Region:Global

Author(s):Dev

Product Code:KRAA2572

Pages:86

Published On:August 2025

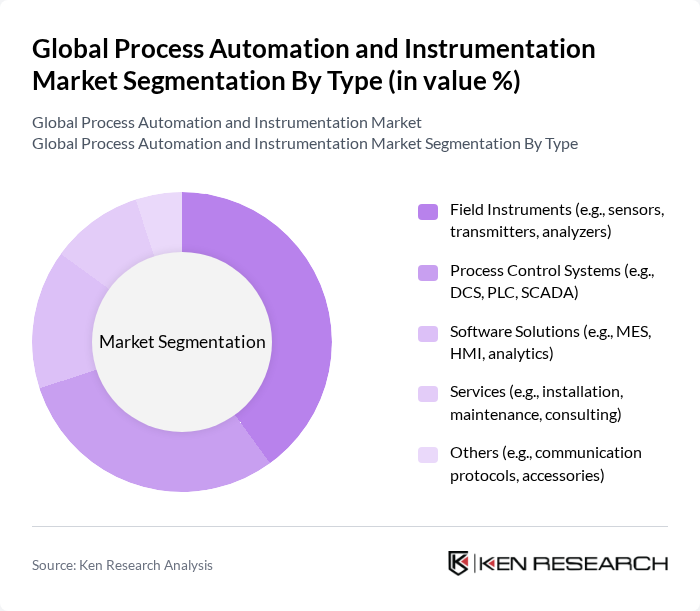

By Type:The market is segmented into Field Instruments, Process Control Systems, Software Solutions, Services, and Others. Field Instruments—including sensors, transmitters, and analyzers—lead the market due to their critical role in real-time data collection, process monitoring, and optimization. The increasing need for predictive maintenance, quality control, and energy management across industries drives demand for these instruments, making them essential for digital transformation and operational excellence .

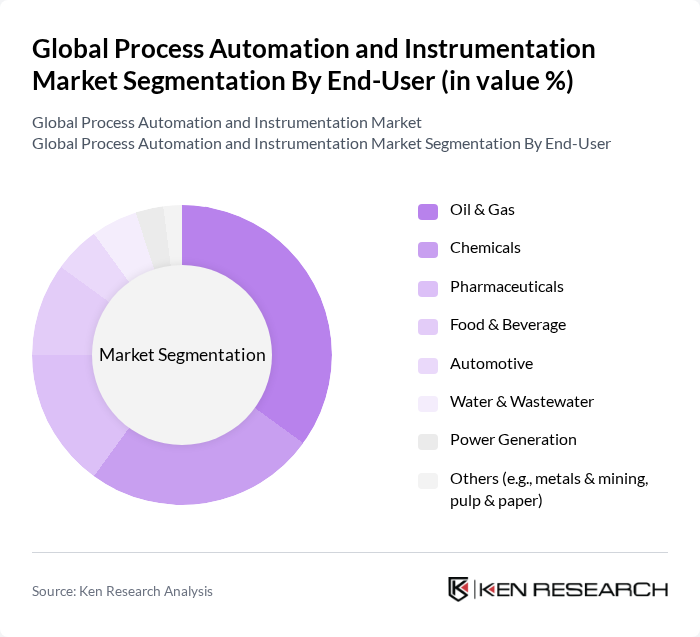

By End-User:The end-user segmentation includes Oil & Gas, Chemicals, Pharmaceuticals, Food & Beverage, Automotive, Water & Wastewater, Power Generation, and Others. The Oil & Gas sector remains the dominant end-user, driven by the need for efficient, safe, and compliant operations in exploration, production, and refining. Increasing complexity in extraction and processing, coupled with stringent safety and environmental regulations, necessitates advanced automation and instrumentation solutions, making this sector a key contributor to market growth .

The Global Process Automation and Instrumentation Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens AG, Honeywell International Inc., ABB Ltd., Emerson Electric Co., Rockwell Automation, Inc., Yokogawa Electric Corporation, Schneider Electric SE, Mitsubishi Electric Corporation, Endress+Hauser AG, KROHNE Group, Azbil Corporation, National Instruments Corporation, GE Digital, Panasonic Corporation, Bosch Rexroth AG, FANUC Corporation, Omron Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the process automation and instrumentation market is poised for significant transformation, driven by advancements in digital technologies and a growing emphasis on sustainability. As industries increasingly adopt smart technologies, the demand for integrated solutions that enhance operational efficiency will rise. Furthermore, the focus on predictive maintenance and real-time data analytics will reshape how companies approach automation, leading to more agile and responsive manufacturing environments. This evolution will create new opportunities for innovation and growth across various sectors.

| Segment | Sub-Segments |

|---|---|

| By Type | Field Instruments (e.g., sensors, transmitters, analyzers) Process Control Systems (e.g., DCS, PLC, SCADA) Software Solutions (e.g., MES, HMI, analytics) Services (e.g., installation, maintenance, consulting) Others (e.g., communication protocols, accessories) |

| By End-User | Oil & Gas Chemicals Pharmaceuticals Food & Beverage Automotive Water & Wastewater Power Generation Others (e.g., metals & mining, pulp & paper) |

| By Application | Manufacturing Automation Process Automation Building Automation Energy Management Safety & Environmental Monitoring Others |

| By Component | Sensors Controllers (PLC, DCS) Actuators Software (HMI, analytics, MES) Communication Devices Others |

| By Sales Channel | Direct Sales Distributors Online Sales System Integrators Others |

| By Distribution Mode | Offline Distribution Online Distribution Hybrid Distribution |

| By Investment Source | Private Investments Public Funding Joint Ventures Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil & Gas Automation Solutions | 60 | Process Engineers, Operations Managers |

| Pharmaceutical Instrumentation | 50 | Quality Control Managers, R&D Directors |

| Food & Beverage Processing | 40 | Production Supervisors, Compliance Officers |

| Water Treatment Automation | 40 | Environmental Engineers, Plant Managers |

| Manufacturing Process Control | 50 | Automation Technicians, Supply Chain Managers |

The Global Process Automation and Instrumentation Market is valued at approximately USD 74 billion, driven by the increasing demand for automation across various sectors, including manufacturing, energy, and utilities, as well as advancements in IoT and AI technologies.