Region:Global

Author(s):Geetanshi

Product Code:KRAA2362

Pages:88

Published On:August 2025

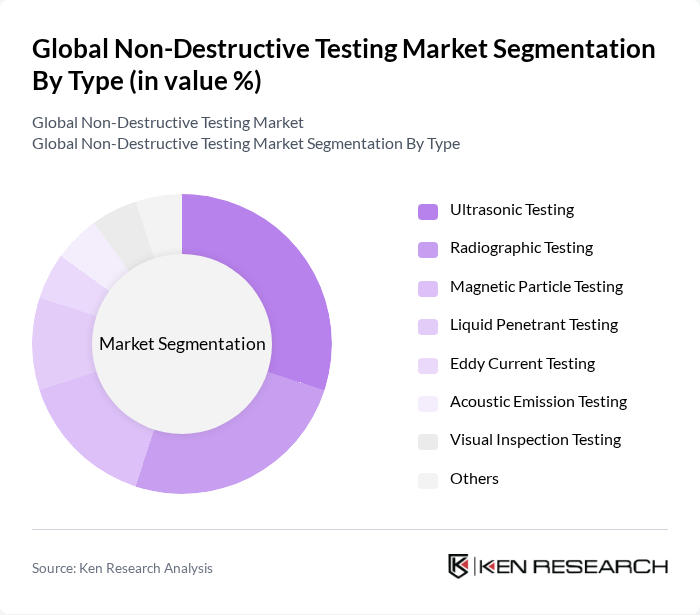

By Type:The Non-Destructive Testing market is segmented into various types, including Ultrasonic Testing, Radiographic Testing, Magnetic Particle Testing, Liquid Penetrant Testing, Eddy Current Testing, Acoustic Emission Testing, Visual Inspection Testing, and Others.Ultrasonic Testingis the most widely used method due to its effectiveness in detecting internal flaws in materials without causing damage. The growing adoption of advanced technologies such as phased array ultrasonics, digital radiography, and automation in industries has further enhanced the demand for ultrasonic testing, making it a dominant segment in the market .

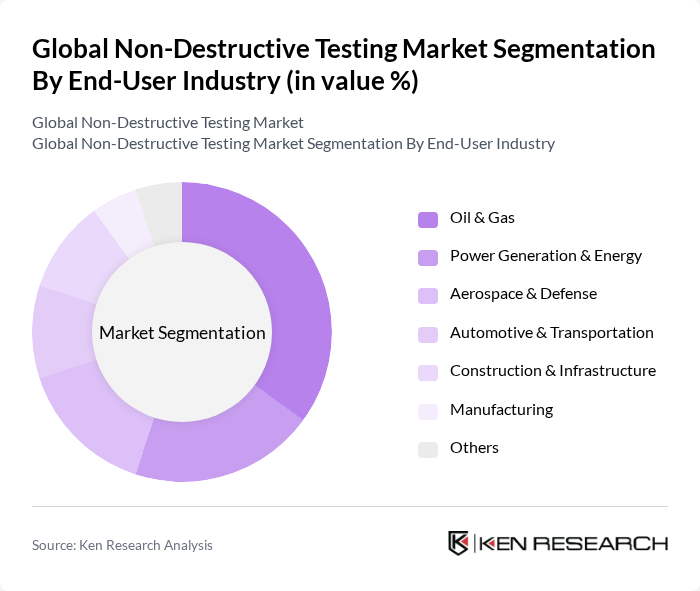

By End-User Industry:The market is further segmented by end-user industries, including Oil & Gas, Power Generation & Energy, Aerospace & Defense, Automotive & Transportation, Construction & Infrastructure, Manufacturing, and Others. TheOil & Gassector is the leading segment, driven by the need for regular inspections to ensure safety and compliance with environmental regulations. Increasing exploration, production activities, and aging infrastructure in this sector have significantly boosted the demand for NDT services, making it a key contributor to market growth. The power generation and aerospace sectors also show robust demand due to stringent safety and reliability requirements .

The Global Non-Destructive Testing Market is characterized by a dynamic mix of regional and international players. Leading participants such as SGS S.A., Intertek Group plc, Bureau Veritas S.A., TÜV Rheinland AG, Applus+, Element Materials Technology, MISTRAS Group, Inc., Eddyfi Technologies, Zetec, Inc., Olympus Corporation, Sonatest Ltd., Acuren Group Inc., NDT Global GmbH & Co. KG, Creaform Inc., TWI Ltd., GE Inspection Technologies (General Electric Company), Magnaflux (Illinois Tool Works Inc.), Fujifilm Corporation, YXLON International GmbH, Ashtead Technology Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the NDT market appears promising, driven by technological innovations and increasing regulatory demands. As industries continue to prioritize safety and quality assurance, the adoption of digital and automated NDT solutions is expected to rise significantly. Furthermore, the integration of AI and machine learning will enhance predictive maintenance capabilities, allowing for more efficient inspections. These trends indicate a robust growth trajectory for the NDT market, with a focus on improving operational efficiency and compliance.

| Segment | Sub-Segments |

|---|---|

| By Type | Ultrasonic Testing Radiographic Testing Magnetic Particle Testing Liquid Penetrant Testing Eddy Current Testing Acoustic Emission Testing Visual Inspection Testing Others |

| By End-User Industry | Oil & Gas Power Generation & Energy Aerospace & Defense Automotive & Transportation Construction & Infrastructure Manufacturing Others |

| By Application | Structural Integrity Testing Weld Inspection Pipeline Inspection Pressure Vessel Inspection Aerospace Component Inspection Power Plant Equipment Inspection Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | North America (United States, Canada) Europe (Germany, United Kingdom, France, Rest of Europe) Asia-Pacific (China, Japan, India, Rest of Asia-Pacific) Latin America (Brazil, Argentina, Mexico, Rest of Latin America) Middle East & Africa (United Arab Emirates, Saudi Arabia, South Africa, Rest of Middle East & Africa) Others |

| By Technology | Conventional NDT Techniques Advanced NDT Techniques (Phased Array UT, Digital Radiography, Infrared Thermography, etc.) Automated & Robotic NDT Systems Others |

| By Service Type | Inspection Services Consulting Services Training & Certification Services Equipment Rental Services Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Aerospace NDT Applications | 100 | Quality Assurance Managers, NDT Technicians |

| Automotive Industry Inspections | 80 | Manufacturing Engineers, Compliance Officers |

| Construction Material Testing | 60 | Site Managers, Structural Engineers |

| Oil & Gas Pipeline Inspections | 90 | Safety Inspectors, Operations Managers |

| Power Generation Equipment Testing | 50 | Maintenance Supervisors, NDT Specialists |

The Global Non-Destructive Testing Market is valued at approximately USD 15 billion, driven by the increasing demand for safety and quality assurance across various industries, including oil and gas, aerospace, automotive, and manufacturing.