Region:Global

Author(s):Geetanshi

Product Code:KRAD4165

Pages:82

Published On:December 2025

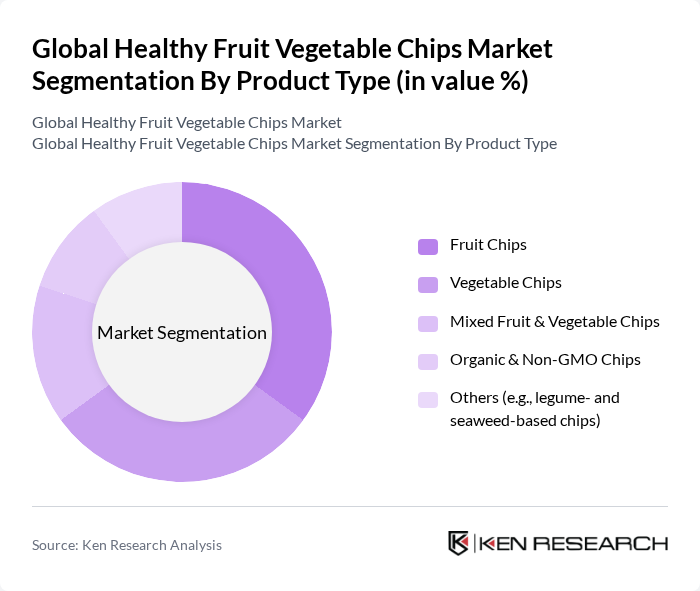

By Product Type:The product type segmentation includes various categories such as fruit chips, vegetable chips, mixed fruit & vegetable chips, organic & non-GMO chips, and others like legume- and seaweed-based chips. This structure is consistent with how recent industry reports segment fruit and vegetable chips by ingredient base and processing claims. Among these, fruit chips have gained significant popularity due to their natural sweetness and perceived health benefits, with apple, banana, and mixed tropical fruit chips seeing strong demand as minimally processed, on-the-go snacks. Consumers are increasingly opting for fruit chips as a healthier alternative to traditional fried snacks, supporting their market share in both offline and online channels. Vegetable chips are also gaining traction, particularly among health-conscious consumers looking for low-calorie, fiber-rich snack options based on sweet potato, beetroot, kale, carrot, and mixed root vegetables. The organic & non-GMO segment is witnessing rapid growth as consumers become more aware of food sourcing, clean-label requirements, and ingredient integrity, driving launches of certified organic, non-GMO, gluten-free, and minimally processed chips.

