Region:Global

Author(s):Geetanshi

Product Code:KRAA2287

Pages:88

Published On:August 2025

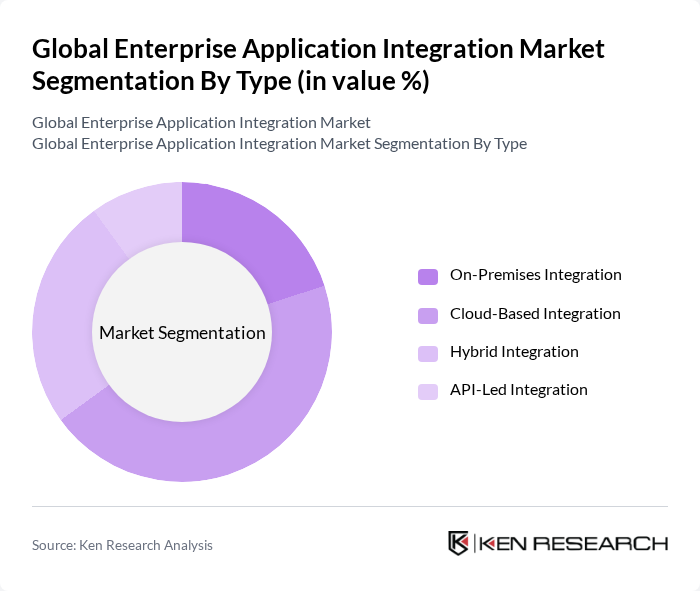

By Type:

The types of integration solutions available in the market include On-Premises Integration, Cloud-Based Integration, Hybrid Integration, and API-Led Integration. Among these, Cloud-Based Integration is currently dominating the market due to its scalability, cost-effectiveness, and ease of deployment. Organizations are increasingly shifting towards cloud solutions to enhance flexibility and reduce infrastructure costs. The growing trend of remote work, expansion of hybrid IT environments, and the need for seamless collaboration across various platforms have further accelerated the adoption of cloud-based integration solutions .

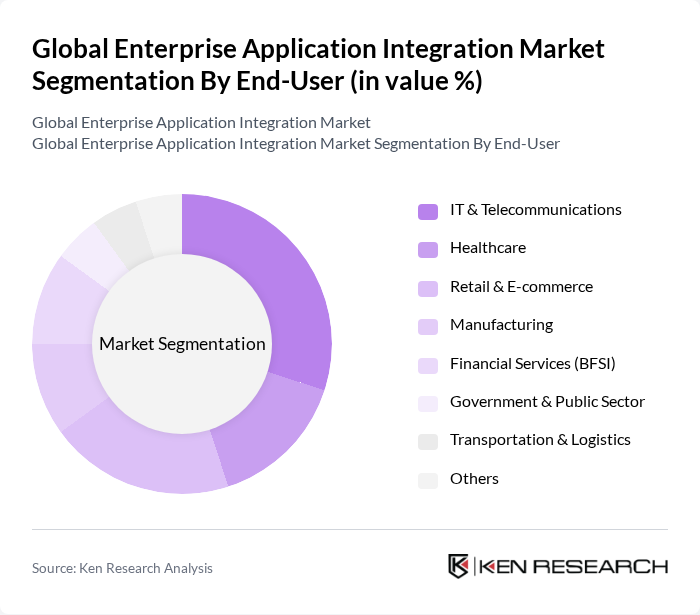

By End-User:

The end-user segments in the market include IT & Telecommunications, Healthcare, Retail & E-commerce, Manufacturing, Financial Services (BFSI), Government & Public Sector, Transportation & Logistics, and Others. The IT & Telecommunications sector is leading the market, driven by the need for efficient data management and integration of various applications to enhance service delivery. The rapid digital transformation in this sector, coupled with the increasing demand for real-time data access and cloud adoption, has made it a significant contributor to the overall market growth. Healthcare and Retail & E-commerce are also experiencing notable growth due to the need for integrated workflows and improved customer experiences .

The Global Enterprise Application Integration Market is characterized by a dynamic mix of regional and international players. Leading participants such as IBM Corporation, Microsoft Corporation, Oracle Corporation, SAP SE, MuleSoft, a Salesforce Company, TIBCO Software Inc., Boomi, a Dell Technologies Company, Informatica LLC, Software AG, Jitterbit, Inc., SnapLogic, Inc., Cleo Communications, Inc., Adeptia, Inc., WSO2, Inc., Talend S.A., Axway, SEEBURGER AG, Fiorano Software, Inc., Red Hat, Inc. (an IBM Company), Elastic.io GmbH contribute to innovation, geographic expansion, and service delivery in this space.

The future of the enterprise application integration market is poised for significant evolution, driven by technological advancements and changing business needs. As organizations increasingly adopt microservices architecture, the demand for agile integration solutions will rise. Furthermore, the integration of artificial intelligence and machine learning into application processes will enhance automation and efficiency, enabling businesses to respond swiftly to market changes and customer demands, thereby shaping a more dynamic integration landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | On-Premises Integration Cloud-Based Integration Hybrid Integration API-Led Integration |

| By End-User | IT & Telecommunications Healthcare Retail & E-commerce Manufacturing Financial Services (BFSI) Government & Public Sector Transportation & Logistics Others |

| By Deployment Model | Public Cloud Private Cloud Hybrid Cloud |

| By Component | Software (Middleware, Integration Platforms, API Management Tools) Services (Consulting, Support & Maintenance, Training) |

| By Application | Data Integration Application-to-Application Integration Business-to-Business (B2B) Integration Process Integration Others |

| By Industry Vertical | Automotive Energy & Utilities Education Media & Entertainment Others |

| By Organization Size | Large Enterprises Small & Medium Enterprises (SMEs) |

| By Pricing Model | Subscription-Based Pay-As-You-Go One-Time License Fee Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Application Integration | 60 | IT Directors, Healthcare System Administrators |

| Financial Services Integration Solutions | 50 | Chief Technology Officers, Compliance Officers |

| Retail Systems Integration | 40 | Operations Managers, E-commerce Directors |

| Manufacturing Process Integration | 45 | Supply Chain Managers, Production Supervisors |

| Telecommunications Integration Strategies | 40 | Network Engineers, IT Project Managers |

The Global Enterprise Application Integration Market is valued at approximately USD 17 billion, reflecting a significant growth driven by the need for businesses to streamline operations and enhance data sharing through integrated systems.