Global Venipuncture Needles and Syringes Market Overview

- The Global Venipuncture Needles and Syringes Market is valued at USD 6.5 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing prevalence of chronic diseases, the rise in diagnostic and surgical procedures, and the growing demand for safe and efficient drug delivery systems. The market is also influenced by technological advancements in needle and syringe design, such as prefilled and safety-engineered devices, which enhance patient comfort and healthcare worker safety .

- Key players in this market include the United States, Germany, and Japan, which dominate due to their advanced healthcare infrastructure, significant investment in medical technology, and a strong emphasis on research and development. The presence of major manufacturers and a robust distribution network further solidify their leadership in the global market .

- In 2023, the U.S. Food and Drug Administration (FDA) implemented the “Medical Devices; Needle Devices Intended for Blood Collection and Blood Sampling, Statement of Policy,” requiring the use of safety-engineered devices for venipuncture procedures. This regulation, issued by the U.S. Food and Drug Administration, aims to reduce needlestick injuries and enhance safety for healthcare workers, thereby driving the demand for innovative syringes and needles in the market .

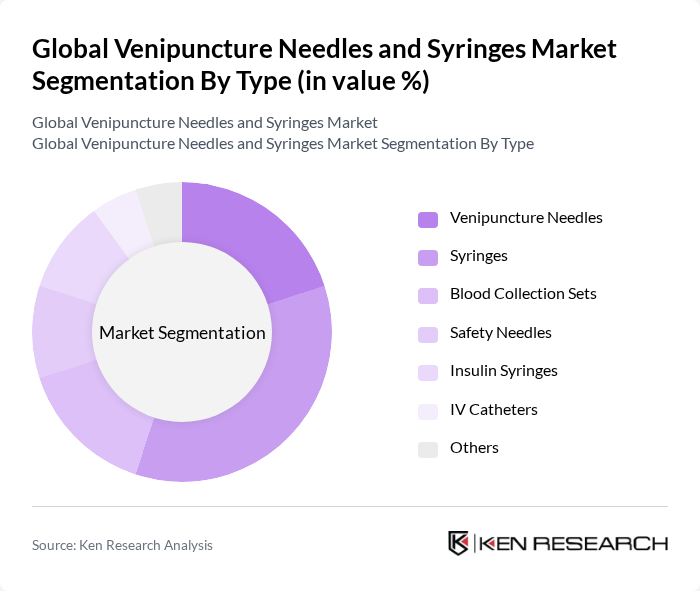

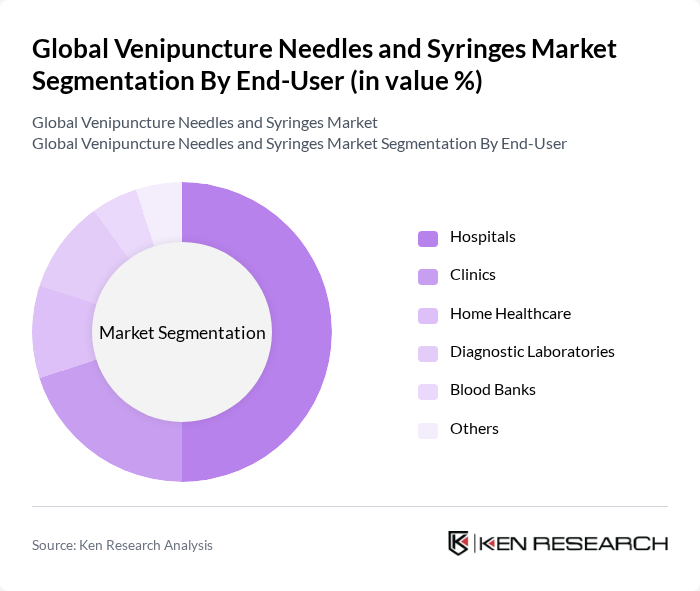

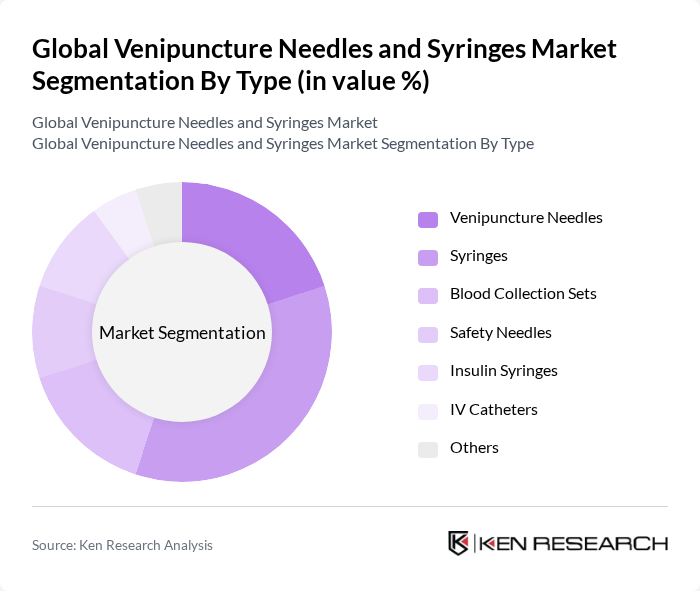

Global Venipuncture Needles and Syringes Market Segmentation

By Type:The market is segmented into various types, including Venipuncture Needles, Syringes, Blood Collection Sets, Safety Needles, Insulin Syringes, IV Catheters, and Others. Among these, Syringes are the most widely used due to their versatility in drug delivery, blood collection, and diagnostic applications. The increasing adoption of prefilled syringes and safety syringes, driven by infection control protocols and the need for precise dosing, is also contributing to the growth of this segment .

