Region:Middle East

Author(s):Dev

Product Code:KRAD5145

Pages:93

Published On:December 2025

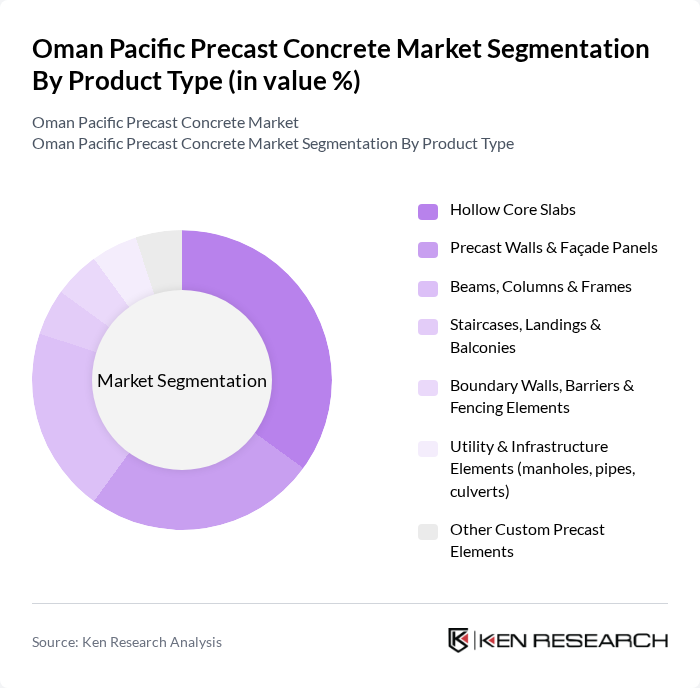

By Product Type:The product type segmentation includes various categories of precast concrete products that cater to different construction needs, such as floors, walls, columns and beams. The dominant sub-segment in this category is Hollow Core Slabs, which are widely used in residential and commercial buildings due to their lightweight and high strength. Other significant sub-segments include Precast Walls & Façade Panels and Beams, Columns & Frames, which are essential for structural integrity and aesthetic appeal in modern architecture.

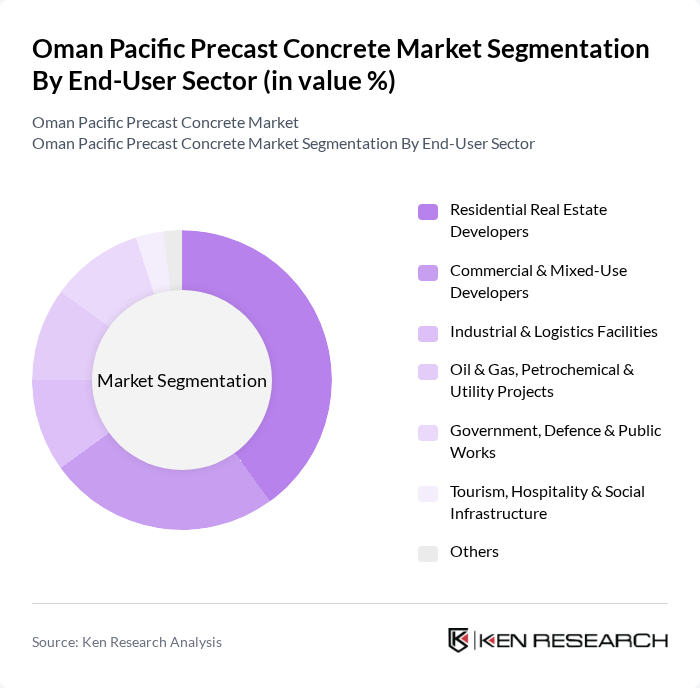

By End-User Sector:The end-user sector segmentation highlights the various industries utilizing precast concrete products across residential, commercial, industrial, and institutional sectors. The Residential Real Estate Developers segment is the largest, driven by the ongoing housing demand in urban areas. Other notable segments include Commercial & Mixed-Use Developers and Government, Defence & Public Works, which are increasingly adopting precast solutions for their efficiency and cost-effectiveness in large-scale projects.

