Region:Global

Author(s):Rebecca

Product Code:KRAA2465

Pages:100

Published On:August 2025

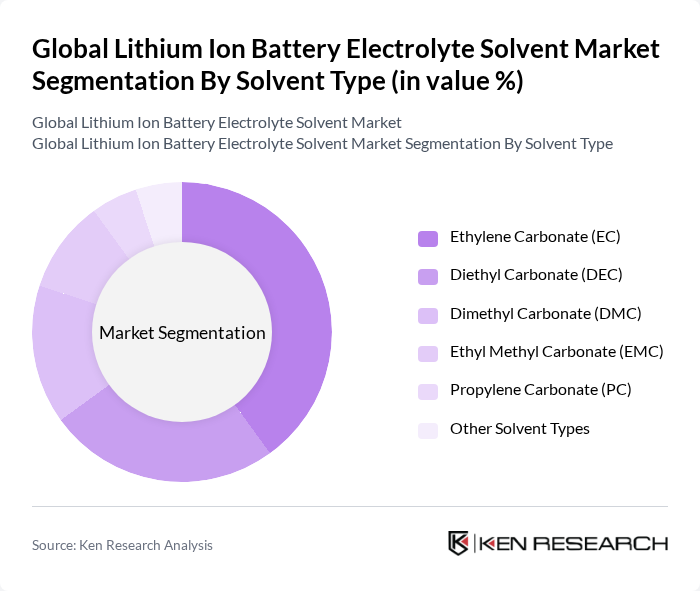

By Solvent Type:The solvent type segmentation includes key chemical compounds used in lithium-ion battery electrolytes: Ethylene Carbonate (EC), Diethyl Carbonate (DEC), Dimethyl Carbonate (DMC), Ethyl Methyl Carbonate (EMC), Propylene Carbonate (PC), and other solvent types. Ethylene Carbonate (EC) remains the most widely used due to its high dielectric constant, excellent solvating properties, and ability to enhance battery performance and safety. Dimethyl Carbonate (DMC) is also gaining prominence for its low toxicity and high efficiency in dissolving electrolyte salts, supporting improved ion transport and battery lifespan.

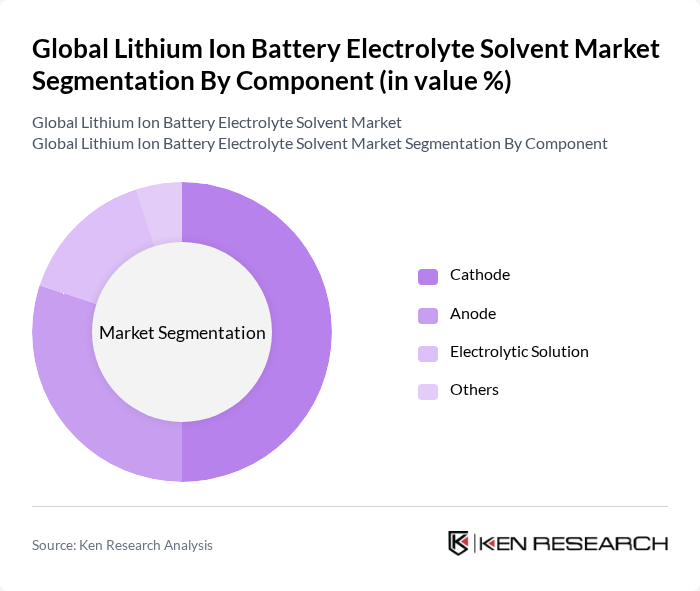

By Component:The component segmentation covers the main parts of lithium-ion batteries utilizing electrolyte solvents: cathode, anode, electrolytic solution, and others. The cathode segment is dominant, driven by surging demand for high-capacity batteries in electric vehicles and consumer electronics, which require advanced cathode materials for optimal energy density and cycle life. The anode and electrolytic solution segments also play critical roles in determining battery safety, charge rate, and overall performance.

The Global Lithium Ion Battery Electrolyte Solvent Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Mitsubishi Chemical Corporation, LG Chem Ltd., Solvay S.A., Gotion High-Tech Co., Ltd., Ube Industries, Ltd., Dow Inc., Samsung SDI Co., Ltd., Panasonic Corporation, Eastman Chemical Company, 3M Company, Asahi Kasei Corporation, KMG Chemicals, Inc., Arkema S.A., Capchem Technology Co., Ltd., Shenzhen Tianjin Jintai New Material Co., Ltd., Shandong Shida Shenghua Chemical Group Co., Ltd., Mitsui Chemicals, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the lithium-ion battery electrolyte solvent market appears promising, driven by technological advancements and increasing environmental awareness. As manufacturers focus on developing eco-friendly solvents, the market is likely to witness a shift towards sustainable practices. Additionally, the integration of artificial intelligence in battery management systems is expected to enhance efficiency and performance, further propelling market growth. Strategic collaborations among industry players will also play a crucial role in addressing challenges and seizing emerging opportunities.

| Segment | Sub-Segments |

|---|---|

| By Solvent Type | Ethylene Carbonate (EC) Diethyl Carbonate (DEC) Dimethyl Carbonate (DMC) Ethyl Methyl Carbonate (EMC) Propylene Carbonate (PC) Other Solvent Types |

| By Component | Cathode Anode Electrolytic Solution Others |

| By Application | Electric Vehicles (EV, HEV, PHEV) Consumer Electronics (Mobile, Laptops, Tablets, Wearables) Energy Storage Systems (Grid, Residential, Industrial) Power Backups/UPS Other Applications |

| By Grade | Battery Grade Industrial Grade |

| By Distribution Channel | Direct Sales Distributor Networks E-commerce Platforms |

| By Region | Asia-Pacific North America Europe Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Electric Vehicle Battery Manufacturers | 100 | Product Development Managers, Technical Directors |

| Consumer Electronics Battery Suppliers | 70 | Supply Chain Managers, Procurement Specialists |

| Renewable Energy Storage Solutions Providers | 60 | Operations Managers, R&D Engineers |

| Academic and Research Institutions | 40 | Research Scientists, Professors in Materials Science |

| Regulatory Bodies and Industry Associations | 40 | Policy Analysts, Compliance Officers |

The Global Lithium Ion Battery Electrolyte Solvent Market is valued at approximately USD 1.3 billion, reflecting a significant growth trajectory driven by the increasing demand for electric vehicles, consumer electronics, and renewable energy storage systems.