Region:Global

Author(s):Geetanshi

Product Code:KRAA2370

Pages:81

Published On:August 2025

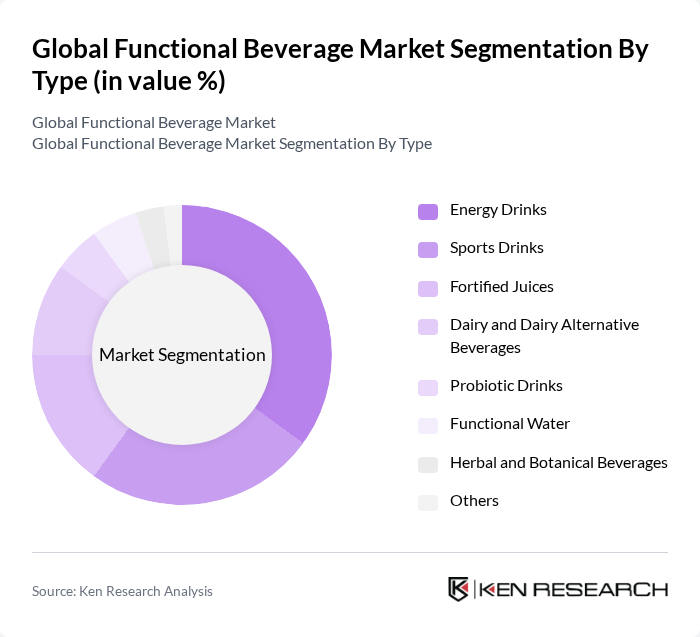

By Type:The functional beverage market is segmented into various types, including energy drinks, sports drinks, fortified juices, dairy and dairy alternative beverages, probiotic drinks, functional water, herbal and botanical beverages, and others. Among these, energy drinks have gained significant traction due to their popularity among younger consumers seeking quick energy boosts. Sports drinks are also prominent, particularly among athletes and fitness enthusiasts, as they provide hydration and replenishment of electrolytes. The market is further characterized by the growing demand for plant-based and low-sugar options, as well as beverages targeting specific health benefits such as gut health and cognitive function .

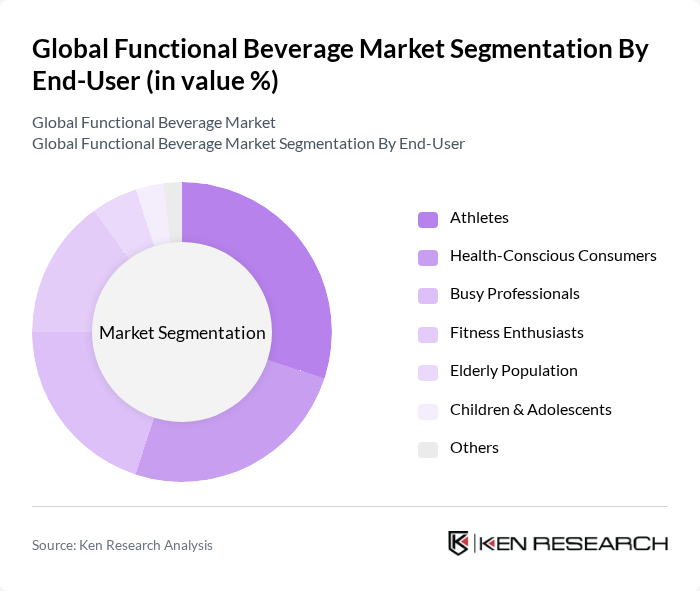

By End-User:The end-user segmentation includes athletes, health-conscious consumers, busy professionals, fitness enthusiasts, elderly population, children & adolescents, and others. Athletes and fitness enthusiasts are primary consumers of functional beverages, driven by their need for hydration and energy replenishment during physical activities. Health-conscious consumers are increasingly opting for these beverages as part of their wellness routines, leading to growing demand across various demographics. The market is also witnessing rising adoption among busy professionals and the elderly, who seek convenient and health-promoting beverage options .

The Global Functional Beverage Market is characterized by a dynamic mix of regional and international players. Leading participants such as The Coca-Cola Company, PepsiCo, Inc., Nestlé S.A., Red Bull GmbH, Monster Beverage Corporation, Keurig Dr Pepper Inc., Danone S.A., Unilever PLC, Suntory Holdings Limited, Herbalife Nutrition Ltd., GNC Holdings, LLC, Vital Proteins LLC, Otsuka Pharmaceutical Co., Ltd., Bai Brands LLC, GT's Living Foods LLC contribute to innovation, geographic expansion, and service delivery in this space.

The future of the functional beverage market appears promising, driven by ongoing trends in health consciousness and innovation. As consumers continue to prioritize wellness, the demand for beverages that offer specific health benefits is expected to rise. Additionally, advancements in technology will facilitate the development of personalized products, catering to individual health needs. Companies that adapt to these trends and invest in sustainable practices will likely gain a competitive edge in this evolving market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Energy Drinks Sports Drinks Fortified Juices Dairy and Dairy Alternative Beverages Probiotic Drinks Functional Water Herbal and Botanical Beverages Others |

| By End-User | Athletes Health-Conscious Consumers Busy Professionals Fitness Enthusiasts Elderly Population Children & Adolescents Others |

| By Distribution Channel | Supermarkets/Hypermarkets Convenience Stores Online Retail Health Food Stores Pharmacies & Drugstores Others |

| By Packaging Type | Bottles Cans Tetra Packs Pouches Others |

| By Flavor | Citrus Berry Tropical Herbal Chocolate & Coffee Others |

| By Price Range | Premium Mid-Range Budget |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Energy Drink Consumers | 100 | Health-conscious individuals, Fitness enthusiasts |

| Probiotic Beverage Users | 80 | Nutritionists, Wellness coaches |

| Herbal Infusion Drinkers | 60 | Tea enthusiasts, Organic product consumers |

| Functional Beverage Retailers | 50 | Store managers, Category buyers |

| Health and Wellness Influencers | 40 | Bloggers, Social media health advocates |

The Global Functional Beverage Market is valued at approximately USD 243 billion, reflecting a significant growth trend driven by increasing consumer awareness of health and wellness, alongside rising demand for beverages that offer functional benefits such as energy and hydration.