Region:Global

Author(s):Dev

Product Code:KRAA2575

Pages:93

Published On:August 2025

By Type:The market is segmented into various types, including Hardware, Software, IT Services, Telecommunication Services, Cloud Computing, Cybersecurity Solutions, Internet of Things (IoT), Big Data & Analytics, and Others. Among these, IT Services and Software are the most dominant segments, driven by the increasing reliance on technology for business operations, the growing need for digital solutions, and the rapid adoption of cloud and AI-powered platforms. Hardware and telecommunication services continue to play a critical role in supporting connectivity and infrastructure, while cybersecurity solutions and IoT are experiencing accelerated growth due to heightened security risks and the expansion of connected devices .

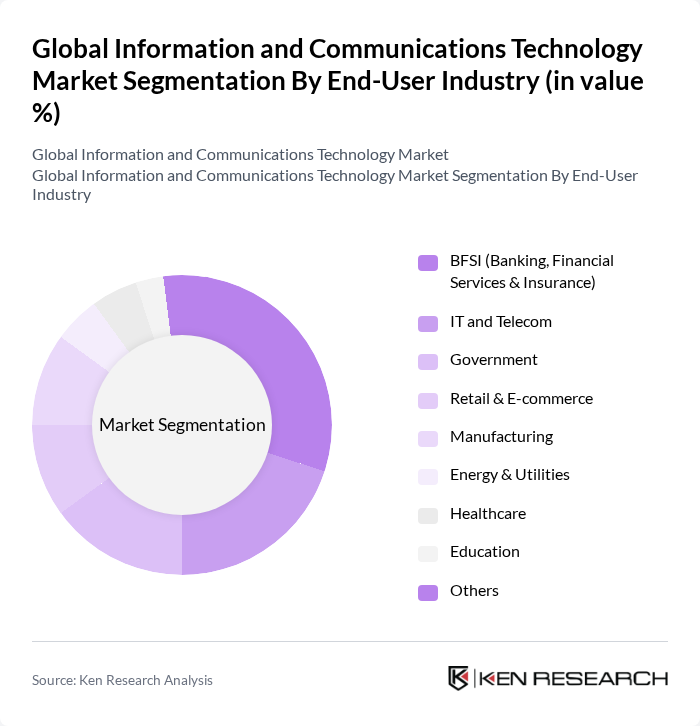

By End-User Industry:The market is further segmented by end-user industries, including BFSI (Banking, Financial Services & Insurance), IT and Telecom, Government, Retail & E-commerce, Manufacturing, Energy & Utilities, Healthcare, Education, and Others. The BFSI sector is the largest consumer of ICT services, driven by the need for secure transactions, advanced data management, and regulatory compliance. IT and Telecom, Government, and Healthcare sectors are also major adopters, leveraging ICT for digital transformation, operational efficiency, and service innovation. Manufacturing and Energy & Utilities increasingly utilize ICT for automation, smart infrastructure, and process optimization .

The Global Information and Communications Technology Market is characterized by a dynamic mix of regional and international players. Leading participants such as IBM Corporation, Microsoft Corporation, Cisco Systems, Inc., Oracle Corporation, SAP SE, Dell Technologies Inc., Hewlett Packard Enterprise, Accenture plc, Intel Corporation, Amazon Web Services, Inc., Google LLC, Salesforce, Inc., VMware, Inc., Ericsson AB, Nokia Corporation, Tata Consultancy Services (TCS), Red Hat, Inc., Fujitsu Limited, NEC Corporation, Capgemini SE contribute to innovation, geographic expansion, and service delivery in this space.

The future of the ICT market is poised for transformative growth, driven by advancements in artificial intelligence and the ongoing digital transformation across industries. As organizations increasingly adopt AI technologies, operational efficiencies will improve, leading to enhanced service delivery. Additionally, the shift towards remote work solutions will continue to shape the market landscape, fostering innovation and collaboration. Companies that embrace these trends will likely gain a competitive edge in the evolving digital economy, positioning themselves for long-term success.

| Segment | Sub-Segments |

|---|---|

| By Type | Hardware Software IT Services Telecommunication Services Cloud Computing Cybersecurity Solutions Internet of Things (IoT) Big Data & Analytics Others |

| By End-User Industry | BFSI (Banking, Financial Services & Insurance) IT and Telecom Government Retail & E-commerce Manufacturing Energy & Utilities Healthcare Education Others |

| By Enterprise Size | Small and Medium Enterprises (SMEs) Large Enterprises |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa Australia & New Zealand |

| By Application | Communication Services Data Management Network Security Cloud Computing Software Development Digital Education Data Center Systems Others |

| By Sales Channel | Direct Sales Online Sales Distributors Retail Others |

| By Investment Source | Private Investment Government Funding Venture Capital Public-Private Partnerships Others |

| By Policy Support | Tax Incentives Grants and Subsidies Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cloud Computing Adoption | 120 | IT Managers, Cloud Architects |

| Cybersecurity Solutions | 90 | CISOs, Security Analysts |

| Telecommunications Infrastructure | 60 | Network Engineers, Telecom Executives |

| AI and Machine Learning Applications | 50 | Data Scientists, Product Managers |

| IoT Device Integration | 70 | IoT Specialists, Operations Managers |

The Global Information and Communications Technology Market is valued at approximately USD 6 trillion, driven by digital transformation, mobile device proliferation, and increased internet connectivity. This growth is further supported by advancements in cloud computing, artificial intelligence, and cybersecurity.