Region:Global

Author(s):Rebecca

Product Code:KRAC3269

Pages:84

Published On:October 2025

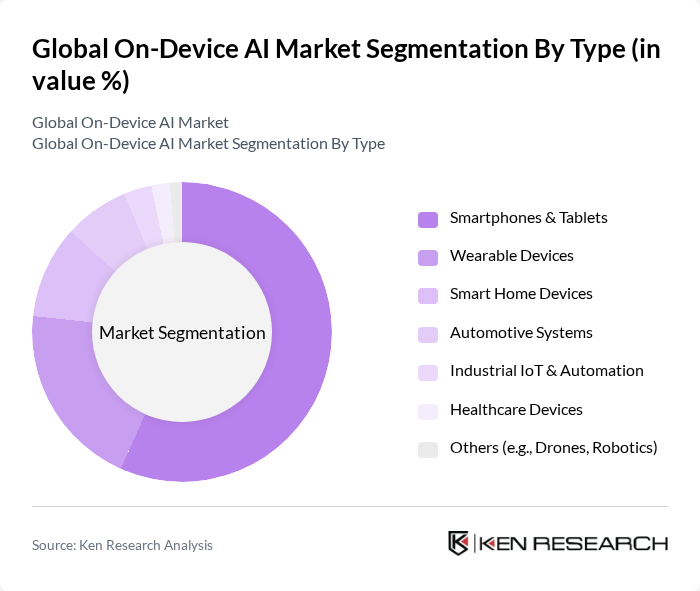

By Type:The market is segmented into smartphones & tablets, wearable devices, smart home devices, automotive systems, industrial IoT & automation, healthcare devices, and others such as drones and robotics.Smartphones & tabletsrepresent the largest segment, driven by the integration of AI features such as facial recognition, voice assistants, and camera enhancements.Wearable devicesare rapidly growing, fueled by demand for fitness monitoring and health tracking.Smart home devicesandautomotive systemsare also significant, leveraging on-device AI for automation, security, and driver assistance.Industrial IoT & automationandhealthcare devicesutilize on-device AI for predictive maintenance, process optimization, and patient monitoring, while the "others" category includes applications in drones and robotics for autonomous operation and real-time analytics .

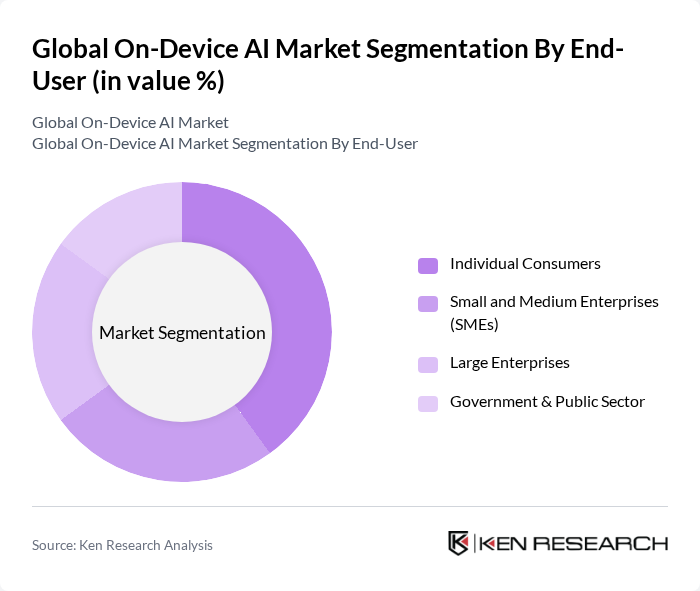

By End-User:The end-user segmentation includes individual consumers, small and medium enterprises (SMEs), large enterprises, and government & public sector.Individual consumersaccount for the largest share, reflecting widespread adoption of AI-enabled smartphones, wearables, and smart home devices.SMEsandlarge enterprisesleverage on-device AI for operational efficiency, automation, and data privacy. Thegovernment & public sectorsegment is expanding as public agencies deploy AI for surveillance, smart infrastructure, and citizen services .

The Global On-Device AI Market is characterized by a dynamic mix of regional and international players. Leading participants such as NVIDIA Corporation, Intel Corporation, Qualcomm Technologies, Inc., Google LLC, Apple Inc., Microsoft Corporation, IBM Corporation, Amazon.com, Inc., Samsung Electronics Co., Ltd., Huawei Technologies Co., Ltd., Baidu, Inc., Micron Technology, Inc., Arm Holdings plc, Texas Instruments Incorporated, Analog Devices, Inc., MediaTek Inc., Advanced Micro Devices, Inc. (AMD), STMicroelectronics N.V., Infineon Technologies AG, Sony Group Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the on-device AI market appears promising, driven by technological advancements and increasing consumer demand for smart solutions. As edge computing continues to evolve, we can expect a surge in decentralized AI applications, enhancing data privacy and processing efficiency. Furthermore, the integration of AI in mobile applications is likely to expand, providing users with more personalized experiences. This trend will be complemented by a growing focus on energy-efficient solutions, aligning with global sustainability goals and regulatory frameworks.

| Segment | Sub-Segments |

|---|---|

| By Type | Smartphones & Tablets Wearable Devices Smart Home Devices Automotive Systems Industrial IoT & Automation Healthcare Devices Others (e.g., Drones, Robotics) |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Large Enterprises Government & Public Sector |

| By Application | Voice Assistants & Speech Recognition Image & Video Recognition Predictive Maintenance Smart Surveillance & Security Natural Language Processing Contextual Awareness & Personalization |

| By Component | Hardware (AI Chipsets, NPUs, SoCs) Software (AI Frameworks, SDKs) Services (Integration, Support) |

| By Distribution Channel | Online Retail Offline Retail Direct Sales |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value-Based Pricing |

| By Market Maturity | Emerging Markets Established Markets Growth Markets |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Electronics with On-Device AI | 120 | Product Managers, Marketing Directors |

| Healthcare Applications of On-Device AI | 90 | Healthcare IT Specialists, Medical Device Engineers |

| Automotive AI Integration | 60 | Automotive Engineers, R&D Managers |

| Smart Home Devices | 50 | Product Development Managers, User Experience Designers |

| Industrial Automation Solutions | 70 | Operations Managers, Automation Engineers |

The Global On-Device AI Market is currently valued at approximately USD 15 billion, driven by the increasing demand for real-time data processing, advancements in technology, and the growing integration of AI into various consumer electronics and industrial applications.