Region:Middle East

Author(s):Geetanshi

Product Code:KRAC3021

Pages:93

Published On:October 2025

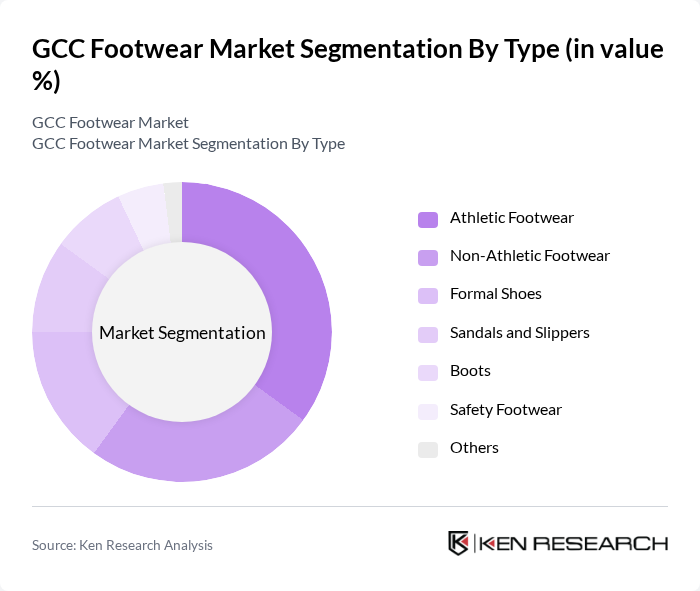

By Type:The footwear market is segmented into various types, including Athletic Footwear, Non-Athletic Footwear, Formal Shoes, Sandals and Slippers, Boots, Safety Footwear, and Others. Non-Athletic Footwear currently accounts for the majority of the market share, driven by strong demand for everyday fashion and lifestyle footwear. Athletic Footwear represents a significant segment, propelled by the increasing popularity of fitness and sports activities among consumers, along with high participation in athletic activities across the region. The demand for Formal Shoes remains steady, particularly in professional settings, while Sandals and Slippers are favored for casual wear in the region's warm climate. Boots and Safety Footwear are also gaining traction due to their functional benefits, with boots showing growing consumer interest.

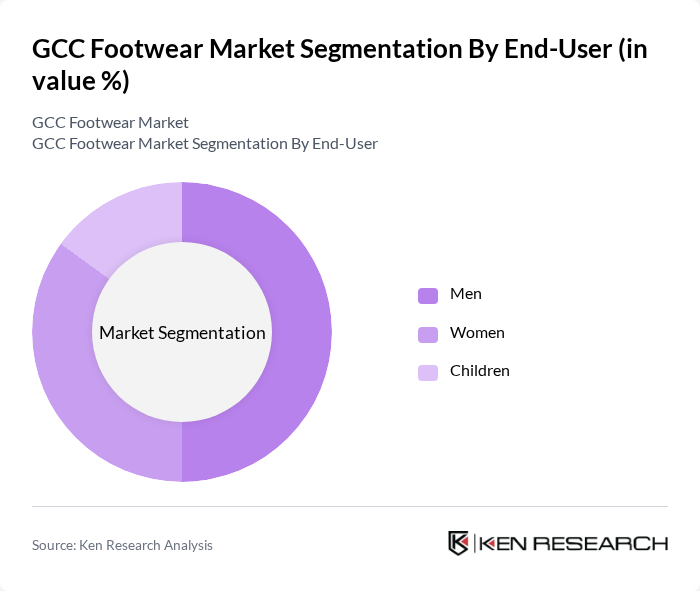

By End-User:The market is segmented by end-user into Men, Women, and Children. The Men's segment dominates the market, driven by higher demand for both athletic and formal footwear, reflecting traditional shopping patterns and professional footwear requirements in the region. Women's footwear is also significant, with trends leaning towards stylish and versatile options that combine fashion with comfort. The Children's segment is growing, fueled by increasing awareness of the importance of proper footwear for development and comfort, as well as rising household incomes enabling greater spending on quality children's products.

The GCC Footwear Market is characterized by a dynamic mix of regional and international players. Leading participants such as Adidas AG, Nike Inc., Puma SE, Skechers USA Inc., New Balance Athletics Inc., ASICS Corporation, Under Armour Inc., Bata Limited, Clarks International Ltd., Ecco Sko A/S, Geox S.p.A., Crocs Inc., Hush Puppies, Dr. Martens plc, Timberland LLC contribute to innovation, geographic expansion, and service delivery in this space.

The GCC footwear market is poised for dynamic growth, driven by evolving consumer preferences and technological advancements. As sustainability becomes a priority, brands are likely to innovate in eco-friendly materials and production methods. Additionally, the rise of digital platforms will enhance customer engagement and streamline purchasing processes. Companies that adapt to these trends will likely capture a larger market share, positioning themselves favorably in an increasingly competitive landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Athletic Footwear Non-Athletic Footwear Formal Shoes Sandals and Slippers Boots Safety Footwear Others |

| By End-User | Men Women Children |

| By Sales Channel | Online Retail Offline Retail Wholesale |

| By Price Range | Mass Market Premium |

| By Material | Leather Rubber Plastic Fabric Others |

| By Distribution Channel | Footwear Specialists Department Stores Supermarkets and Hypermarkets Online Sales |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences in Footwear | 100 | General Consumers, Fashion Enthusiasts |

| Retail Footwear Sales Insights | 60 | Store Managers, Retail Buyers |

| Footwear Manufacturing Trends | 50 | Production Managers, Supply Chain Analysts |

| Online Footwear Shopping Behavior | 80 | E-commerce Managers, Digital Marketing Specialists |

| Footwear Sustainability Practices | 40 | Sustainability Officers, Product Development Managers |

The GCC Footwear Market is valued at approximately USD 5.1 billion, driven by increasing disposable incomes, a growing population, and a rising trend towards fashionable and lifestyle footwear products.