Region:Middle East

Author(s):Geetanshi

Product Code:KRAC9402

Pages:94

Published On:November 2025

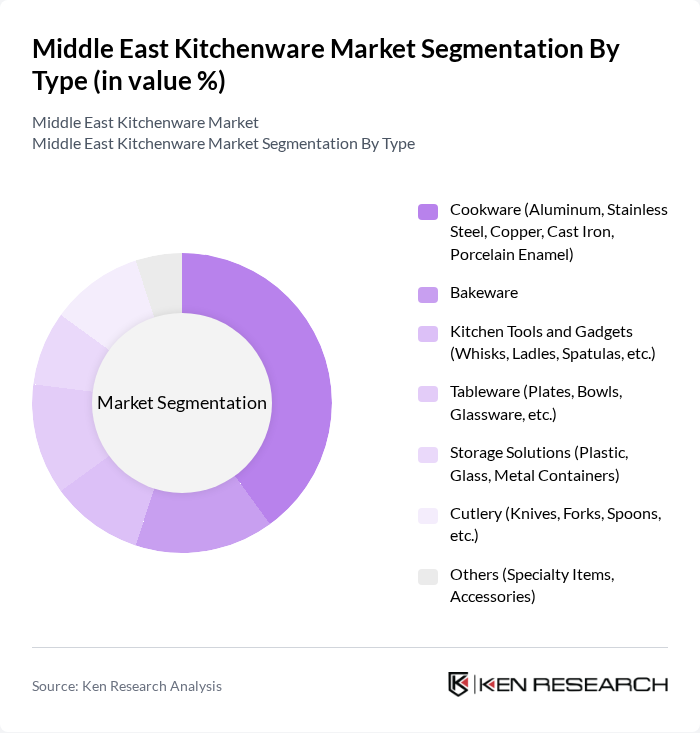

By Type:The kitchenware market is segmented into cookware, bakeware, kitchen tools and gadgets, tableware, storage solutions, cutlery, and others. Cookware, especially aluminum and stainless steel, remains the leading segment due to its durability, versatility, and alignment with consumer preferences for both performance and design. The rise in home cooking and the adoption of modular kitchens have further boosted demand for high-quality cookware.

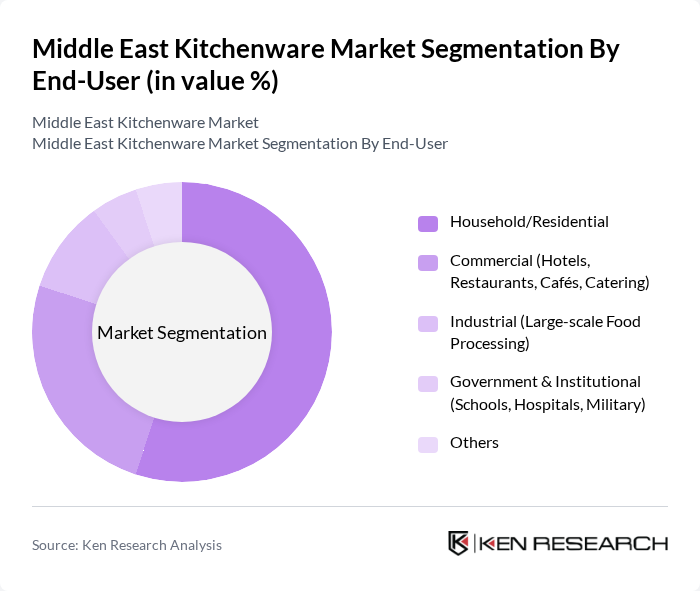

By End-User:The kitchenware market is segmented by end-user into household/residential, commercial, industrial, government & institutional, and others. The household/residential segment leads the market, driven by the increasing number of home cooks, rising disposable incomes, and the trend of home dining. Consumers are investing in quality kitchenware to enhance their cooking experience, with commercial segments such as hotels and restaurants also contributing significantly to market growth.

The Middle East Kitchenware Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tefal, Pyrex, IKEA, Cuisinart, Kenwood, Philips, Luminarc, Royalford, Prestige, KitchenAid, Joseph Joseph, Le Creuset, Lodge Cast Iron, All-Clad, Home Centre contribute to innovation, geographic expansion, and service delivery in this space.

The Middle East kitchenware market is poised for significant transformation, driven by evolving consumer preferences and technological advancements. As urbanization continues to rise, the demand for innovative and multifunctional kitchen tools will likely increase. Additionally, the integration of smart technology into kitchenware will cater to the growing interest in convenience and efficiency. Brands that adapt to these trends and focus on sustainability will be well-positioned to capture market share in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Cookware (Aluminum, Stainless Steel, Copper, Cast Iron, Porcelain Enamel) Bakeware Kitchen Tools and Gadgets (Whisks, Ladles, Spatulas, etc.) Tableware (Plates, Bowls, Glassware, etc.) Storage Solutions (Plastic, Glass, Metal Containers) Cutlery (Knives, Forks, Spoons, etc.) Others (Specialty Items, Accessories) |

| By End-User | Household/Residential Commercial (Hotels, Restaurants, Cafés, Catering) Industrial (Large-scale Food Processing) Government & Institutional (Schools, Hospitals, Military) Others |

| By Material | Aluminum Stainless Steel Plastic Glass Ceramic Copper Cast Iron Others (Silicone, Wood, etc.) |

| By Distribution Channel | Online Retail (E-commerce Platforms) Supermarkets/Hypermarkets Specialty Stores Direct Sales Others (Department Stores, Wholesale) |

| By Price Range | Economy/Budget Mid-Range Premium Luxury Others |

| By Brand Type | National Brands Private Labels International Brands Local/Regional Brands Others |

| By Functionality | Multi-functional Single-purpose Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Kitchenware Sales | 100 | Store Managers, Category Buyers |

| Consumer Preferences in Kitchenware | 120 | Household Decision Makers, Cooking Enthusiasts |

| Distribution Channel Insights | 80 | Logistics Coordinators, Supply Chain Managers |

| Market Trends and Innovations | 60 | Product Development Managers, Marketing Executives |

| Online Kitchenware Purchases | 70 | E-commerce Managers, Digital Marketing Specialists |

The Middle East Kitchenware Market is valued at approximately USD 7.7 billion, driven by factors such as increasing consumer spending on home improvement, urbanization, and a growing trend towards cooking at home.