Region:Global

Author(s):Shubham

Product Code:KRAA3140

Pages:82

Published On:August 2025

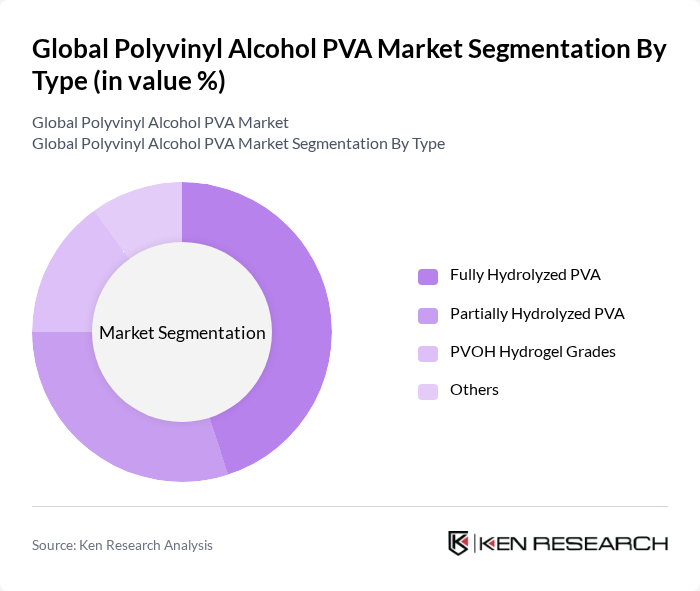

By Type:The PVA market is segmented into four main types: Fully Hydrolyzed PVA, Partially Hydrolyzed PVA, PVOH Hydrogel Grades, and Others. Among these, Fully Hydrolyzed PVA is the leading subsegment due to its superior properties such as high tensile strength, excellent film-forming capabilities, and high resistance to oils and greases. These characteristics make it ideal for applications in adhesives, coatings, and packaging. The demand for this type is driven by its extensive use in industries that require high-performance and water-soluble materials, particularly in packaging, textiles, and paper .

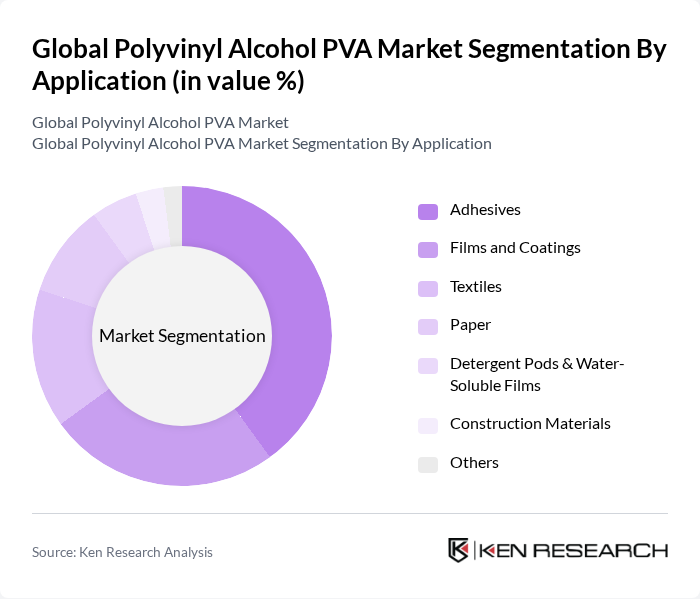

By Application:The applications of PVA are diverse, including Adhesives, Films and Coatings, Textiles, Paper, Detergent Pods & Water-Soluble Films, Construction Materials, and Others. The Adhesives segment is currently the most dominant, driven by the increasing demand for high-performance and environmentally friendly adhesives in construction, automotive, and packaging industries. The trend towards eco-friendly adhesives is also boosting the use of PVA, as it offers a biodegradable and water-soluble alternative to traditional synthetic adhesives. Films and coatings are also significant application areas, benefiting from PVA’s excellent barrier properties and solubility .

The Global Polyvinyl Alcohol PVA Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kuraray Co., Ltd., Sekisui Chemical Co., Ltd., Mitsubishi Chemical Corporation, Chang Chun Group, Anhui Wanwei Group Co., Ltd., Sinopec Shanghai Petrochemical Company Limited, The Nippon Synthetic Chemical Industry Co., Ltd. (Nippon Gohsei), Zhejiang Jianye Chemical Co., Ltd., Shandong Haohua Chemical Co., Ltd., Inner Mongolia Shuangxin Environment-Friendly Material Co., Ltd., Huzhou Hualian Chemical Co., Ltd., Hubei Xinyang Chemical Co., Ltd., Jiangsu Yida Chemical Co., Ltd., Lianhua Technology Co., Ltd., Shijiazhuang Shuanghua Chemical Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the PVA market appears promising, driven by the increasing demand for sustainable materials and technological advancements in production processes. As industries continue to prioritize eco-friendly solutions, PVA's biodegradable properties will enhance its appeal. Additionally, innovations in product formulations and applications are expected to open new avenues for growth, particularly in emerging economies where industrialization is accelerating. Strategic partnerships among manufacturers will also play a crucial role in expanding market reach and enhancing product offerings.

| Segment | Sub-Segments |

|---|---|

| By Type | Fully Hydrolyzed PVA Partially Hydrolyzed PVA PVOH Hydrogel Grades Others |

| By Application | Adhesives Films and Coatings Textiles Paper Detergent Pods & Water-Soluble Films Construction Materials Others |

| By End-User | Packaging Construction Healthcare & Pharmaceuticals Electronics Agriculture Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Low Price Mid Price High Price |

| By Product Form | Powder Granules Solutions Films Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Textile Industry Applications | 100 | Textile Manufacturers, Product Development Managers |

| Adhesives and Sealants Market | 80 | R&D Managers, Procurement Managers |

| Packaging Solutions Sector | 70 | Packaging Engineers, Supply Chain Analysts |

| Construction and Building Materials | 60 | Construction Managers, Material Scientists |

| Pharmaceutical Applications | 40 | Quality Control Managers, Regulatory Affairs Specialists |

The Global Polyvinyl Alcohol (PVA) Market is valued at approximately USD 1.1 billion, reflecting significant growth driven by the demand for eco-friendly and biodegradable materials across various industries, including packaging, textiles, and construction.