Region:Global

Author(s):Geetanshi

Product Code:KRAD7151

Pages:86

Published On:December 2025

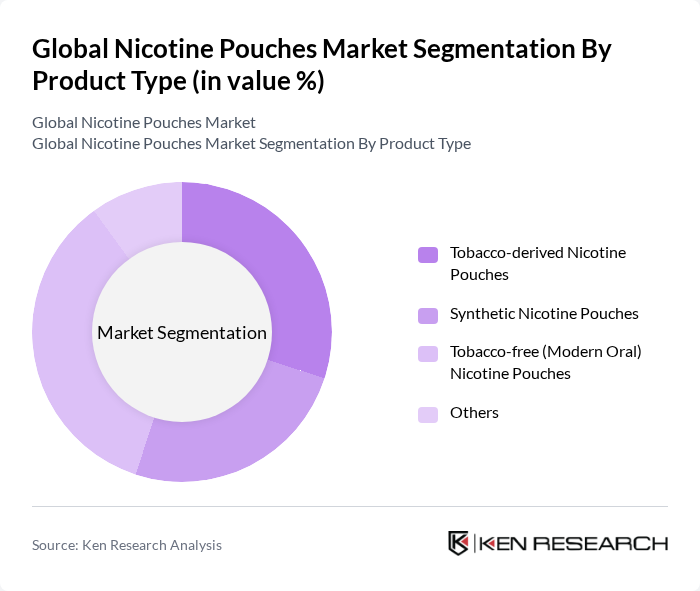

By Product Type:The market is segmented into Tobacco-derived Nicotine Pouches, Synthetic Nicotine Pouches, Tobacco-free (Modern Oral) Nicotine Pouches, and Others. Tobacco-free (Modern Oral) Nicotine Pouches, typically containing purified nicotine in a cellulose or plant-fiber base without tobacco leaf, are gaining significant traction due to their appeal to health-conscious adult consumers who want to avoid combustion, smoke, and traditional smokeless tobacco formats. The increasing preference for tobacco-free options is driven by growing awareness of the health risks associated with combustible tobacco use and the convenience of discreet, spit-free oral formats, leading to a pronounced shift in consumer behavior towards perceived lower-risk and more socially acceptable nicotine alternatives.

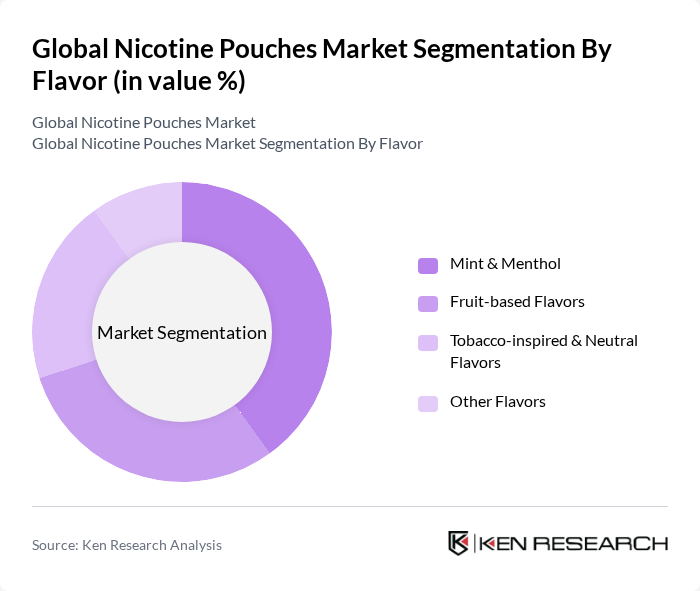

By Flavor:The flavor segmentation includes Mint & Menthol, Fruit-based Flavors, Tobacco-inspired & Neutral Flavors, and Other Flavors. Mint & Menthol flavors currently dominate the market, reflecting manufacturer portfolios in leading brands such as ZYN, VELO, on!, and Nordic Spirit, which heavily emphasize mint, peppermint, spearmint, and mentholated variants as core offerings. The popularity of these flavors is attributed to their refreshing and cooling sensory profile and their ability to soften the perceived harshness of nicotine, making products more approachable for adult smokers transitioning from cigarettes and enhancing mouthfeel for existing pouch users, while fruit and other sweet flavors are increasingly used to differentiate brands and target specific adult consumer segments subject to local flavor rules.

The Global Nicotine Pouches Market is characterized by a dynamic mix of regional and international players. Leading participants such as Swedish Match AB (ZYN), Altria Group, Inc. (on! Nicotine Pouches), British American Tobacco p.l.c. (Velo, Lyft), Philip Morris International Inc. (Shiro and Other Modern Oral Brands), Reynolds American Inc. (Rogue Nicotine), Japan Tobacco International (Nordic Spirit and Other Brands), Imperial Brands PLC (Zone X, Skruf), Turning Point Brands, Inc. (FR? and Related Brands), NIQO Co. / Swedish Match (Europe-focused Nicotine Pouches), GN Tobacco Sweden AB (White Fox, Odens), Skruf Snus AB (Skruf, Småland, etc.), Nicopods ehf. (IceTool, Related Nicotine Pouch Brands), SnusCentral (Online Retailer & Private-label Nicotine Pouches), Swisher (Rogue and Other Oral Nicotine Products), Tobacco Concept Factory Sp. z o.o. (Poland-based Nicotine Pouch Producer) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the nicotine pouches market appears promising, driven by evolving consumer preferences and increasing health consciousness. As more individuals seek smoke-free alternatives, the market is likely to witness a surge in innovative product offerings. Additionally, the rise of e-commerce platforms will facilitate broader access to these products, enhancing market penetration. Companies that prioritize sustainability and natural ingredients are expected to gain a competitive edge, aligning with consumer trends towards healthier lifestyles and environmental responsibility.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Tobacco-derived Nicotine Pouches Synthetic Nicotine Pouches Tobacco-free (Modern Oral) Nicotine Pouches Others |

| By Flavor | Mint & Menthol Fruit-based Flavors Tobacco-inspired & Neutral Flavors Other Flavors |

| By Nicotine Strength | Low Strength (up to 4 mg) Medium Strength (5–7 mg) High Strength (8–12 mg) Extra-high Strength (above 12 mg) |

| By Distribution Channel | Online (D2C Websites & Marketplaces) Convenience Stores & Gas Stations Tobacco & Vape Shops Pharmacies & Drugstores Other Offline Channels |

| By End User | Current and Former Smokers Vapers and Dual Users Lifestyle & Recreational Users Casual / First-time Users |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Distribution of Nicotine Pouches | 120 | Store Managers, Category Buyers |

| Consumer Usage Patterns | 150 | Regular Users, Occasional Users |

| Market Entry Strategies | 100 | Marketing Directors, Brand Managers |

| Regulatory Impact Assessment | 80 | Compliance Officers, Legal Advisors |

| Product Development Insights | 70 | R&D Managers, Product Innovation Leads |

The Global Nicotine Pouches Market is valued at approximately USD 5.4 billion, reflecting significant growth driven by the rising adoption of smoke-free alternatives and increasing consumer awareness in key markets like the United States and Nordic Europe.