Region:Global

Author(s):Rebecca

Product Code:KRAA2860

Pages:92

Published On:August 2025

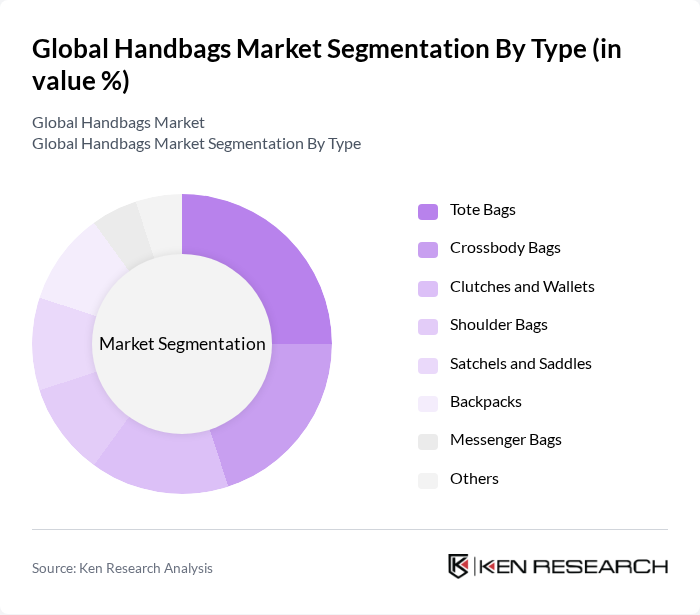

By Type:The handbags market is segmented into various types, including tote bags, crossbody bags, clutches and wallets, shoulder bags, satchels and saddles, backpacks, messenger bags, and others. Among these, tote bags and crossbody bags are particularly popular due to their versatility and practicality, appealing to a wide range of consumers. The demand for clutches and wallets remains strong, especially for formal occasions, while backpacks are increasingly favored by younger demographics seeking stylish yet functional options. The trend toward multi-functional and gender-neutral designs is also influencing product innovation .

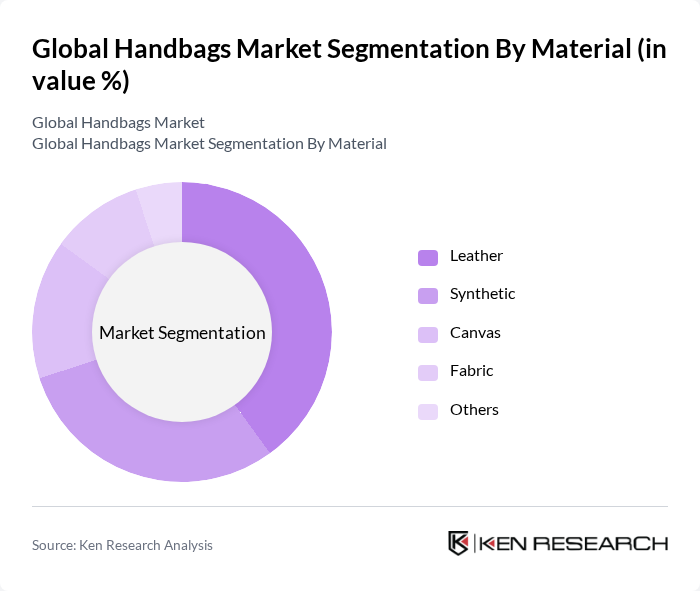

By Material:The handbags market is also categorized by material, including leather, synthetic, canvas, fabric, and others. Leather remains the most sought-after material due to its durability and luxury appeal, while synthetic materials are gaining popularity for their affordability and variety. Canvas and fabric options are favored for casual and eco-friendly choices, appealing to a younger audience. The growing emphasis on sustainability is prompting brands to incorporate recycled and plant-based materials, reflecting consumer demand for environmentally responsible products .

The Global Handbags Market is characterized by a dynamic mix of regional and international players. Leading participants such as LVMH Moët Hennessy Louis Vuitton, Gucci (Kering Group), Prada Group, Coach (Tapestry, Inc.), Michael Kors (Capri Holdings), Hermès International, Burberry Group plc, Kate Spade (Tapestry, Inc.), Tory Burch LLC, Fossil Group, Inc., Ralph Lauren Corporation, Marc Jacobs International LLC, Longchamp SAS, Kipling (VF Corporation), Tumi Holdings, Inc. (Samsonite International S.A.) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the handbags market appears promising, driven by evolving consumer preferences and technological advancements. As sustainability becomes a priority, brands that adopt eco-friendly practices are likely to attract a loyal customer base. Additionally, the integration of technology in design and production processes is expected to enhance product offerings, catering to the demand for innovative and multifunctional bags. The market is poised for growth as brands adapt to these trends and capitalize on emerging opportunities.

| Segment | Sub-Segments |

|---|---|

| By Type | Tote Bags Crossbody Bags Clutches and Wallets Shoulder Bags Satchels and Saddles Backpacks Messenger Bags Others |

| By Material | Leather Synthetic Canvas Fabric Others |

| By Price Range | Budget Mid-range Premium Luxury |

| By Distribution Channel | Online Retail Department Stores Specialty Stores Supermarkets Others |

| By End-User | Women Men Children Unisex |

| By Occasion | Casual Formal Travel Sports Others |

| By Brand Type | Luxury Brands Mass Market Brands Private Labels Others |

| By Geography | North America (United States, Canada, Mexico) South America (Brazil, Argentina, Rest of South America) Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe) Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa) Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Handbag Market Insights | 100 | Brand Managers, Luxury Retail Executives |

| Mid-range Handbag Consumer Preferences | 80 | Retail Store Managers, Fashion Buyers |

| Budget Handbag Sales Trends | 70 | Sales Associates, E-commerce Managers |

| Handbag Design and Innovation Feedback | 60 | Product Designers, Trend Analysts |

| Consumer Purchase Behavior Analysis | 90 | Fashion Consumers, Market Researchers |

The Global Handbags Market is valued at approximately USD 56 billion, reflecting a significant growth trend driven by rising disposable incomes, fashion consciousness, and the demand for luxury handbags.