Global Dry Mix Mortar Additives and Chemicals Market Overview

- The Global Dry Mix Mortar Additives and Chemicals Market is valued at USD 27.5 billion, based on a five-year analysis. This growth is primarily driven by the increasing demand for construction activities, particularly in the Asia-Pacific region, where countries such as China, India, and ASEAN nations are witnessing substantial investments in infrastructure and housing. The market is further supported by the rising adoption of advanced, high-performance building materials that enhance durability, energy efficiency, and sustainability. Technological advancements in additive formulations, such as improved polymer powders and eco-friendly plasticizers, are also enhancing the performance characteristics of dry mix mortars, contributing to market expansion .

- Key players in this market include countries such as China, the United States, and Germany. China dominates the global landscape, accounting for the majority share in Asia-Pacific, driven by massive urbanization, government-backed infrastructure projects, and the rapid expansion of residential and commercial construction. The United States and Germany also play pivotal roles due to their robust construction sectors, advanced manufacturing capabilities, and significant investments in sustainable building practices. The presence of leading manufacturers and extensive distribution networks in these regions further strengthens their market positions and shapes global industry trends .

- The European Union’s Regulation (EU) 305/2011, known as the Construction Products Regulation (CPR), issued by the European Parliament and the Council, sets binding requirements for construction products, including dry mix mortars and their additives. This regulation mandates that all construction products placed on the EU market must meet harmonized sustainability and performance criteria, including requirements related to carbon emissions, recyclability, and the use of eco-friendly additives. The CPR is part of the EU’s broader strategy to promote sustainable construction and reduce the environmental impact of building materials .

Global Dry Mix Mortar Additives and Chemicals Market Segmentation

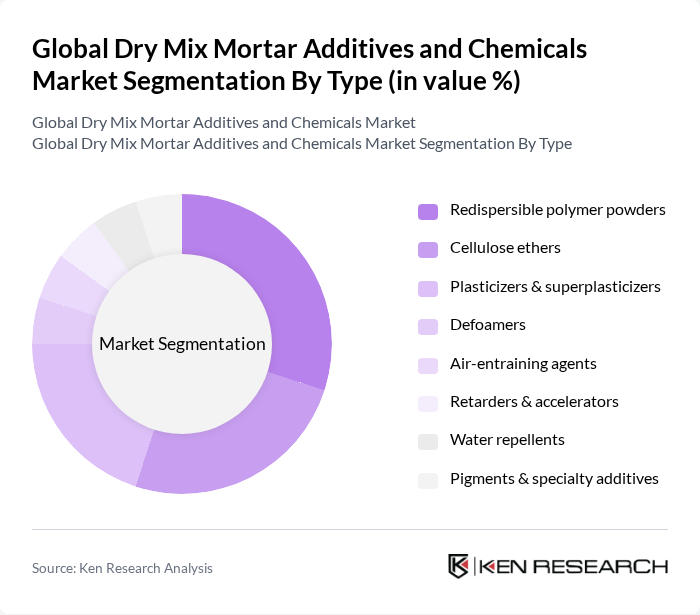

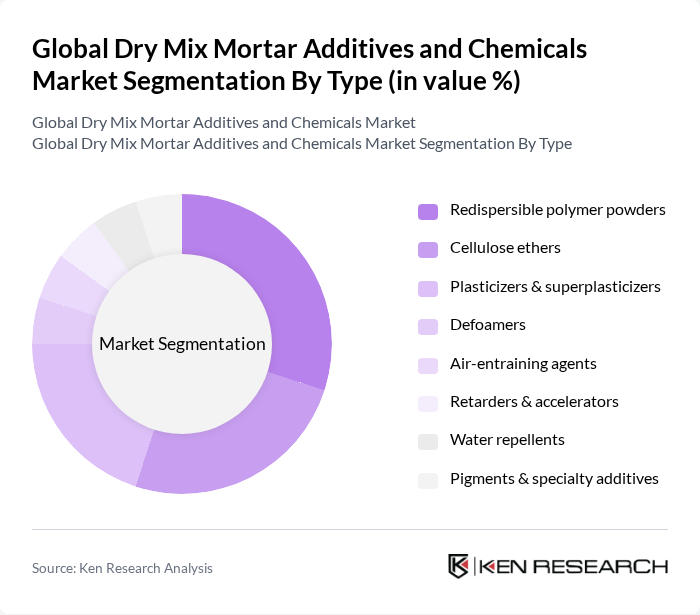

By Type:The market is segmented into various types of additives and chemicals that enhance the performance of dry mix mortars. Among these, redispersible polymer powders and cellulose ethers are particularly significant due to their ability to improve adhesion, flexibility, and water retention in mortars. The demand for plasticizers and superplasticizers is also on the rise, driven by the need for improved workability and reduced water content in mortar formulations. The market is characterized by a diverse range of products catering to different construction needs .

