Region:Middle East

Author(s):Geetanshi

Product Code:KRAC9387

Pages:92

Published On:November 2025

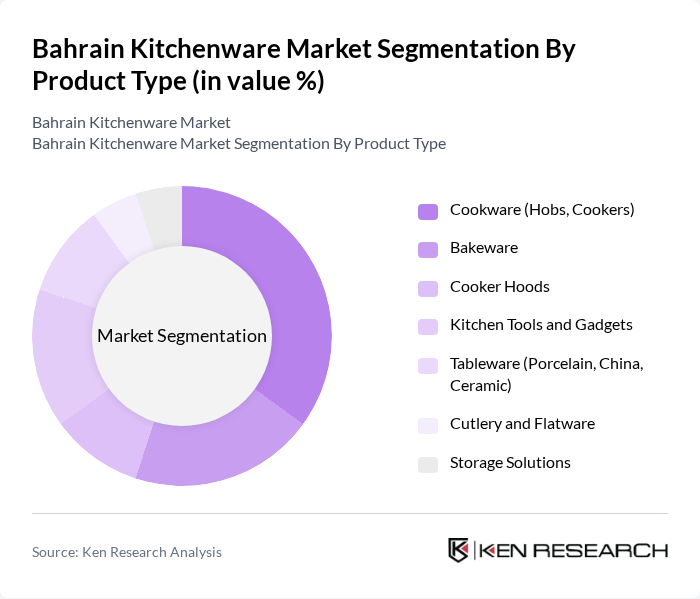

By Product Type:The product type segmentation includes various categories such as cookware, bakeware, cooker hoods, kitchen tools and gadgets, tableware, cutlery and flatware, and storage solutions. Among these, cookware, particularly hobs and cookers, is the leading sub-segment due to the increasing popularity of home cooking and culinary shows that inspire consumers to invest in high-quality cooking equipment. The demand for innovative and multifunctional cookware is also on the rise, driven by changing consumer preferences.

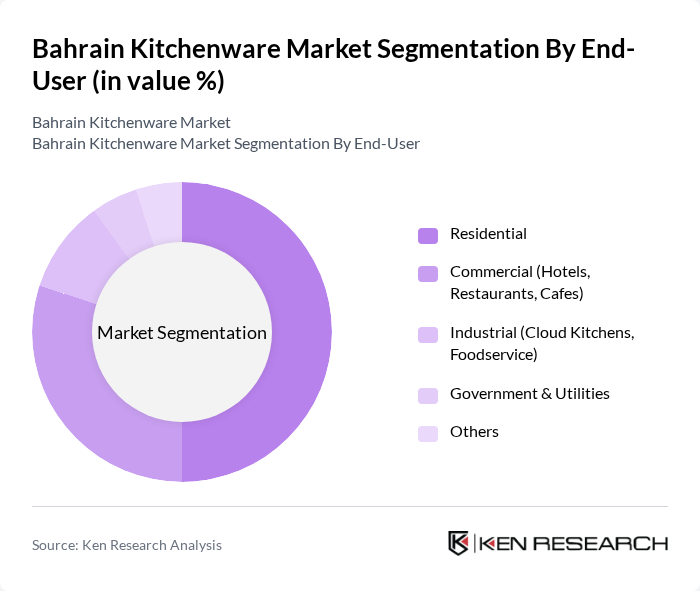

By End-User:The end-user segmentation encompasses residential, commercial, industrial, government & utilities, and others. The residential segment is the dominant sub-segment, driven by the growing trend of home cooking and the increasing number of households investing in kitchenware. The rise of social media platforms showcasing home-cooked meals has further fueled consumer interest in high-quality kitchen products.

The Bahrain Kitchenware Market is characterized by a dynamic mix of regional and international players. Leading participants such as IKEA Bahrain, Carrefour Bahrain, LuLu Hypermarket Bahrain, Al-Futtaim ACE, Daiso Japan Bahrain, Home Centre Bahrain, Americana Restaurants (Foodservice Kitchenware), Kitopi (Cloud Kitchen Operator), Talabat (Online Food Delivery - Kitchenware Demand Driver), Local Kitchenware Retailers and Distributors, Specialty Kitchen Stores, E-commerce Platforms (Regional) contribute to innovation, geographic expansion, and service delivery in this space.

The Bahrain kitchenware market is poised for significant transformation, driven by evolving consumer preferences and technological advancements. As sustainability becomes a priority, manufacturers are likely to focus on eco-friendly materials and practices. Additionally, the integration of smart technology into kitchen appliances is expected to gain traction, appealing to tech-savvy consumers. These trends, combined with the expansion of e-commerce platforms, will create a dynamic market landscape, fostering innovation and enhancing consumer access to diverse kitchenware options.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Cookware (Hobs, Cookers) Bakeware Cooker Hoods Kitchen Tools and Gadgets Tableware (Porcelain, China, Ceramic) Cutlery and Flatware Storage Solutions |

| By End-User | Residential Commercial (Hotels, Restaurants, Cafes) Industrial (Cloud Kitchens, Foodservice) Government & Utilities Others |

| By Distribution Channel | Online Retail (E-commerce Platforms) Supermarkets/Hypermarkets Specialty Stores Direct Sales Others |

| By Material | Stainless Steel Non-stick Coatings Glass Ceramic Silicone |

| By Price Range | Mass/Budget Mid-range Premium Luxury |

| By Brand Loyalty | Brand Loyal Customers Price-sensitive Customers Quality-focused Customers Others |

| By Usage Frequency | Daily Use Weekly Use Occasional Use Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Kitchenware Outlets | 60 | Store Managers, Sales Executives |

| Consumer Preferences Survey | 120 | Household Decision Makers, Kitchen Enthusiasts |

| Manufacturers and Suppliers | 40 | Production Managers, Supply Chain Coordinators |

| Online Kitchenware Retailers | 50 | E-commerce Managers, Digital Marketing Specialists |

| Market Trend Analysts | 40 | Market Researchers, Industry Analysts |

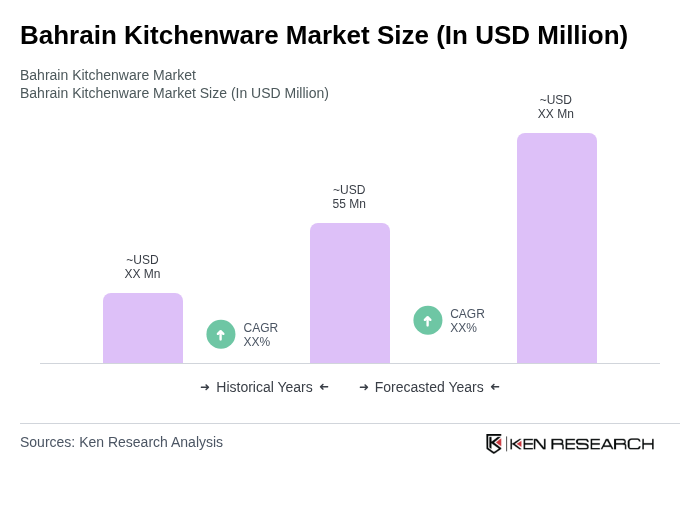

The Bahrain Kitchenware Market is valued at approximately USD 55 million, reflecting a comprehensive analysis of various sub-segments, including kitchen hoods, tableware, and plastic kitchenware, with kitchen hoods alone accounting for over USD 52 million in 2024.