Region:Middle East

Author(s):Rebecca

Product Code:KRAD7359

Pages:97

Published On:December 2025

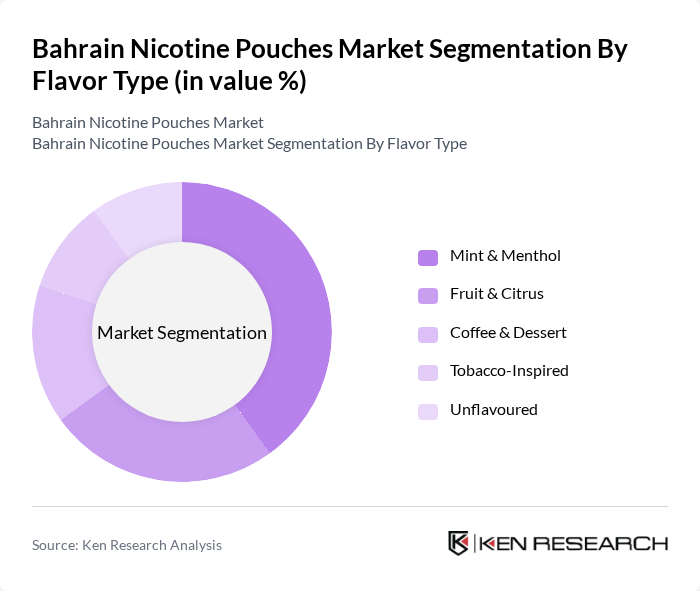

By Flavor Type:The flavor type segmentation includes various options that cater to diverse consumer preferences. The subsegments are Mint & Menthol, Fruit & Citrus, Coffee & Dessert, Tobacco-Inspired, and Unflavoured. This structure aligns with global nicotine pouch portfolios, where mint, menthol, fruit, and other sweet flavors dominate offerings from leading brands. Among these, Mint & Menthol flavors dominate the market due to their refreshing taste, strong sensory impact, and popularity among users seeking a cooling sensation, which is consistent with global and regional trends where mint-based pouches account for the largest share of flavored products. This preference is driven by younger adult consumers who are more inclined towards flavored products and are often transitioning from menthol cigarettes or flavored vapes, making it a leading choice in the nicotine pouch market.

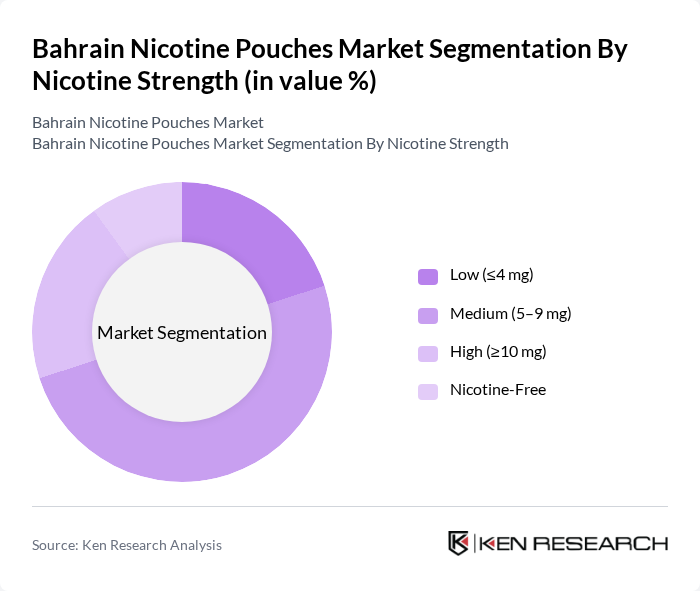

By Nicotine Strength:The nicotine strength segmentation includes Low (?4 mg), Medium (5–9 mg), High (?10 mg), and Nicotine-Free options. This classification is consistent with common strength bands used by major nicotine pouch manufacturers globally, which often group products into up to 5 mg, 5–10 mg, and above 10 mg categories. The Medium strength segment is currently leading the market, as it appeals to a broad range of users, including those transitioning from traditional smoking or vaping who seek a noticeable yet manageable nicotine hit. This segment's popularity is attributed to its balanced nicotine delivery, which satisfies both new users and those looking to reduce their nicotine intake gradually, aligning with global harm-reduction and step-down usage patterns observed in the nicotine pouch category.

The Bahrain Nicotine Pouches Market is characterized by a dynamic mix of regional and international players. Leading participants such as Swedish Match AB (ZYN), Philip Morris International Inc. (VEEV NEO / VELO Licensing & Distribution), British American Tobacco p.l.c. (VELO), Altria Group, Inc. (on! via Helix Innovations), Japan Tobacco International (Nordic Spirit), Imperial Brands PLC (Zone X), GN Tobacco Sweden AB (White Fox), Skruf Snus AB (XR / Skruf-branded Nicotine Pouches), Nicopods ehf (Iceland) – Private Label & Imported Brands, White Industries AB (ACE Nicotine Pouches), Ministry of Snus ApS (RITE / ACE Distribution), Local & Regional Importers / Distributors (Bahrain & GCC), Online-First Retailers & Marketplaces in Bahrain, Duty-Free & Travel Retail Operators in Bahrain (e.g., Bahrain Duty Free), Other Emerging & Niche Brands Present in Bahrain contribute to innovation, geographic expansion, and service delivery in this space.

The future of the nicotine pouches market in Bahrain appears promising, driven by evolving consumer preferences and increasing health awareness. As more consumers seek alternatives to traditional tobacco products, the market is expected to witness continued growth. Innovations in product offerings, such as unique flavors and enhanced formulations, will likely attract a broader demographic. Additionally, the expansion of e-commerce platforms will facilitate easier access to nicotine pouches, further driving market penetration and consumer engagement.

| Segment | Sub-Segments |

|---|---|

| By Flavor Type | Mint & Menthol Fruit & Citrus Coffee & Dessert Tobacco-Inspired Unflavoured |

| By Nicotine Strength | Low (?4 mg) Medium (5–9 mg) High (?10 mg) Nicotine-Free |

| By Composition | Tobacco-Derived Nicotine Pouches Synthetic (Tobacco-Free) Nicotine Pouches |

| By Consumer Group | Current Cigarette Smokers Former Smokers Dual Users (Cigarettes & NGPs) Nicotine Users New to Oral Products |

| By Distribution Channel | Specialist Vape & Tobacco Shops Supermarkets & Hypermarkets Convenience Stores & Petrol Stations Online Retailers & Marketplaces Duty-Free & Travel Retail |

| By Packaging Format | Round Tins Slim Pocket Packs Multipacks Others |

| By Consumer Demographics | By Age Group (18–24, 25–34, 35–44, 45+) By Gender By Income Level By Nationality (Bahraini vs Expatriate) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Distribution of Nicotine Pouches | 100 | Store Managers, Retail Buyers |

| Consumer Preferences and Usage Patterns | 140 | Regular Users, Occasional Users |

| Health Impact Awareness | 80 | Public Health Officials, Health Advocates |

| Market Entry Barriers for New Brands | 60 | Entrepreneurs, Industry Analysts |

| Regulatory Compliance Insights | 50 | Legal Advisors, Compliance Officers |

The Bahrain Nicotine Pouches Market is valued at approximately USD 28 million, reflecting a growing trend towards smokeless alternatives to traditional tobacco products, driven by health awareness and changing consumer preferences.