Region:Global

Author(s):Dev

Product Code:KRAA2574

Pages:81

Published On:August 2025

Composites Market.png)

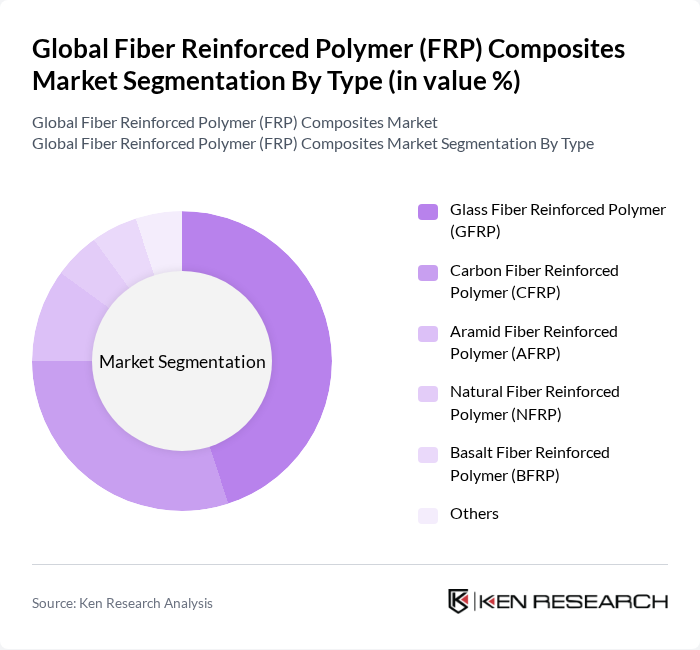

By Type:The market is segmented into various types of fiber reinforced polymers, each catering to different applications and industries. The primary types includeGlass Fiber Reinforced Polymer (GFRP),Carbon Fiber Reinforced Polymer (CFRP),Aramid Fiber Reinforced Polymer (AFRP),Natural Fiber Reinforced Polymer (NFRP),Basalt Fiber Reinforced Polymer (BFRP), and Others. Among these, GFRP and CFRP are the most widely used due to their superior mechanical properties, cost-effectiveness, and versatility.

TheGlass Fiber Reinforced Polymer (GFRP)segment dominates the market due to its cost-effectiveness, lightweight nature, and excellent corrosion resistance, making it ideal for construction and infrastructure applications. GFRP is widely used in structural components such as beams and columns, where strength and durability are critical. The increasing adoption of GFRP in automotive, marine, and wind energy sectors further solidifies its leading position in the market.

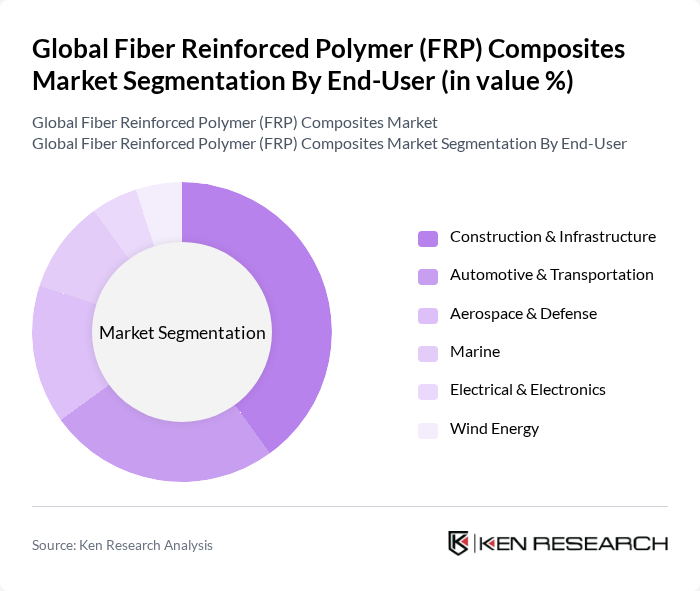

By End-User:The market is segmented based on end-user industries, includingConstruction & Infrastructure,Automotive & Transportation,Aerospace & Defense,Marine,Electrical & Electronics,Wind Energy, and Others. Each segment has unique requirements and applications for FRP composites, with construction and automotive being the largest consumers.

TheConstruction & Infrastructuresegment is the largest end-user of FRP composites, driven by the increasing demand for lightweight and durable materials in building and civil engineering projects. The use of FRP in reinforcing structures, bridges, and other infrastructure projects enhances longevity and reduces maintenance costs. The automotive sector is also witnessing a growing trend toward lightweight materials to improve fuel efficiency and support electric vehicle production, further boosting the demand for FRP composites.

The Global Fiber Reinforced Polymer (FRP) Composites Market is characterized by a dynamic mix of regional and international players. Leading participants such as Hexcel Corporation, Toray Industries, Inc., Owens Corning, SGL Carbon SE, Mitsubishi Chemical Corporation, BASF SE, Teijin Limited, Jushi Group Co., Ltd., Solvay S.A., AOC, LLC, Formosa Plastics Corporation, 3M Company, Zoltek Companies, Inc., DuPont de Nemours, Inc., Gurit Holding AG contribute to innovation, geographic expansion, and service delivery in this space.

The future of the FRP composites market appears promising, driven by increasing environmental regulations and a shift towards sustainable materials. As industries seek to reduce their carbon footprint, the adoption of bio-based FRP composites is expected to rise significantly. Additionally, the integration of smart technologies into FRP products will enhance their functionality, making them more appealing to manufacturers. These trends indicate a robust growth trajectory for the FRP market, with significant advancements anticipated in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Glass Fiber Reinforced Polymer (GFRP) Carbon Fiber Reinforced Polymer (CFRP) Aramid Fiber Reinforced Polymer (AFRP) Natural Fiber Reinforced Polymer (NFRP) Basalt Fiber Reinforced Polymer (BFRP) Others |

| By End-User | Construction & Infrastructure Automotive & Transportation Aerospace & Defense Marine Electrical & Electronics Wind Energy Others |

| By Application | Structural Components (Beams, Columns, Rebars, Panels) Pipes & Tanks Facades & Cladding Electrical Components Thermal Components Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Low Medium High |

| By Manufacturing Process | Hand Lay-Up Resin Transfer Molding (RTM) Pultrusion Filament Winding Compression Molding Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Sector FRP Applications | 100 | Project Managers, Structural Engineers |

| Automotive Industry FRP Usage | 80 | Product Development Engineers, Procurement Managers |

| Aerospace FRP Innovations | 60 | R&D Managers, Compliance Officers |

| Marine Applications of FRP | 50 | Marine Engineers, Design Specialists |

| Consumer Goods Utilizing FRP | 40 | Product Managers, Marketing Directors |

The Global Fiber Reinforced Polymer (FRP) Composites Market is valued at approximately USD 98 billion, driven by the demand for lightweight and high-strength materials across various industries, including construction, automotive, aerospace, and renewable energy.