By End-User:The market is categorized by end-users, including Hospitals, Clinics, Home Healthcare, Diagnostic Laboratories, Blood Banks, and Others. Hospitals are the leading end-user segment, driven by the high volume of procedures requiring venipuncture, increasing hospital admissions, and the need for efficient and safe blood collection methods. The expansion of point-of-care diagnostics and the growing trend toward outpatient and home-based care are also influencing demand across other segments .

Global Venipuncture Needles and Syringes Market Competitive Landscape

The Global Venipuncture Needles and Syringes Market is characterized by a dynamic mix of regional and international players. Leading participants such as Becton, Dickinson and Company, Terumo Corporation, Smiths Medical, Medtronic plc, Nipro Corporation, Cardinal Health, Inc., Fresenius Kabi AG, Gerresheimer AG, Halyard Health, Inc., Amsino International, Inc., Shanghai Kindly Enterprise Development Group Co., Ltd., B. Braun Melsungen AG, HMD Healthcare Ltd., CML Biotech Ltd., Demophorius Healthcare, Disera Medical Equipment Logistics Inc., FL Medical S.r.l. contribute to innovation, geographic expansion, and service delivery in this space.

Global Venipuncture Needles and Syringes Market Industry Analysis

Growth Drivers

- Increasing Prevalence of Chronic Diseases:The rise in chronic diseases such as diabetes and cardiovascular conditions is a significant growth driver for the venipuncture needles and syringes market. According to the World Health Organization, approximately 422 million people worldwide have diabetes, with the number expected to rise by 50% in future. This growing patient population necessitates frequent blood sampling and insulin administration, thereby increasing the demand for venipuncture devices in healthcare settings.

- Rising Demand for Minimally Invasive Procedures:The healthcare sector is witnessing a shift towards minimally invasive procedures, which are associated with reduced recovery times and lower risk of complications. The global market for minimally invasive surgical devices is projected to reach $50 billion in future, according to industry reports. This trend is driving the demand for advanced venipuncture needles and syringes that facilitate these procedures, enhancing patient comfort and operational efficiency in medical facilities.

- Technological Advancements in Needle Design:Innovations in needle technology, such as safety-engineered devices and smart syringes, are propelling market growth. For instance, the introduction of retractable needles has significantly reduced the risk of needle-stick injuries, which affect approximately 385,000 healthcare workers annually in the U.S. alone. These advancements not only improve safety but also enhance the overall user experience, leading to increased adoption in hospitals and clinics.

Market Challenges

- Stringent Regulatory Requirements:The venipuncture needles and syringes market faces significant challenges due to stringent regulatory frameworks imposed by health authorities. For example, the FDA mandates rigorous testing and approval processes for medical devices, which can take several years and incur substantial costs. This regulatory burden can hinder the speed of product innovation and market entry, impacting overall growth in the industry.

- Risk of Needle-Stick Injuries:Despite advancements in safety technology, the risk of needle-stick injuries remains a critical challenge. The Centers for Disease Control and Prevention (CDC) estimates that about 1,000 needle-stick injuries occur daily in the U.S. healthcare system. These incidents not only pose health risks to healthcare workers but also lead to increased costs related to treatment and legal liabilities, creating a complex environment for manufacturers.

Global Venipuncture Needles and Syringes Market Future Outlook

The future of the venipuncture needles and syringes market appears promising, driven by ongoing technological innovations and an increasing focus on patient safety. As healthcare systems globally adapt to the rising burden of chronic diseases, the demand for advanced venipuncture solutions is expected to grow. Additionally, the integration of smart technologies into syringes will likely enhance user experience and operational efficiency, paving the way for new product developments and market expansion.

Market Opportunities

- Expansion in Emerging Markets:Emerging markets present significant growth opportunities for venipuncture needles and syringes. With healthcare spending in countries like India and Brazil projected to increase by 10% annually in future, manufacturers can capitalize on the rising demand for medical devices in these regions, enhancing their market presence and profitability.

- Development of Eco-Friendly Products:The growing emphasis on sustainability is driving the demand for eco-friendly medical products. Manufacturers that invest in the development of biodegradable syringes and recyclable needles can tap into a niche market, appealing to environmentally conscious consumers and healthcare providers, thereby enhancing their competitive edge.