Region:Global

Author(s):Geetanshi

Product Code:KRAA2796

Pages:88

Published On:August 2025

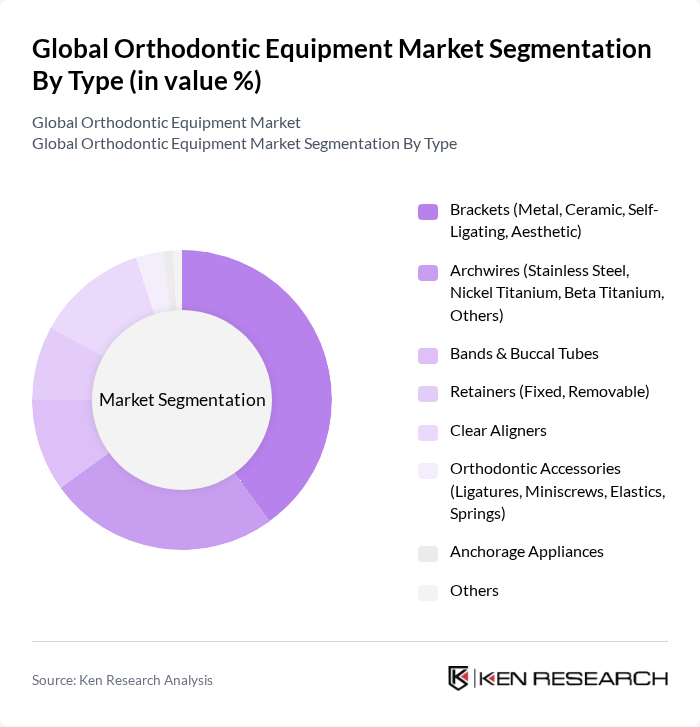

By Type:The orthodontic equipment market is segmented into various types, including brackets, archwires, bands & buccal tubes, retainers, clear aligners, orthodontic accessories, anchorage appliances, and others. Among these, brackets—particularly self-ligating and aesthetic types—lead the market due to their popularity among patients seeking less visible treatment options. Clear aligners are also gaining traction, driven by consumer preference for discreet orthodontic solutions and the rapid adoption of digital treatment planning.

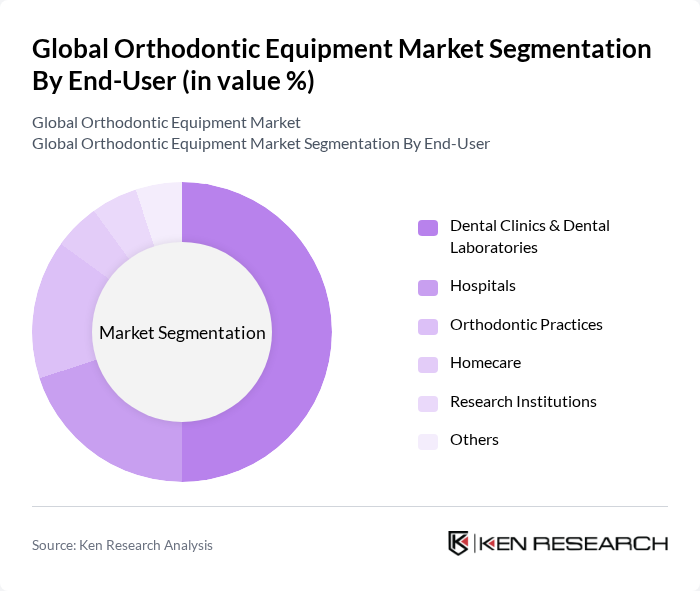

By End-User:The market is segmented by end-users, including dental clinics & dental laboratories, hospitals, orthodontic practices, homecare, research institutions, and others. Dental clinics and orthodontic practices are the primary end-users, as they are the main providers of orthodontic treatments. The increasing number of dental professionals and the rise in orthodontic procedures, especially cosmetic and preventive treatments, are driving growth in these segments.

The Global Orthodontic Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Align Technology, Inc., 3M Company, Dentsply Sirona Inc., Ormco Corporation, Henry Schein, Inc., Straumann Holding AG, GC Corporation, American Orthodontics, Patterson Companies, Inc., KaVo Kerr, Dental Wings Inc., Biolase, Inc., SmileDirectClub, Inc., ClearCorrect, LLC, TBS Dental, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The orthodontic equipment market in None is poised for significant growth, driven by increasing consumer awareness and technological advancements. As more individuals prioritize oral health, the demand for innovative orthodontic solutions will rise. Additionally, the expansion of orthodontic services into rural areas is expected to enhance accessibility. The integration of digital technologies will further streamline treatment processes, making orthodontic care more efficient and appealing to a broader demographic, including adults seeking cosmetic solutions.

| Segment | Sub-Segments |

|---|---|

| By Type | Brackets (Metal, Ceramic, Self-Ligating, Aesthetic) Archwires (Stainless Steel, Nickel Titanium, Beta Titanium, Others) Bands & Buccal Tubes Retainers (Fixed, Removable) Clear Aligners Orthodontic Accessories (Ligatures, Miniscrews, Elastics, Springs) Anchorage Appliances Others |

| By End-User | Dental Clinics & Dental Laboratories Hospitals Orthodontic Practices Homecare Research Institutions Others |

| By Distribution Channel | Direct Sales Online Sales Distributors Retail Pharmacies Others |

| By Region | North America (U.S., Canada, Mexico) Europe (UK, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe) Asia-Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia-Pacific) Latin America (Brazil, Argentina, Rest of Latin America) Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of MEA) Others |

| By Product Type | Fixed Appliances Removable Appliances Functional Appliances Others |

| By Age Group | Children Adolescents Adults Others |

| By Treatment Type | Preventive Treatment Corrective Treatment Retention Treatment Cosmetic Treatment Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Orthodontic Equipment Manufacturers | 60 | Product Managers, Sales Directors |

| Dental Clinics and Practices | 120 | Orthodontists, Practice Owners |

| Dental Supply Distributors | 50 | Distribution Managers, Procurement Officers |

| Dental Equipment Retailers | 40 | Store Managers, Sales Representatives |

| Industry Experts and Consultants | 45 | Market Analysts, Dental Technology Consultants |

The Global Orthodontic Equipment Market is valued at approximately USD 7.6 billion, reflecting significant growth driven by increasing dental disorders, heightened awareness of oral health, and advancements in orthodontic technology.