |

| By Product Form | Ready-Mix Concrete Precast Concrete Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Decorative Concrete Applications | 100 | Homeowners, Residential Contractors |

| Commercial Decorative Concrete Projects | 80 | Commercial Builders, Project Managers |

| Industrial Decorative Concrete Solutions | 60 | Facility Managers, Industrial Contractors |

| Architectural Design Trends in Decorative Concrete | 50 | Architects, Interior Designers |

| Supplier and Distributor Insights | 70 | Product Managers, Sales Representatives |

The Global Decorative Concrete Market is valued at approximately USD 19 billion, driven by increasing demand for aesthetic and durable flooring solutions in both residential and commercial sectors, alongside a rise in global construction activities.