Region:Middle East

Author(s):Shubham

Product Code:KRAA8863

Pages:82

Published On:November 2025

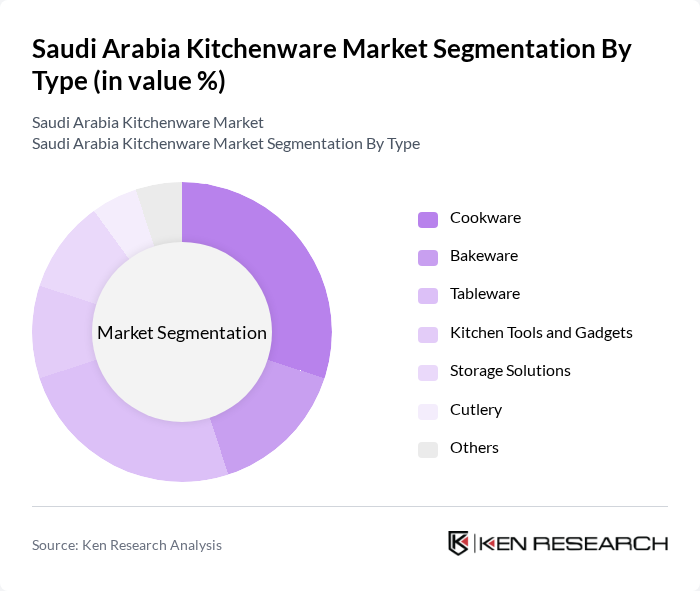

By Type:The kitchenware market can be segmented into various types, including cookware, bakeware, tableware, kitchen tools and gadgets, storage solutions, cutlery, and others. Each of these segments caters to different consumer needs and preferences. Cookware and tableware are particularly popular due to their essential roles in daily cooking and dining, while bakeware and kitchen gadgets are gaining traction among younger consumers and those interested in gourmet cooking and meal prepping. Storage solutions and multifunctional products are also in demand as consumers seek to maximize kitchen efficiency and organization .

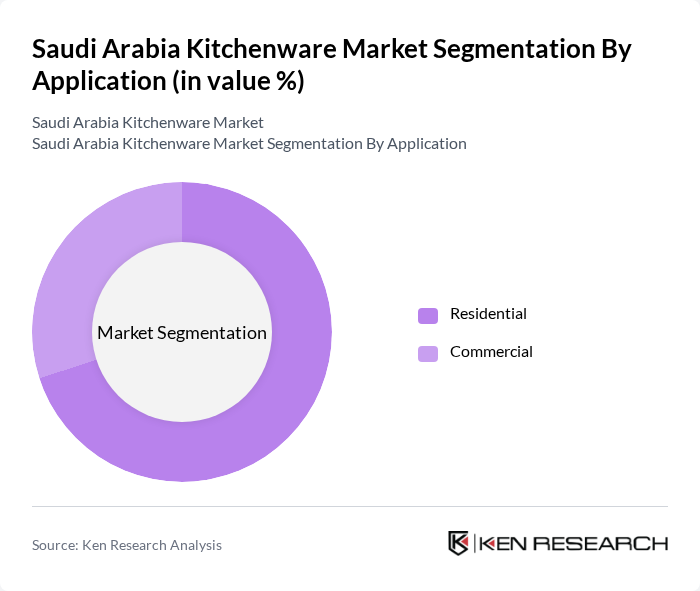

By Application:The kitchenware market is further segmented by application into residential and commercial sectors. The residential segment is driven by the growing trend of home cooking, the increasing number of urban households, and a rising interest in healthy meal preparation. The commercial segment benefits from the expansion of hotels, restaurants, and catering services, with a focus on high-durability and ergonomic kitchenware to meet professional demands .

The Saudi Arabia Kitchenware Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tefal, IKEA, Al-Dar Kitchenware, Al Hada Company, Home Centre, Carrefour, LuLu Hypermarket, Nasser Bin Khaled Holding Co. Ltd., ALFAISAL Group, SEDCO Holding LLC, King Abdallah Economic City Kitchenware Products Factory (KAPF), Abdulaziz Saud Baeshen & Sons Co. Ltd., Al-Muhaidib Group, Al-Jazira Group, Faisal Jassim Trading Co. contribute to innovation, geographic expansion, and service delivery in this space .

The Saudi Arabia kitchenware market is poised for significant transformation driven by technological advancements and changing consumer preferences. As urbanization continues, the demand for innovative kitchen solutions will rise, particularly in smart appliances. Additionally, the growing trend towards sustainability will encourage manufacturers to develop eco-friendly products. With the expansion of e-commerce, brands will increasingly leverage online platforms to reach consumers, enhancing market accessibility and driving sales growth in the future.

| Segment | Sub-Segments |

|---|---|

| By Type | Cookware Bakeware Tableware Kitchen Tools and Gadgets Storage Solutions Cutlery Others |

| By Application | Residential Commercial |

| By Material | Stainless Steel Aluminum Non-stick Coatings Glass Silicone Plastic Others |

| By Distribution Channel | Hypermarkets/Supermarkets Specialty Stores Online Retail Others |

| By Price Range | Budget Mid-range Premium Luxury Others |

| By Region | Riyadh Jeddah Dammam Khobar Dhahran Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Kitchenware Sales | 100 | Store Managers, Category Buyers |

| Consumer Preferences in Kitchenware | 120 | Household Decision Makers, Cooking Enthusiasts |

| Online Kitchenware Purchases | 80 | E-commerce Managers, Digital Marketing Specialists |

| Kitchenware Manufacturing Insights | 60 | Production Managers, Quality Control Officers |

| Trends in Kitchenware Design | 60 | Product Designers, Trend Analysts |

The Saudi Arabia kitchenware market is valued at approximately USD 785 million, reflecting a significant growth trend driven by evolving consumer lifestyles and increased interest in home cooking.