Region:Global

Author(s):Geetanshi

Product Code:KRAA2369

Pages:100

Published On:August 2025

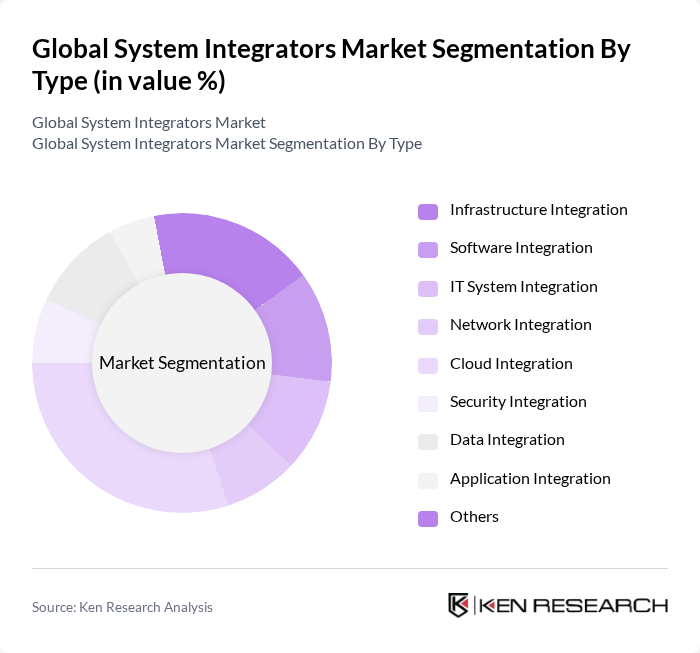

By Type:The market is segmented into Infrastructure Integration, Software Integration, IT System Integration, Network Integration, Cloud Integration, Security Integration, Data Integration, Application Integration, and Others.Cloud Integrationis currently the leading sub-segment, driven by the increasing adoption of cloud services by businesses seeking flexibility and scalability. The demand for seamless integration of cloud applications with existing systems is a significant factor contributing to its dominance, alongside the rise of hybrid IT environments and the need for secure, scalable solutions.

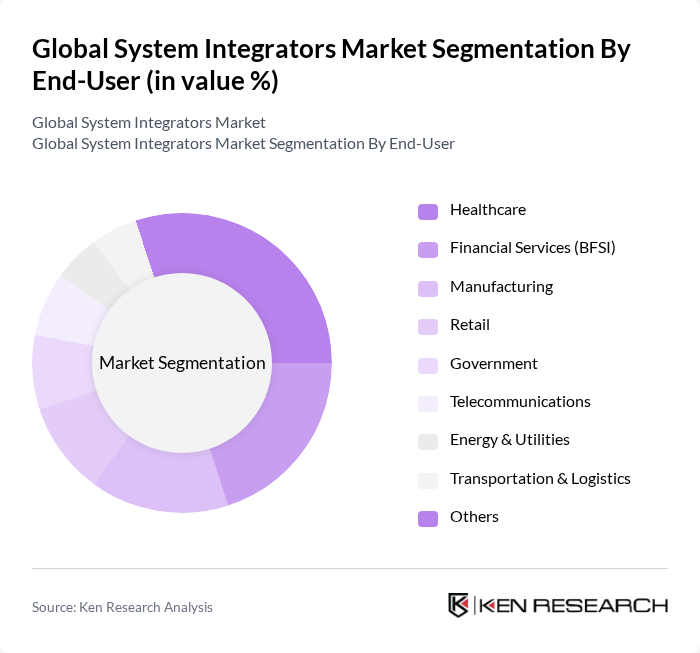

By End-User:The end-user segmentation includes Healthcare, Financial Services (BFSI), Manufacturing, Retail, Government, Telecommunications, Energy & Utilities, Transportation & Logistics, and Others.Healthcareis currently the dominant end-user, driven by the need for integrated systems that enhance patient care, streamline operations, and comply with regulatory requirements. The increasing digitization of health records, telemedicine solutions, and interoperability initiatives further fuel this growth, alongside rising investments in healthcare IT infrastructure.

The Global System Integrators Market is characterized by a dynamic mix of regional and international players. Leading participants such as Accenture, IBM Corporation, Capgemini, Deloitte, Infosys, Wipro, Tata Consultancy Services (TCS), HCL Technologies, Atos SE, CGI Inc., NTT DATA Corporation, Fujitsu Limited, Larsen & Toubro Infotech (LTI), Tech Mahindra, DXC Technology, Siemens AG, Schneider Electric, Honeywell International Inc., Rockwell Automation, Cognizant, Burrow Global LLC, Matrix Technologies, Avid Solutions, CEC Controls Company, Hallam-ICS, Stone Technologies, Testengeer, BTM Global contribute to innovation, geographic expansion, and service delivery in this space.

The future of the system integrators market appears promising, driven by technological advancements and evolving client needs. As organizations increasingly adopt digital transformation strategies, the demand for integrated solutions will rise. Additionally, the integration of AI and machine learning into system integration processes is expected to enhance efficiency and innovation. Furthermore, the focus on sustainability will drive system integrators to develop eco-friendly solutions, aligning with global environmental goals and regulations.

| Segment | Sub-Segments |

|---|---|

| By Type | Infrastructure Integration Software Integration IT System Integration Network Integration Cloud Integration Security Integration Data Integration Application Integration Others |

| By End-User | Healthcare Financial Services (BFSI) Manufacturing Retail Government Telecommunications Energy & Utilities Transportation & Logistics Others |

| By Industry Vertical | Automotive Energy and Utilities Transportation and Logistics Education Aerospace and Defense Oil & Gas Chemicals & Petrochemicals Food & Beverages Pharmaceuticals Mining & Metals Others |

| By Service Type | Consulting Services Implementation Services Support and Maintenance Services Managed Services Others |

| By Deployment Model | On-Premises Cloud-Based Hybrid Others |

| By Geographic Presence | North America Europe Asia-Pacific Latin America Middle East and Africa Others |

| By Pricing Model | Fixed Pricing Time and Material Pricing Subscription-Based Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare System Integration | 100 | IT Directors, Healthcare Administrators |

| Financial Services Integration Projects | 80 | Chief Technology Officers, Compliance Managers |

| Manufacturing Automation Integrations | 70 | Operations Managers, Production Engineers |

| Retail Technology Integration | 60 | Supply Chain Managers, IT Project Leads |

| Telecommunications System Integration | 50 | Network Engineers, Systems Architects |

The Global System Integrators Market is valued at approximately USD 460 billion, reflecting significant growth driven by digital transformation, cloud computing, and the demand for integrated solutions across various industries.