Region:Global

Author(s):Rebecca

Product Code:KRAA2445

Pages:95

Published On:August 2025

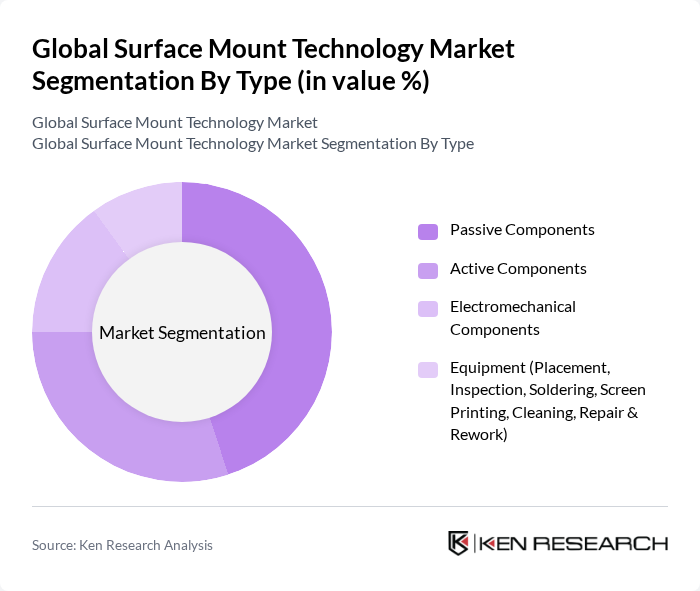

By Type:The Surface Mount Technology market is segmented into Passive Components, Active Components, Electromechanical Components, and Equipment. Among these,Passive Componentsmaintain the largest market share, attributed to their foundational role in ensuring circuit stability and reliability. Their demand is closely tied to the surge in consumer electronics production, where miniaturization and efficiency are critical.Active Componentsfollow, driven by their necessity in signal processing, amplification, and the increasing complexity of electronic devices. Electromechanical Components and Equipment segments support the assembly and operational efficiency of SMT lines .

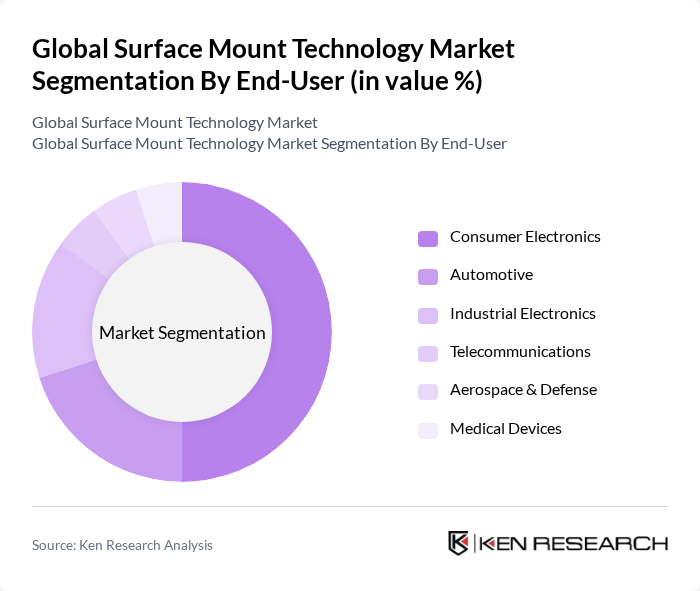

By End-User:The market is also segmented by end-user applications, including Consumer Electronics, Automotive, Industrial Electronics, Telecommunications, Aerospace & Defense, and Medical Devices. TheConsumer Electronicssegment dominates, fueled by the proliferation of smartphones, wearables, and smart home devices, as well as the demand for advanced features and compact form factors. TheAutomotivesector is experiencing robust growth, driven by the increasing integration of electronic systems in vehicles for safety, infotainment, and electrification. Industrial Electronics, Telecommunications, Aerospace & Defense, and Medical Devices segments benefit from the ongoing adoption of automation, IoT, and high-reliability requirements .

The Global Surface Mount Technology Market is characterized by a dynamic mix of regional and international players. Leading participants such as Samsung Electronics Co., Ltd., Panasonic Corporation, Texas Instruments Incorporated, STMicroelectronics N.V., NXP Semiconductors N.V., Infineon Technologies AG, Analog Devices, Inc., ON Semiconductor Corporation, Vishay Intertechnology, Inc., Microchip Technology Inc., Broadcom Inc., Qualcomm Technologies, Inc., Renesas Electronics Corporation, JUKI Corporation, Fuji Corporation, ASMPT Ltd., Yamaha Motor Co., Ltd. (SMT Division), Nordson Corporation, Mycronic AB, Hanwha Techwin Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the SMT market appears promising, driven by ongoing technological advancements and increasing demand across various sectors. As manufacturers continue to adopt automation and AI technologies, production efficiency is expected to improve significantly. Additionally, the integration of IoT in manufacturing processes will enhance connectivity and data utilization, leading to smarter production systems. These trends will likely foster innovation and collaboration among tech companies, positioning the SMT market for sustained growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Passive Components Active Components Electromechanical Components Equipment (Placement, Inspection, Soldering, Screen Printing, Cleaning, Repair & Rework) |

| By End-User | Consumer Electronics Automotive Industrial Electronics Telecommunications Aerospace & Defense Medical Devices |

| By Component | Resistors Capacitors Integrated Circuits Transistors & Diodes Others |

| By Application | Printed Circuit Boards (PCBs) LED Lighting Medical Devices Power Electronics Industrial Automation Others |

| By Sales Channel | Direct Sales Distributors Online Sales Others |

| By Distribution Mode | Wholesale Retail E-commerce Others |

| By Price Range | Low Price Mid Price High Price Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Electronics Manufacturing | 120 | Production Managers, SMT Line Supervisors |

| Automotive Electronics Integration | 90 | Engineering Leads, Quality Control Managers |

| Telecommunications Equipment Production | 60 | Product Development Engineers, Supply Chain Analysts |

| Medical Device Manufacturing | 50 | Regulatory Affairs Specialists, Manufacturing Engineers |

| Industrial Electronics Assembly | 70 | Operations Managers, Technical Directors |

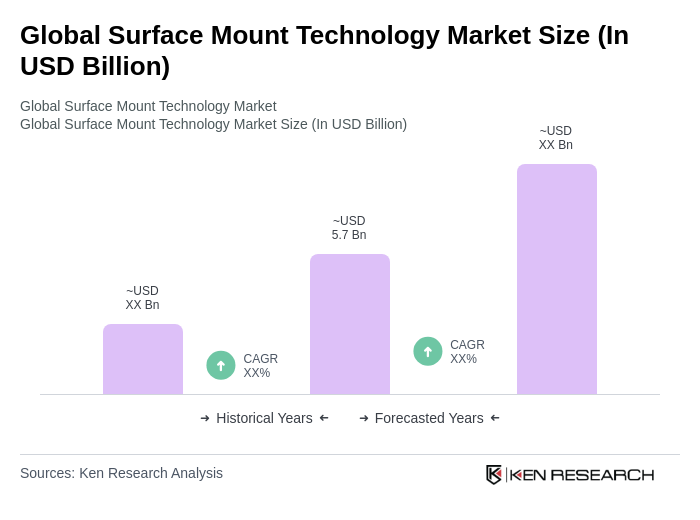

The Global Surface Mount Technology Market is valued at approximately USD 5.7 billion, driven by the increasing demand for compact electronic devices and advancements in manufacturing technologies, particularly in automation and artificial intelligence.