Region:Global

Author(s):Geetanshi

Product Code:KRAA2736

Pages:83

Published On:August 2025

By Type:The market is segmented into various types of fulfillment services, including Third-Party Logistics (3PL), Fulfillment by Amazon (FBA), In-House Fulfillment, Dropshipping, Micro-Fulfillment Centers, Warehousing and Storage Fulfillment Services, Shipping Fulfillment Services, Bundling Fulfillment Services, and Others. Among these,Third-Party Logistics (3PL)is the leading sub-segment, driven by its ability to provide scalable solutions and cost efficiencies for businesses of all sizes. The increasing trend of outsourcing logistics functions to specialized providers has further solidified its dominance. Outsourced fulfillment models, including 3PL, account for the largest share of market revenues, reflecting the preference for flexible and technology-driven logistics solutions .

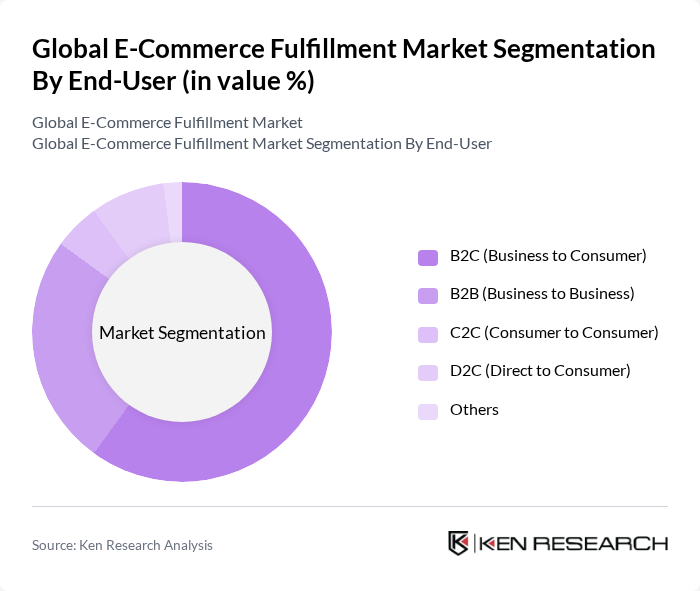

By End-User:The market is segmented by end-users into B2C (Business to Consumer), B2B (Business to Business), C2C (Consumer to Consumer), D2C (Direct to Consumer), and Others. TheB2C segmentis the most significant contributor, fueled by the rapid growth of online retail and changing consumer behaviors favoring convenience and speed. The increasing number of online shoppers and the expansion of e-commerce platforms have further propelled this segment's growth. B2C fulfillment is characterized by high order volumes, demand for fast delivery, and the integration of digital payment solutions .

The Global E-Commerce Fulfillment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amazon.com, Inc., Alibaba Group Holding Limited, FedEx Corporation, United Parcel Service, Inc. (UPS), DHL International GmbH, XPO Logistics, Inc., Rakuten, Inc., Shopify, Inc., JD.com, Inc., eFulfillment Service, Inc., Ingram Micro, Inc., ShipBob, Inc., Shipfusion Inc., Red Stag Fulfillment, Sprocket Express, Wayfair Inc., Chewy, Inc., Overstock.com, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of e-commerce fulfillment in the None region is poised for transformative growth, driven by technological advancements and evolving consumer preferences. As businesses increasingly adopt automation and AI, fulfillment processes will become more efficient, reducing costs and improving service levels. Additionally, the rise of sustainable practices will shape operational strategies, aligning with consumer demand for environmentally responsible solutions. Companies that adapt to these trends will likely gain a competitive edge in the rapidly evolving market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Third-Party Logistics (3PL) Fulfillment by Amazon (FBA) In-House Fulfillment Dropshipping Micro-Fulfillment Centers Warehousing and Storage Fulfillment Services Shipping Fulfillment Services Bundling Fulfillment Services Others |

| By End-User | B2C (Business to Consumer) B2B (Business to Business) C2C (Consumer to Consumer) D2C (Direct to Consumer) Others |

| By Sales Channel | Online Marketplaces Brand Websites Social Media Platforms Omnichannel Retailers Others |

| By Distribution Mode | Direct Shipping Click and Collect Same-Day Delivery Next-Day Delivery Cross-Border Fulfillment Others |

| By Packaging Type | Standard Packaging Eco-Friendly Packaging Custom Packaging Automated Packaging Others |

| By Customer Segment | Small and Medium Enterprises (SMEs) Large Enterprises Startups E-Commerce Aggregators Others |

| By Geographic Focus | North America Europe Asia-Pacific Latin America Middle East & Africa Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Fulfillment Center Operations | 100 | Operations Managers, Warehouse Supervisors |

| Last-Mile Delivery Services | 80 | Logistics Coordinators, Delivery Managers |

| Returns Management in E-commerce | 60 | Customer Service Managers, Returns Analysts |

| Technology Integration in Fulfillment | 50 | IT Managers, Systems Analysts |

| Consumer Experience in E-commerce Fulfillment | 70 | Marketing Managers, User Experience Researchers |

The Global E-Commerce Fulfillment Market is valued at approximately USD 138 billion, reflecting significant growth driven by increased online shopping, mobile commerce, and advancements in logistics technologies.