Region:Global

Author(s):Geetanshi

Product Code:KRAA2748

Pages:87

Published On:August 2025

By Type:The video game market can be segmented into various types, includingAction Games, Role-Playing Games (RPGs), Simulation Games, Sports Games, Puzzle Games, Adventure Games, and Others. Among these, Action Games and RPGs remain particularly popular due to their immersive gameplay and engaging storylines. Action Games attract a wide audience with fast-paced mechanics and competitive elements, while RPGs offer deep narratives and character progression, appealing to a diverse demographic. Simulation and Sports Games are also gaining traction, driven by innovations in realism and online multiplayer features .

By Platform:The market can also be segmented by platform, includingMobile, Console, PC, Cloud, and Others (e.g., VR/AR devices). Mobile gaming continues to lead with the largest market share, driven by smartphone accessibility and freemium monetization models. Console and PC platforms remain strong due to advanced graphics and immersive experiences, while cloud gaming is rapidly emerging, enabling access to high-quality games without dedicated hardware. VR/AR devices represent a niche but growing segment, fueled by technological advancements and new content offerings .

The Global Video Game Market is characterized by a dynamic mix of regional and international players. Leading participants such as Activision Blizzard, Inc., Electronic Arts Inc., Tencent Holdings Limited, Sony Interactive Entertainment LLC, Microsoft Corporation, Nintendo Co., Ltd., Ubisoft Entertainment S.A., Take-Two Interactive Software, Inc., Bandai Namco Entertainment Inc., Square Enix Holdings Co., Ltd., Epic Games, Inc., Riot Games, Inc., Valve Corporation, NetEase, Inc., Roblox Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the video game market appears promising, driven by technological advancements and evolving consumer preferences. The integration of artificial intelligence in game development is expected to enhance user experiences, while the growth of cloud gaming will facilitate access to high-quality games without the need for expensive hardware. Additionally, the increasing focus on inclusivity and diversity in gaming content will likely attract a broader audience, fostering a more vibrant gaming community and driving further market expansion.

| Segment | Sub-Segments |

|---|---|

| By Type | Action Games Role-Playing Games (RPGs) Simulation Games Sports Games Puzzle Games Adventure Games Others |

| By Platform | Mobile Console PC Cloud Others (e.g., VR/AR devices) |

| By Genre | First-Person Shooter (FPS) Multiplayer Online Battle Arena (MOBA) Battle Royale Fighting Games Racing Games Strategy Games Others |

| By Distribution Channel | Digital Downloads Retail Stores Subscription Services Cloud Streaming Others |

| By User Demographics | Age Group (Children, Teens, Adults, Seniors) Gender (Male, Female, Non-binary/Other) Skill Level (Casual, Core, Hardcore) Geographic Location Others |

| By Monetization Model | Free-to-Play (F2P) Pay-to-Play (P2P) In-Game Purchases (Microtransactions, DLC) Subscription-Based Advertising-Supported Others |

| By Region | North America (U.S., Canada, Mexico) Europe (UK, Germany, France, Russia, Rest of Europe) Asia-Pacific (China, Japan, South Korea, India, Rest of APAC) Latin America (Brazil, Argentina, Rest of LATAM) Middle East & Africa Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Console Gaming Market | 150 | Console Gamers, Retail Managers |

| Mobile Gaming Trends | 100 | Mobile Game Developers, App Store Managers |

| PC Gaming Community | 90 | PC Gamers, Hardware Manufacturers |

| Esports and Competitive Gaming | 60 | Esports Team Managers, Event Organizers |

| Virtual Reality Gaming | 40 | VR Developers, Tech Enthusiasts |

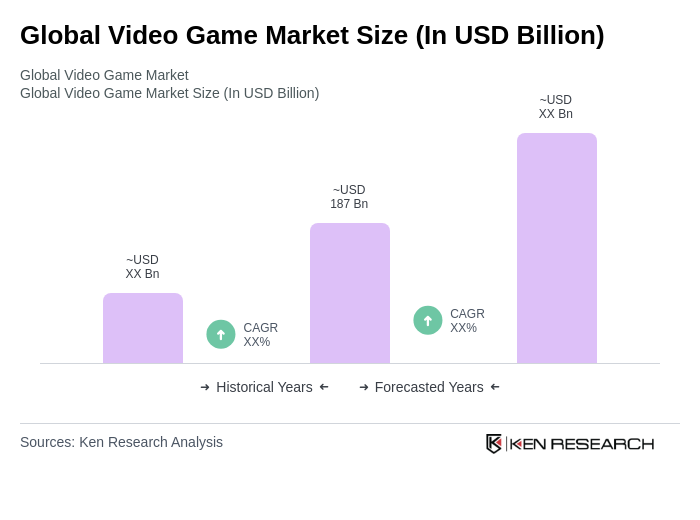

The Global Video Game Market is valued at approximately USD 187 billion, reflecting significant growth driven by mobile gaming, cloud technology advancements, and the rise of eSports. This valuation is based on a comprehensive five-year historical analysis.