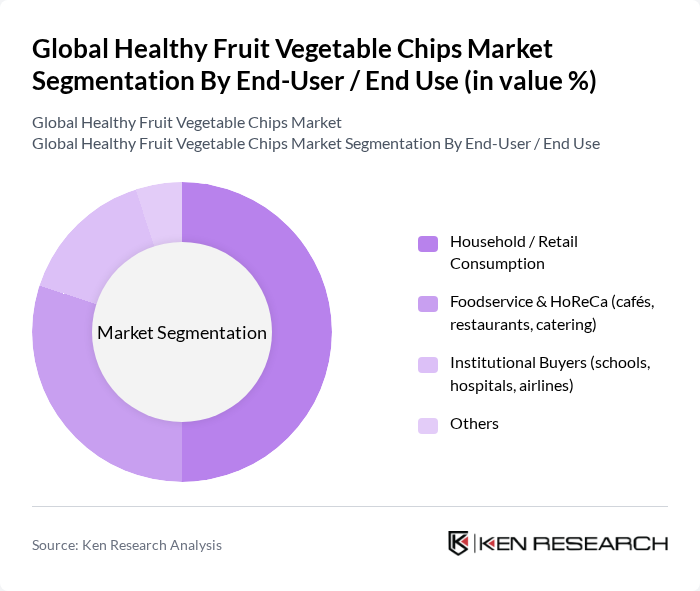

By End-User / End Use:This segmentation includes household/retail consumption, foodservice & HoReCa (cafés, restaurants, catering), institutional buyers (schools, hospitals, airlines), and others. This structure is consistent with leading market studies that classify end use into household, foodservice, and institutional channels for vegetable and fruit-based snacks. The household/retail consumption segment is the largest, driven by the increasing trend of healthy snacking at home, growth of modern grocery retail, and rapid expansion of e-commerce and quick-commerce platforms focused on better-for-you snacks. Consumers are more inclined to purchase healthy snacks for personal and family consumption, leading to a rise in retail sales of baked, air-dried, vacuum-fried, and portion-controlled chip formats. The foodservice sector is also expanding as restaurants, cafés, coffee chains, and workplace and airline catering incorporate healthy snack options (such as vegetable crisps as sides and fruit chips as toppings) into their menus, responding to the growing demand for nutritious and premium snacking choices away from home.

The Global Healthy Fruit Vegetable Chips Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bare Snacks (Bare Foods Co., a PepsiCo brand), Rhythm Superfoods (Rhythm Foods), Terra Chips (Hain Celestial Group), Calbee Inc., PepsiCo, Inc. (including Off The Eaten Path, SunChips), Kellogg Company (Kellanova) – e.g., Special K, related better-for-you snacks, General Mills, Inc. (including Food Should Taste Good), The Hain Celestial Group, Inc. (including Sensible Portions, Garden of Eatin’), Utz Brands, Inc. (including Good Health Natural Products), Simply 7 Snacks LLC, Herr Foods Inc. (including Herr’s Veggie & baked chips), Campbell Soup Company (Kettle Brand), PepsiCo France – Vico / Benenuts vegetable & better-for-you chips, Want Want China Holdings Limited (healthy rice and vegetable-based snacks), Local & Emerging Brands (e.g., Luke’s Organic, The Good Crisp Company, Deep River Snacks) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the healthy fruit and vegetable chips market appears promising, driven by increasing consumer demand for nutritious snacks and innovative product offerings. As health trends continue to evolve, companies are likely to invest in research and development to create new flavors and textures. Additionally, the expansion of e-commerce platforms will facilitate greater accessibility, allowing brands to reach a broader audience. This dynamic environment presents opportunities for growth and innovation in the sector, particularly as consumers seek healthier alternatives.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Fruit Chips Vegetable Chips Mixed Fruit & Vegetable Chips Organic & Non-GMO Chips Others (e.g., legume- and seaweed-based chips) |

| By End-User / End Use | Household / Retail Consumption Foodservice & HoReCa (cafés, restaurants, catering) Institutional Buyers (schools, hospitals, airlines) Others |

| By Processing / Preparation Method | Baked Air-Dried / Dehydrated Vacuum-Fried Freeze-Dried Others |

| By Flavor Profile | Savory & Salted Sweet & Fruit-Flavored Spicy & Ethnic Flavors Others (e.g., herb, umami, gourmet) |

| By Distribution Channel | Supermarkets / Hypermarkets Convenience & Specialty Health Stores Online Retail & E-commerce Other Offline Channels (club stores, pharmacies, etc.) |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Key Health & Nutrition Claim | Low-Calorie / Reduced Fat Options High-Fiber / Whole-Ingredient Options Gluten-Free & Allergen-Free Options Organic, Clean-Label & Non-GMO Options |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Health Food Retailers | 100 | Store Managers, Category Buyers |

| Snack Food Manufacturers | 90 | Product Development Leads, Marketing Managers |

| Consumer Focus Groups | 60 | Health-Conscious Consumers, Snack Enthusiasts |

| Nutrition Experts | 50 | Dietitians, Health Coaches |

| Distribution Channels | 70 | Logistics Coordinators, Supply Chain Analysts |

The Global Healthy Fruit Vegetable Chips Market is valued at approximately USD 14.0 billion, reflecting a significant growth trend driven by increasing health consciousness and demand for healthier snacking options among consumers.