Region:Global

Author(s):Shubham

Product Code:KRAA2655

Pages:96

Published On:August 2025

By Type:The market is segmented into Indoor WLAN Solutions, Outdoor WLAN Solutions, and Hybrid WLAN Solutions. Indoor WLAN Solutions are primarily deployed in offices, educational campuses, and healthcare facilities, delivering high-density connectivity for employees and devices. Outdoor WLAN Solutions serve public venues, industrial sites, and large campuses, supporting robust coverage in open environments. Hybrid WLAN Solutions integrate both indoor and outdoor capabilities, providing scalable and flexible wireless infrastructure for organizations with diverse connectivity needs .

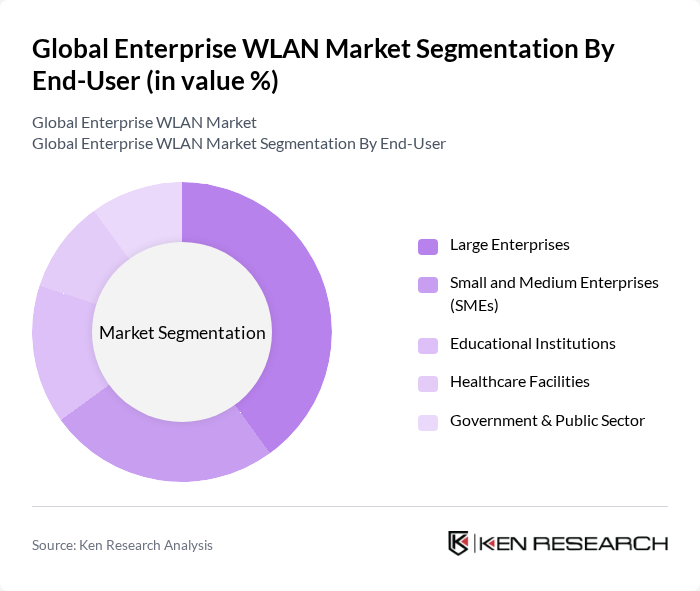

By End-User:The end-user segmentation includes Large Enterprises, Small and Medium Enterprises (SMEs), Educational Institutions, Healthcare Facilities, and Government & Public Sector. Large Enterprises dominate the market due to extensive network requirements, multi-site deployments, and significant IT budgets. SMEs are rapidly adopting WLAN solutions for operational efficiency and secure connectivity. Educational institutions and healthcare facilities prioritize reliable wireless networks for digital learning and patient care, while government and public sector organizations invest in secure, scalable WLAN infrastructure for public services and administration .

The Global Enterprise WLAN Market is characterized by a dynamic mix of regional and international players. Leading participants such as Cisco Systems, Inc., Aruba Networks (Hewlett Packard Enterprise), Ruckus Networks (CommScope), Ubiquiti Inc., Extreme Networks, Inc., Cisco Meraki, NETGEAR, Inc., TP-Link Technologies Co., Ltd., D-Link Corporation, Huawei Technologies Co., Ltd., Juniper Networks, Inc. (Mist Systems), Fortinet, Inc., Allied Telesis, Inc., Cambium Networks Corporation, ZTE Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the enterprise WLAN market is poised for significant transformation, driven by technological advancements and evolving business needs. The integration of AI and machine learning for network management is expected to enhance operational efficiency and security. Additionally, the expansion of 5G technology will facilitate faster and more reliable wireless connections, enabling enterprises to adopt innovative solutions. As organizations increasingly prioritize digital transformation, the demand for advanced WLAN solutions will continue to grow, shaping the market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Indoor WLAN Solutions Outdoor WLAN Solutions Hybrid WLAN Solutions |

| By End-User | Large Enterprises Small and Medium Enterprises (SMEs) Educational Institutions Healthcare Facilities Government & Public Sector |

| By Component | Access Points (Wi-Fi 5, Wi-Fi 6/6E, Wi-Fi 7) WLAN Controllers Network Management & Analytics Software Security Solutions |

| By Deployment Mode | On-Premises Deployment Cloud-Based Deployment Hybrid Deployment |

| By Service Type | Managed Services Professional Services (Consulting, Integration, Support) |

| By Industry Vertical | Retail Hospitality Transportation and Logistics Manufacturing Education Healthcare BFSI (Banking, Financial Services, and Insurance) |

| By Region | North America Europe Asia-Pacific Latin America Middle East and Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare WLAN Solutions | 60 | IT Directors, Network Administrators |

| Education Sector WLAN Deployment | 50 | Campus IT Managers, System Administrators |

| Retail WLAN Infrastructure | 45 | Store IT Managers, IT Support Staff |

| Manufacturing WLAN Applications | 40 | Operations Managers, Network Engineers |

| Enterprise WLAN Security Solutions | 55 | Cybersecurity Analysts, IT Security Managers |

The Global Enterprise WLAN Market is valued at approximately USD 12 billion, reflecting significant growth driven by the demand for high-speed internet, the adoption of Wi-Fi 6E and Wi-Fi 7 standards, and the rise of cloud-managed WLAN solutions.