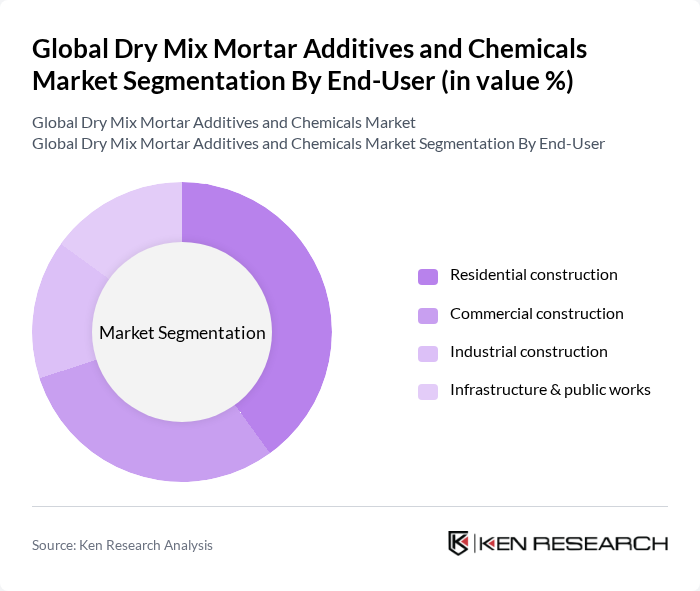

By End-User:The end-user segment of the market includes residential, commercial, industrial, and infrastructure construction. The residential construction sector is the largest consumer of dry mix mortar additives, driven by the increasing demand for housing, renovation, and urbanization projects, especially in Asia-Pacific. Commercial construction follows closely, supported by investments in office buildings, retail, and hospitality sectors. The industrial construction segment is expanding due to the growth of manufacturing and warehousing facilities, while infrastructure projects benefit from government initiatives focused on public works and transportation networks .

Global Dry Mix Mortar Additives and Chemicals Market Competitive Landscape

The Global Dry Mix Mortar Additives and Chemicals Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Sika AG, Saint-Gobain S.A., Mapei S.p.A., Dow Inc., RPM International Inc., Bostik SA (an Arkema company), Ardex Group, Fosroc International Limited, Knauf Gips KG, CEMEX S.A.B. de C.V., Heidelberg Materials AG, GCP Applied Technologies Inc., Tarmac Trading Limited, Boral Limited, Wacker Chemie AG, Pidilite Industries Limited, MC-Bauchemie Müller GmbH & Co. KG, LafargeHolcim Ltd (now Holcim Group), Sika (China) Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

Global Dry Mix Mortar Additives and Chemicals Market Industry Analysis

Growth Drivers

- Increasing Demand for Construction Activities:The global construction industry is projected to reach a value of $12 trillion by future, driven by significant investments in residential and commercial projects. In regions like Vietnam, construction spending is expected to increase by approximately $250 billion, reflecting a robust demand for dry mix mortar additives. This surge in construction activities is primarily fueled by government initiatives aimed at infrastructure development and urban renewal, creating a favorable environment for market growth.

- Rising Urbanization and Infrastructure Development:Urbanization rates in Vietnam are projected to rise from 37% to 45% by future, leading to increased demand for housing and infrastructure. This urban shift necessitates the use of advanced construction materials, including dry mix mortar additives, to meet the growing needs of urban populations. The government’s commitment to enhancing infrastructure, with an estimated investment of $200 billion in public works, further propels the market forward, creating opportunities for manufacturers.

- Technological Advancements in Construction Materials:The introduction of innovative construction technologies, such as 3D printing and smart materials, is revolutionizing the industry. In Vietnam, the adoption of these technologies is expected to increase by 35% in future, enhancing the performance and efficiency of construction processes. This trend drives the demand for high-quality dry mix mortar additives that can improve adhesion, durability, and sustainability, positioning manufacturers to capitalize on these advancements.

Market Challenges

- Fluctuating Raw Material Prices:The volatility in raw material prices poses a significant challenge for the dry mix mortar additives market. For instance, the cost of key ingredients like cement and polymers has seen fluctuations of up to 20% in the past year. This unpredictability can lead to increased production costs, affecting profit margins for manufacturers in Vietnam. Companies must develop strategies to mitigate these risks, such as securing long-term contracts with suppliers to stabilize costs.

- Stringent Environmental Regulations:Compliance with environmental regulations is becoming increasingly stringent, particularly in Vietnam, where new laws mandate reductions in carbon emissions by 30% by future. These regulations require manufacturers to invest in cleaner production technologies and sustainable materials, which can increase operational costs. Failure to comply not only results in financial penalties but also impacts brand reputation, making it essential for companies to adapt to these regulatory changes effectively.

Global Dry Mix Mortar Additives and Chemicals Market Future Outlook

The future of the dry mix mortar additives market in Vietnam appears promising, driven by ongoing urbanization and technological advancements. As construction activities ramp up, the demand for high-performance materials will likely increase, fostering innovation in product formulations. Additionally, the emphasis on sustainability will push manufacturers to develop eco-friendly solutions, aligning with regulatory requirements and consumer preferences. Strategic partnerships and collaborations will also play a crucial role in enhancing market competitiveness and expanding product offerings in future.

Market Opportunities

- Expansion in Emerging Markets:Emerging markets in Vietnam present significant growth opportunities, with construction spending expected to rise by 25% annually. This growth is driven by urbanization and infrastructure projects, creating a demand for dry mix mortar additives. Companies can leverage this trend by establishing local production facilities to cater to regional needs effectively.

- Development of Innovative Product Formulations:The increasing demand for specialized construction materials opens avenues for developing innovative product formulations. By investing in research and development, manufacturers can create high-performance, eco-friendly additives that meet evolving market needs. This focus on innovation can enhance competitive advantage and drive market growth in Vietnam.