Region:Global

Author(s):Shubham

Product Code:KRAA3131

Pages:81

Published On:August 2025

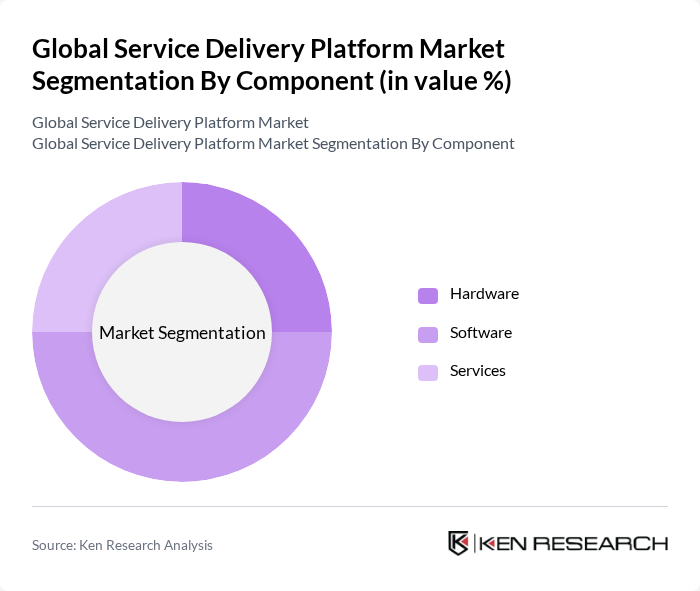

By Component:The components of the service delivery platform market include hardware, software, and services. Software remains the leading sub-segment, driven by the increasing need for integrated solutions that enhance operational efficiency, enable automation, and support advanced analytics. Organizations are prioritizing software platforms that facilitate cloud-native transformation, microservices adoption, and real-time orchestration, reflecting the shift towards agile and scalable service delivery models .

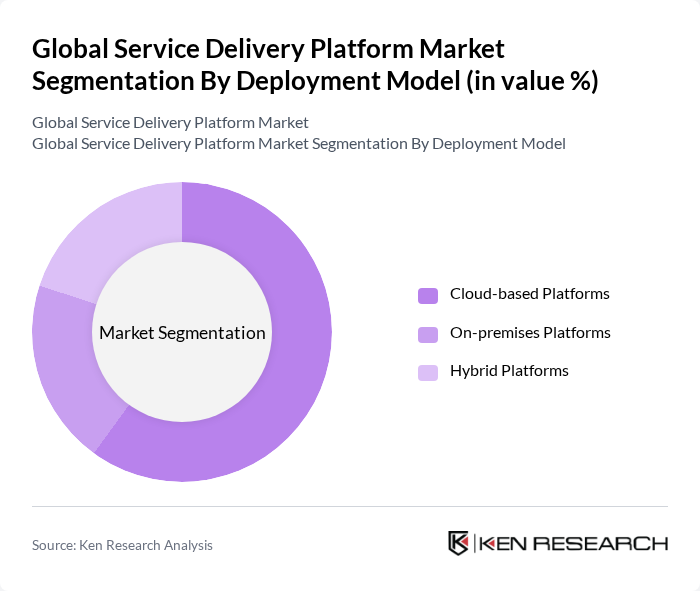

By Deployment Model:The deployment models for service delivery platforms include cloud-based platforms, on-premises platforms, and hybrid platforms. Cloud-based platforms are the most popular choice among organizations, favored for their scalability, cost-effectiveness, and seamless integration with existing systems. The acceleration of remote work, demand for flexible service delivery, and the rise of cloud-native architectures have further increased the adoption of cloud-based models. Hybrid platforms are gaining traction among enterprises seeking to balance regulatory compliance and operational agility .

The Global Service Delivery Platform Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amdocs Limited, Oracle Corporation, Ericsson AB, Nokia Corporation, Huawei Technologies Co., Ltd., IBM Corporation, Cisco Systems, Inc., ZTE Corporation, CSG International, Inc., Netcracker Technology Corporation, Hewlett Packard Enterprise Development LP, Tata Consultancy Services Limited, Accenture PLC, Infosys Limited, Capgemini SE contribute to innovation, geographic expansion, and service delivery in this space.

The future of service delivery platforms is poised for transformative growth, driven by technological advancements and evolving consumer expectations. As businesses increasingly prioritize customer experience, platforms that integrate AI and machine learning will become essential for personalized service delivery. Additionally, the ongoing development of 5G technology will enhance connectivity and enable real-time data processing, further driving innovation in service delivery solutions across various sectors.

| Segment | Sub-Segments |

|---|---|

| By Component | Hardware Software Services |

| By Deployment Model | Cloud-based Platforms On-premises Platforms Hybrid Platforms |

| By Organization Size | Small and Medium-sized Enterprises (SMEs) Large Enterprises |

| By End-User | Telecom Operators Enterprises Content Providers |

| By Application | Customer Engagement Service Management Network Management Billing and Revenue Management |

| By Industry Vertical | Telecommunications Banking and Finance (BFSI) Healthcare Retail Manufacturing Government |

| By Region | North America Europe Asia-Pacific Middle East & Africa Latin America |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Enterprise Service Delivery Platforms | 120 | CTOs, IT Directors |

| Cloud-Based Service Solutions | 90 | Cloud Architects, Service Managers |

| Telecom Service Delivery Models | 60 | Network Engineers, Operations Managers |

| AI-Driven Service Platforms | 50 | Data Scientists, Product Managers |

| Customer Experience Management Tools | 70 | Customer Experience Officers, Marketing Managers |

The Global Service Delivery Platform Market is valued at approximately USD 7 billion, driven by the increasing demand for seamless service delivery across various sectors, including telecommunications, IT services, and financial services.