The Oman Pacific Precast Concrete Market is characterized by a dynamic mix of regional and international players. Leading participants such as Oman Precast LLC, Oman Concrete Products LLC, Al Tasnim Precast (Al Tasnim Group), Assarain Concrete Products & Trading LLC, Sohar Precast Concrete Products LLC, Salalah Readymix LLC (Precast & Concrete Products), Al Turki Enterprises LLC – Precast & Construction Products, Muscat Precast Concrete Industries LLC, Desert Line Projects LLC (Precast & Infrastructure Solutions), Hilal Cement – Precast & Concrete Products (GCC Operations Relevant to Oman), Gulf Precast Concrete Co. LLC (Regional Player Serving Oman Projects), Raysut Cement Company SAOG (Downstream Precast & Concrete Affiliates), Al Madina Logistics & Industrial Investment (Precast & Industrial Construction), Galfar Engineering & Contracting SAOG (Precast & Modular Construction Capabilities), Larsen & Toubro Oman LLC (Precast-based EPC & Infrastructure Projects) contribute to innovation, geographic expansion, and service delivery in this space.

The Oman Pacific precast concrete market is poised for significant growth, driven by increasing infrastructure investments and a shift towards sustainable construction practices. As the government continues to prioritize economic diversification and infrastructure development, the demand for precast solutions is expected to rise. Additionally, technological advancements in precast manufacturing will enhance product quality and efficiency, further solidifying the market's position. Stakeholders must adapt to these trends to capitalize on emerging opportunities and navigate potential challenges effectively.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Hollow Core Slabs Precast Walls & Façade Panels Beams, Columns & Frames Staircases, Landings & Balconies Boundary Walls, Barriers & Fencing Elements Utility & Infrastructure Elements (manholes, pipes, culverts) Other Custom Precast Elements |

| By End-User Sector | Residential Real Estate Developers Commercial & Mixed-Use Developers Industrial & Logistics Facilities Oil & Gas, Petrochemical & Utility Projects Government, Defence & Public Works Tourism, Hospitality & Social Infrastructure Others |

| By Application | Buildings (residential, commercial, institutional) Transportation Infrastructure (roads, bridges, tunnels) Water & Wastewater Infrastructure Industrial Plants & Warehouses Ports, Airports & Logistics Hubs Other Civil & Marine Structures |

| By Material Type | Reinforced Concrete Pre-stressed Concrete High-Performance & Self-Compacting Concrete Lightweight & Insulated Precast Systems Others |

| By Manufacturing Process | Wet Cast Dry Cast Automated & Semi-Automated Production Lines On-site (Mobile) Precasting Others |

| By Contracting & Delivery Model | Direct Supply to Contractors / EPCs Design–Manufacture–Install (Turnkey Precast Packages) Supply through Building Material Distributors Public–Private Partnership (PPP) / Long-Term Framework Contracts Others |

| By Region | Muscat Governorate Dhofar Governorate Al Batinah North & South Al Dakhiliyah & Al Dhahirah Al Sharqiyah North & South Other Governorates |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Construction Projects | 110 | Project Managers, Site Engineers |

| Commercial Building Developments | 85 | Architects, Construction Managers |

| Infrastructure Projects (Bridges, Roads) | 75 | Civil Engineers, Urban Planners |

| Precast Concrete Manufacturing | 55 | Production Managers, Quality Control Officers |

| Supply Chain and Distribution | 95 | Logistics Coordinators, Procurement Specialists |

The Oman Pacific Precast Concrete Market is valued at approximately USD 140 million, driven by infrastructure development, urbanization, and sustainable construction practices. This valuation is based on a five-year historical analysis of market trends and growth factors.