Region:Asia

Author(s):Rebecca

Product Code:KRAA9255

Pages:96

Published On:November 2025

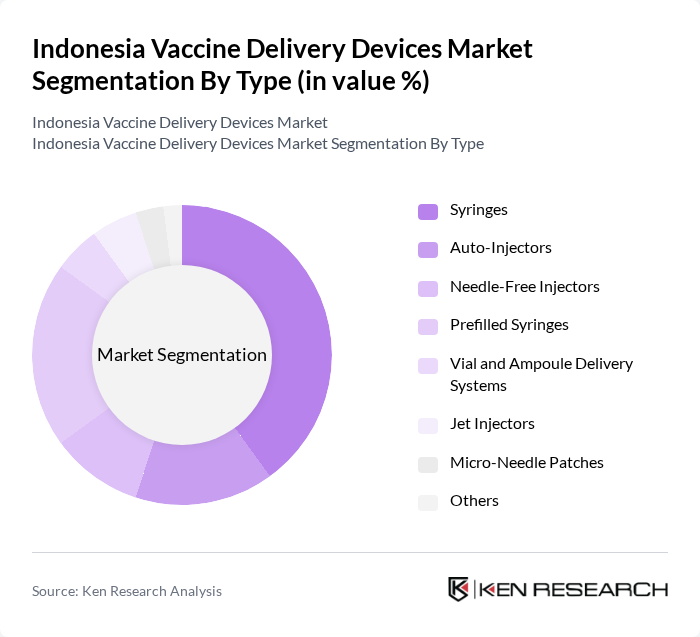

By Type:The market is segmented into various types of vaccine delivery devices, each catering to specific needs and preferences in the healthcare sector. The subsegments include Syringes, Auto-Injectors, Needle-Free Injectors, Prefilled Syringes, Vial and Ampoule Delivery Systems, Jet Injectors, Micro-Needle Patches, and Others. Among these, the Syringes segment remains the most dominant due to their widespread use in hospitals and clinics, driven by cost-effectiveness, reliability, and established supply chains. However, there is notable growth in needle-free injectors and microneedle patches, reflecting a shift toward safer and more patient-friendly delivery methods, especially in mass immunization campaigns and remote outreach programs .

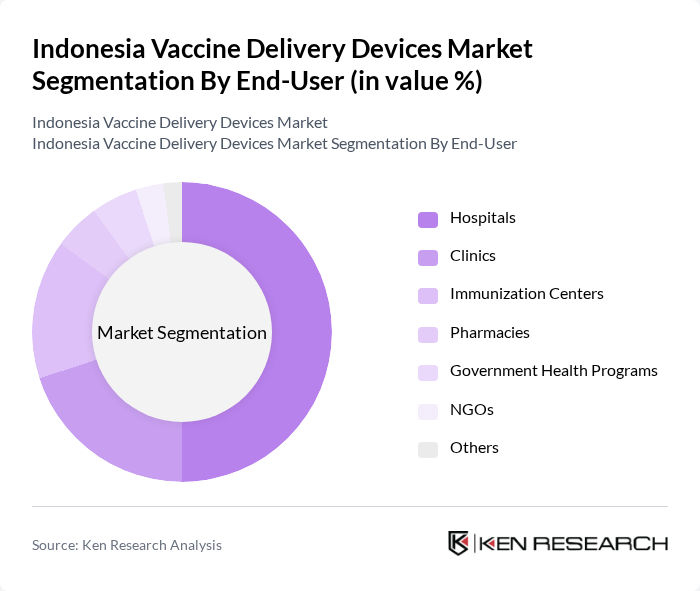

By End-User:The end-user segmentation includes Hospitals, Clinics, Immunization Centers, Pharmacies, Government Health Programs, NGOs, and Others. Hospitals are the leading end-user segment, primarily due to their capacity to handle large volumes of vaccinations and their critical role in public health initiatives. Immunization centers are gaining market share, supported by government and multilateral investments in dedicated facilities and mobile outreach. The increasing number of vaccination campaigns and the need for efficient healthcare delivery systems further bolster demand for vaccine delivery devices in hospitals and specialized immunization centers .

The Indonesia Vaccine Delivery Devices Market is characterized by a dynamic mix of regional and international players. Leading participants such as PT Bio Farma (Persero), PT Kimia Farma Tbk, PT Indofarma Tbk, PT Medion Farma Jaya, PT Kalbe Farma Tbk, PT Sanofi Indonesia, PT Pfizer Indonesia, PT Merck Sharp & Dohme Pharma Tbk, PT GlaxoSmithKline Indonesia, PT Johnson & Johnson Indonesia, PT Novartis Indonesia, PT AstraZeneca Indonesia, PT Roche Indonesia, PT Abbott Indonesia, PT Takeda Indonesia contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Indonesia vaccine delivery devices market appears promising, driven by ongoing government support and technological innovations. As the country aims for higher vaccination coverage, the integration of IoT in delivery systems is expected to enhance tracking and efficiency. Additionally, the rise of mobile vaccination units will facilitate access in rural areas, ensuring that underserved populations receive timely vaccinations. These trends indicate a robust growth trajectory for the market in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Syringes Auto-Injectors Needle-Free Injectors Prefilled Syringes Vial and Ampoule Delivery Systems Jet Injectors Micro-Needle Patches Others |

| By End-User | Hospitals Clinics Immunization Centers Pharmacies Government Health Programs NGOs Others |

| By Application | Pediatric Vaccination Adult Vaccination Travel Vaccination Emergency Vaccination Others |

| By Distribution Channel | Direct Sales Online Sales Distributors Retail Pharmacies Hospital Pharmacies Vaccination Centers Others |

| By Region | Java Sumatra Bali and Nusa Tenggara Kalimantan Sulawesi Papua Others |

| By Technology | Conventional Delivery Systems Advanced Delivery Systems Smart Delivery Systems Others |

| By Policy Support | Government Subsidies Tax Incentives Grants for Research and Development Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Providers | 100 | Doctors, Nurses, Immunization Coordinators |

| Vaccine Manufacturers | 60 | Product Managers, R&D Directors |

| Logistics and Distribution Companies | 50 | Supply Chain Managers, Operations Directors |

| Government Health Officials | 40 | Policy Makers, Health Program Managers |

| Pharmaceutical Retailers | 40 | Pharmacy Managers, Procurement Officers |

The Indonesia Vaccine Delivery Devices Market is valued at approximately USD 145 million, driven by increasing immunization demands, government healthcare initiatives, and advancements in vaccine delivery technologies.