Region:Global

Author(s):Geetanshi

Product Code:KRAD3944

Pages:95

Published On:November 2025

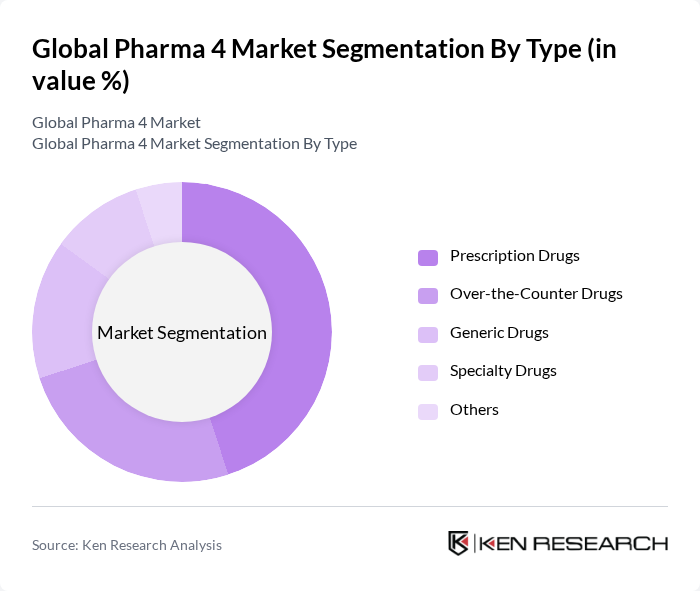

By Type:The market is segmented into various types, including Prescription Drugs, Over-the-Counter Drugs, Generic Drugs, Specialty Drugs, and Others. Prescription drugs dominate the market due to their critical role in treating chronic and complex conditions, driving significant revenue. Over-the-counter drugs also hold a substantial share, as they cater to consumer demand for self-medication and convenience. Specialty drugs are gaining traction due to their targeted therapies for specific diseases.

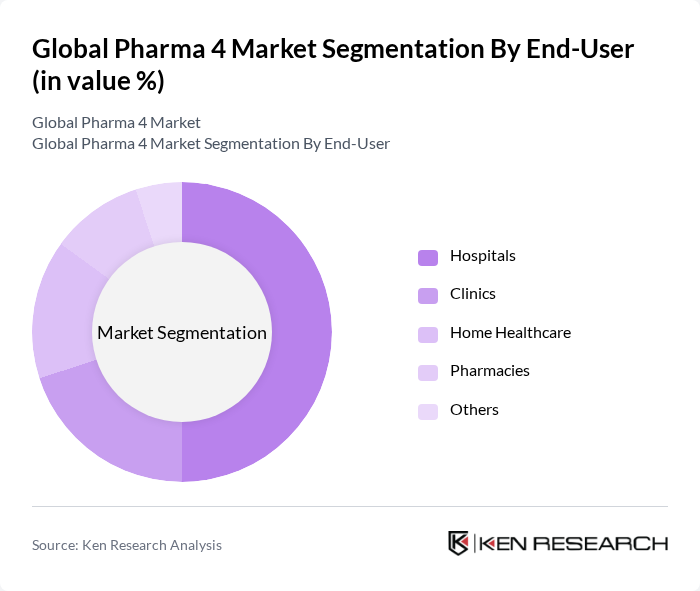

By End-User:The market is segmented by end-users, including Hospitals, Clinics, Home Healthcare, Pharmacies, and Others. Hospitals are the leading end-user segment, driven by the high demand for advanced medical treatments and the increasing number of hospital admissions. Pharmacies also play a crucial role, as they serve as the primary point of access for consumers seeking medications. Home healthcare is emerging as a significant segment due to the growing trend of at-home treatments and monitoring.

The Global Pharma 4 Market is characterized by a dynamic mix of regional and international players. Leading participants such as Pfizer Inc., Johnson & Johnson, Roche Holding AG, Merck & Co., Inc., Novartis AG, AstraZeneca PLC, Gilead Sciences, Inc., Sanofi S.A., GlaxoSmithKline PLC, Amgen Inc., AbbVie Inc., Bayer AG, Bristol-Myers Squibb Company, Eli Lilly and Company, Takeda Pharmaceutical Company Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the pharmaceutical industry is poised for transformation, driven by technological advancements and evolving patient needs. The integration of artificial intelligence in drug discovery is expected to streamline processes, reducing development timelines significantly. Additionally, the shift towards value-based care will encourage pharmaceutical companies to focus on outcomes rather than volume, fostering innovation. As emerging markets continue to expand, they will present new opportunities for growth, particularly in biologics and personalized medicine, reshaping the competitive landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Prescription Drugs Over-the-Counter Drugs Generic Drugs Specialty Drugs Others |

| By End-User | Hospitals Clinics Home Healthcare Pharmacies Others |

| By Therapeutic Area | Oncology Cardiovascular Neurology Infectious Diseases Others |

| By Distribution Channel | Direct Sales Wholesalers Retail Pharmacies Online Pharmacies Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Drug Formulation | Tablets Injectables Capsules Liquids Others |

| By Research and Development Stage | Preclinical Clinical Trials Marketed Products Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oncology Drug Utilization | 150 | Oncologists, Clinical Pharmacists |

| Cardiovascular Medication Adherence | 120 | Cardiologists, General Practitioners |

| Diabetes Management Solutions | 100 | Endocrinologists, Diabetes Educators |

| Antibiotic Resistance Awareness | 80 | Infectious Disease Specialists, Pharmacists |

| Patient Perspectives on Biologics | 90 | Patients, Healthcare Advocates |

The Global Pharma 4 Market is valued at approximately USD 1,500 billion, driven by increasing healthcare expenditures, advancements in biotechnology, and a rising prevalence of chronic diseases, highlighting the sector's significant growth potential.