Region:Global

Author(s):Rebecca

Product Code:KRAD4957

Pages:82

Published On:December 2025

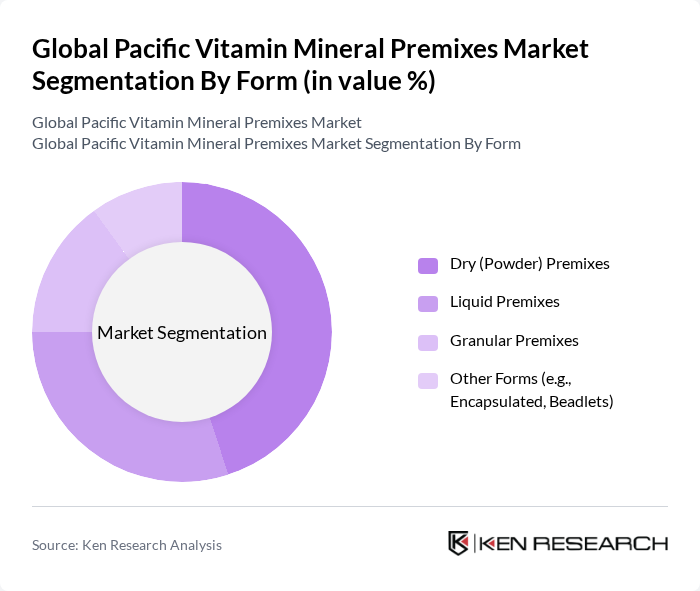

By Form:The market is segmented into various forms of vitamin and mineral premixes, including Dry (Powder) Premixes, Liquid Premixes, Granular Premixes, and Other Forms such as Encapsulated and Beadlets. Powder premixes are widely used and hold the leading share globally, supported by their affordability, convenient packaging, better stability, and flexibility in formulation for both food and feed applications. Among these, Dry (Powder) Premixes dominate the market due to their versatility, ease of use, and longer shelf life, making them a preferred choice for food manufacturers and dietary supplement producers. The demand for Liquid Premixes is also growing, particularly in the beverage and liquid dietary supplement sectors, where liquid fortification is increasingly popular for ready-to-drink products, pediatric nutrition, and medical nutrition beverages.

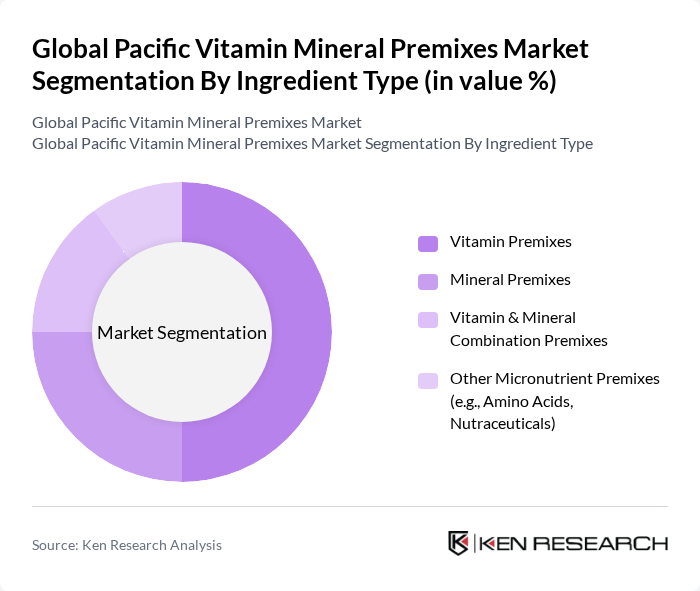

By Ingredient Type:The market is further segmented by ingredient type into Vitamin Premixes, Mineral Premixes, Vitamin & Mineral Combination Premixes, and Other Micronutrient Premixes such as Amino Acids and Nutraceuticals. Vitamin-focused premixes account for a substantial share of the market, reflecting the strong demand for vitamin fortification in dietary supplements, functional foods, and beverages aimed at immunity, energy, and overall wellness. Mineral premixes are also gaining traction, particularly in regions with high prevalence of deficiencies in iron, calcium, iodine, and trace minerals, as well as in feed nutrition where mineral premixes are key for animal growth and health. Combination premixes that blend vitamins and minerals are increasingly favored for their comprehensive nutritional benefits and formulation efficiency, supporting targeted applications such as infant nutrition, sports nutrition, geriatric nutrition, and fortified staples.

The Global Pacific Vitamin Mineral Premixes Market is characterized by a dynamic mix of regional and international players. Leading participants such as DSM-Firmenich AG, BASF SE, Archer Daniels Midland Company (ADM), Glanbia Nutritionals (Glanbia plc), Cargill, Incorporated, Nutreco N.V. (Trouw Nutrition), Corbion N.V., SternVitamin GmbH & Co. KG, Prinova Group LLC (A Nagase Group Company), Hexagon Nutrition Limited, Jubilant Ingrevia Limited, Barentz International B.V., Farbest Brands, Vitablend Nederland B.V. (Barentz Group), Watson Inc. (Glanbia Nutritionals) contribute to innovation, geographic expansion, and service delivery in this space through investments in premix manufacturing facilities, customized formulation capabilities, and partnerships with food, beverage, and feed manufacturers across Asia-Pacific and global markets.

The future of the vitamin and mineral premixes market appears promising, driven by increasing consumer demand for health-oriented products and innovations in formulation technologies. As personalized nutrition gains traction, companies are likely to invest in tailored premix solutions that cater to specific health needs. Additionally, the rise of e-commerce platforms will facilitate broader access to these products, enabling manufacturers to reach a wider audience and adapt to changing consumer preferences effectively.

| Segment | Sub-Segments |

|---|---|

| By Form | Dry (Powder) Premixes Liquid Premixes Granular Premixes Other Forms (e.g., Encapsulated, Beadlets) |

| By Ingredient Type | Vitamin Premixes Mineral Premixes Vitamin & Mineral Combination Premixes Other Micronutrient Premixes (e.g., Amino Acids, Nutraceuticals) |

| By Application | Food & Beverage Fortification Dietary Supplements & Nutraceuticals Infant & Early Life Nutrition Sports & Performance Nutrition Animal Feed & Pet Nutrition Other Applications (e.g., Medical Nutrition) |

| By End-Use Industry | Food Manufacturers Beverage Manufacturers Dietary Supplement Manufacturers Feed & Pet Food Manufacturers Pharmaceutical & Clinical Nutrition Companies |

| By Distribution Channel | Direct Sales (B2B) Distributors & Traders Online B2B Platforms Other Channels |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Packaging Type | Bulk Industrial Packaging Intermediate Bulk Containers & Drums Small Packs & Sachets Other Packaging Types |

| By Formulation Approach | Standard (Off-the-Shelf) Premix Formulations Customized (Tailor-Made) Premix Formulations Clean-Label & Organic-Compliant Formulations Other Specialized Formulations (e.g., Allergen-Free) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Vitamin Premixes for Food Industry | 110 | Food Technologists, Product Managers |

| Mineral Premixes for Animal Feed | 85 | Animal Nutritionists, Feed Mill Managers |

| Health Supplements Retail Market | 130 | Retail Buyers, Category Managers |

| Pharmaceutical Applications of Vitamin Premixes | 75 | Pharmaceutical R&D Managers, Quality Assurance Officers |

| Sports Nutrition Segment | 95 | Sports Nutritionists, Fitness Product Developers |

The Global Pacific Vitamin Mineral Premixes Market is valued at approximately USD 9.0 billion, driven by increasing demand for fortified food and beverages, rising health consciousness, and trends in preventive healthcare.