Region:Global

Author(s):Dev

Product Code:KRAC0387

Pages:89

Published On:August 2025

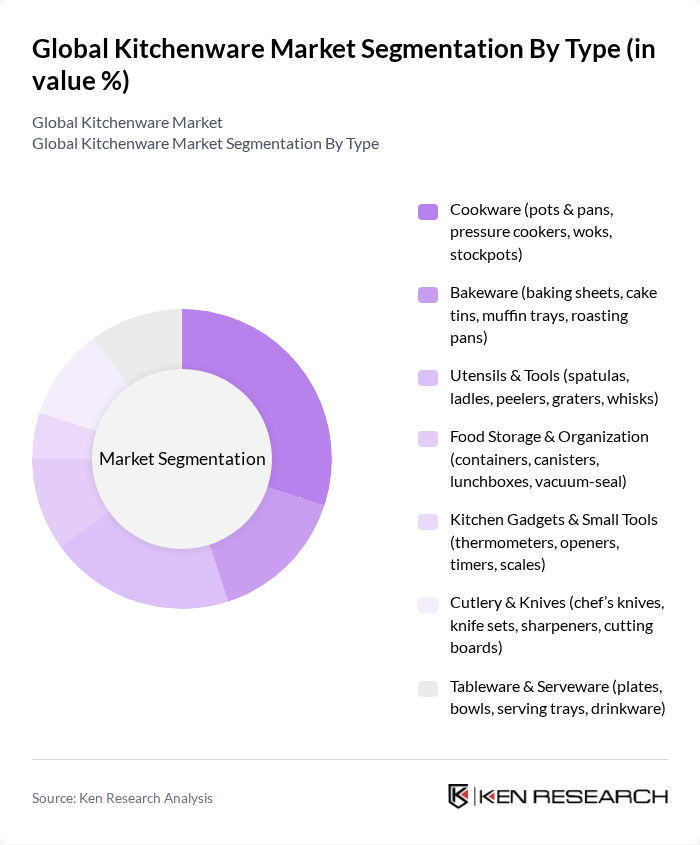

By Type:The kitchenware market can be segmented into various types, including cookware, bakeware, utensils and tools, food storage and organization, kitchen gadgets and small tools, cutlery and knives, and tableware and serveware. Each of these segments caters to different consumer needs and preferences, with cookware and utensils being the most popular due to their essential role in daily cooking activities.

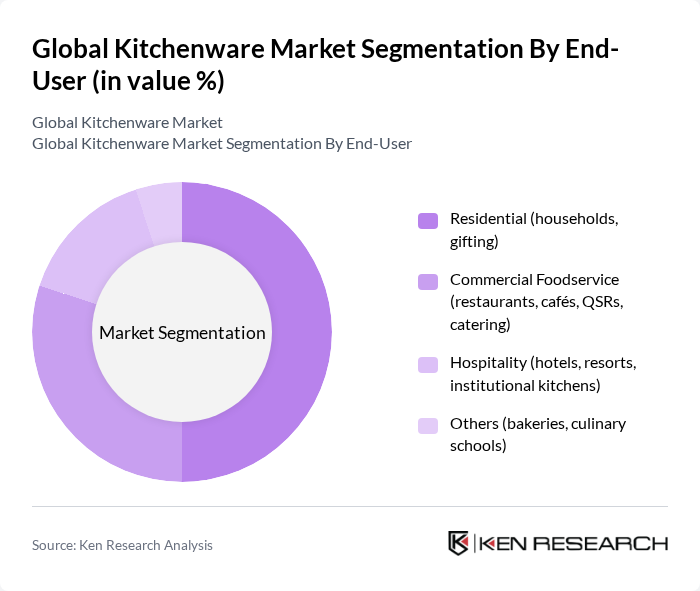

By End-User:The kitchenware market is segmented by end-user into residential, commercial foodservice, hospitality, and others. The residential segment dominates the market, driven by the increasing trend of home cooking and the rise of culinary enthusiasts; recent industry data indicates residential accounts for a majority share. The commercial foodservice segment is also significant, as restaurants and cafes require high-quality kitchenware to meet customer demands, with sector expansion supporting demand.

The Global Kitchenware Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tupperware Brands Corporation, OXO (Helen of Troy Limited), Cuisinart (Conair LLC), KitchenAid (Whirlpool Corporation), Rubbermaid (Newell Brands), Pyrex (Instant Brands), Le Creuset, Zojirushi Corporation, Joseph Joseph, All-Clad Metalcrafters LLC, Scanpan, Tefal (Groupe SEB), Brabantia, Cuisipro, KitchenCraft (Lifetime Brands), Zwilling J.A. Henckels, WMF (Groupe SEB), Fiskars Group (including Iittala, Royal Doulton, Waterford), Meyer Corporation (Circulon, Anolon, Prestige), Tramontina, Lodge Cast Iron, GreenPan (The Cookware Company), BergHOFF, Fissler, Hawkins Cookers Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the kitchenware market in None appears promising, driven by evolving consumer preferences and technological advancements. As sustainability becomes a priority, manufacturers are likely to invest in eco-friendly materials and innovative designs. Additionally, the integration of smart technology into kitchenware is expected to enhance user experience, catering to the tech-savvy consumer. These trends will shape the market landscape, fostering growth and encouraging new product development in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Cookware (pots & pans, pressure cookers, woks, stockpots) Bakeware (baking sheets, cake tins, muffin trays, roasting pans) Utensils & Tools (spatulas, ladles, peelers, graters, whisks) Food Storage & Organization (containers, canisters, lunchboxes, vacuum-seal) Kitchen Gadgets & Small Tools (thermometers, openers, timers, scales) Cutlery & Knives (chef’s knives, knife sets, sharpeners, cutting boards) Tableware & Serveware (plates, bowls, serving trays, drinkware) |

| By End-User | Residential (households, gifting) Commercial Foodservice (restaurants, cafés, QSRs, catering) Hospitality (hotels, resorts, institutional kitchens) Others (bakeries, culinary schools) |

| By Sales Channel | Online Retail (marketplaces, brand D2C) Offline Retail (hypermarkets, specialty & department stores) B2B/Contract Sales (HoReCa distributors, institutional) Wholesale |

| By Material | Stainless Steel Aluminum (including hard-anodized) Cast Iron & Enameled Cast Iron Nonstick Coated (PTFE/PFOA-free, ceramic-coated) Glass & Borosilicate Silicone Wood & Bamboo Plastics & Composites Ceramics & Stoneware |

| By Price Range | Budget Mid-Range Premium & Luxury |

| By Brand | Established Brands Emerging/Digital-First Brands Private Labels (retailer-owned) |

| By Functionality | Multi-functional Specialized/Professional Basic/Everyday |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cookware Sales Insights | 140 | Product Managers, Retail Buyers |

| Consumer Preferences in Kitchen Utensils | 110 | End Consumers, Kitchenware Enthusiasts |

| Market Trends in Kitchen Storage Solutions | 80 | Supply Chain Managers, Retail Analysts |

| Impact of E-commerce on Kitchenware Sales | 120 | E-commerce Managers, Digital Marketing Specialists |

| Sustainability Trends in Kitchenware | 90 | Product Development Managers, Sustainability Officers |

The Global Kitchenware Market is valued at approximately USD 73 billion, reflecting a significant growth trend driven by increased consumer interest in home cooking, culinary shows, and sustainable purchasing practices.