Region:Middle East

Author(s):Geetanshi

Product Code:KRAC9399

Pages:93

Published On:November 2025

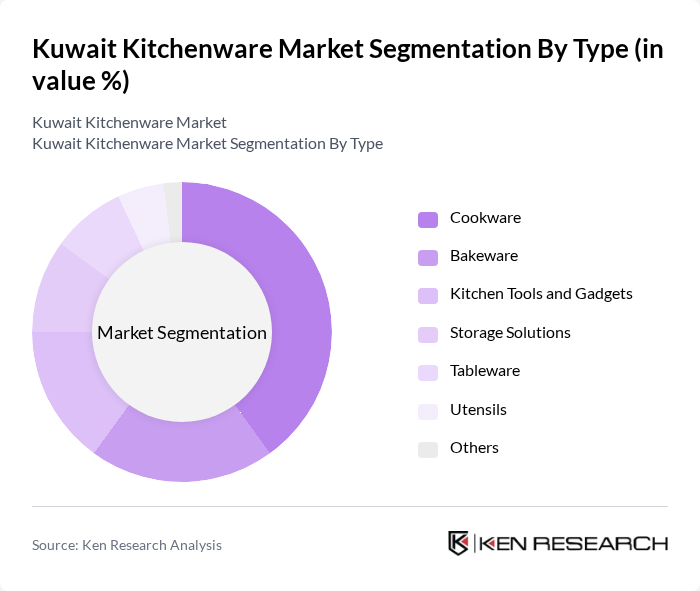

By Type:The kitchenware market can be segmented into various types, including cookware, bakeware, kitchen tools and gadgets, storage solutions, tableware, utensils, and others. Among these, cookware is the leading sub-segment, driven by the increasing popularity of home cooking and the demand for high-quality pots and pans. Consumers are increasingly investing in durable and versatile cookware that enhances their cooking experience. Bakeware and kitchen tools also show significant demand, reflecting trends in baking and meal preparation. The market is further shaped by consumer preferences for non-stick and stainless steel cookware, as well as multi-functional kitchen gadgets .

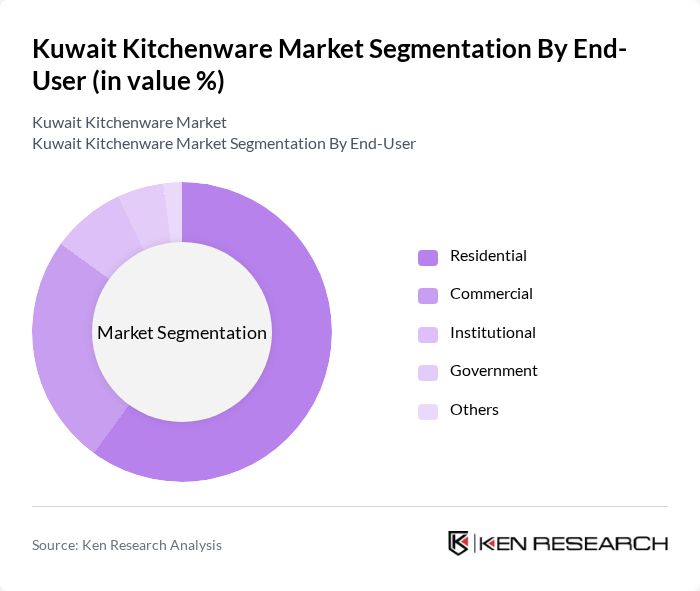

By End-User:The kitchenware market is segmented by end-user into residential, commercial, institutional, government, and others. The residential segment dominates the market, driven by the growing trend of home cooking and kitchen renovations. Consumers are increasingly investing in high-quality kitchenware to enhance their cooking experience at home. The commercial segment also shows significant growth, particularly in restaurants and catering services, which require durable and efficient kitchenware. Institutional and government segments remain niche but are supported by procurement for large-scale facilities and public sector kitchens .

The Kuwait Kitchenware Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al-Homaizi Group, Al-Mansouria Kitchenware, M.H. Alshaya Co., Al-Futtaim Group, IKEA Kuwait, Home Centre, Carrefour Kuwait, LuLu Hypermarket, Xcite by Alghanim Electronics, Sultan Center, Al-Muhalab Mall, Al-Dhow Group, Al-Qurain Group, Al-Mazaya Holding, Al-Sayer Group contribute to innovation, geographic expansion, and service delivery in this space .

The Kuwait kitchenware market is poised for dynamic growth, driven by evolving consumer preferences and technological advancements. As the trend towards smart kitchenware gains traction, manufacturers are likely to innovate and introduce products that integrate technology for enhanced functionality. Additionally, the increasing focus on sustainability will encourage brands to develop eco-friendly kitchenware, aligning with consumer values. These trends will shape the market landscape, presenting opportunities for growth and differentiation in a competitive environment.

| Segment | Sub-Segments |

|---|---|

| By Type | Cookware Bakeware Kitchen Tools and Gadgets Storage Solutions Tableware Utensils Others |

| By End-User | Residential Commercial Institutional Government Others |

| By Material | Stainless Steel Non-stick Glass Ceramic Others |

| By Distribution Channel | Online Retail Supermarkets/Hypermarkets Specialty Stores Direct Sales Third-party E-commerce Platforms Social Media Sales Others |

| By Price Range | Budget Mid-Range Premium Luxury Others |

| By Brand | Local Brands International Brands Private Labels Others |

| By Usage | Daily Use Occasional Use Professional Use Others |

| By Functionality | Multi-functional Products Specialty Products Basic Products Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Kitchenware Sales | 100 | Store Managers, Category Buyers |

| Consumer Preferences in Kitchenware | 120 | Household Decision Makers, Cooking Enthusiasts |

| Kitchenware Importers and Distributors | 80 | Logistics Managers, Procurement Officers |

| Online Kitchenware Retailers | 60 | E-commerce Managers, Digital Marketing Specialists |

| Kitchenware Product Manufacturers | 50 | Product Development Managers, Quality Assurance Leads |

The Kuwait Kitchenware Market is valued at approximately USD 250 million, reflecting a significant growth trend driven by increased consumer spending on home improvement and kitchen renovations, particularly following the COVID-19 pandemic.