Global Waterproofing Chemicals Market Overview

- The Global Waterproofing Chemicals Market is valued at USD 8.4 billion, based on a five-year historical analysis. This growth is primarily driven by increasing construction activities, rapid urbanization, and the rising need for infrastructure resilience against water damage. The demand for waterproofing solutions is further fueled by the adoption of sustainable building materials, stricter environmental standards, and ongoing innovation in chemical formulations that enhance durability and safety of structures. Recent trends highlight the shift toward nontoxic, low-VOC waterproofing chemicals supporting green building initiatives and regulatory compliance.

- Key players in this market include the United States, Germany, and China, which dominate due to robust construction sectors and significant investments in infrastructure development. The Asia Pacific region, led by China, holds the largest market share, driven by rapid urbanization and expansive infrastructure projects. Europe and North America also maintain strong positions due to advanced construction practices and regulatory frameworks supporting sustainable and energy-efficient buildings.

- In 2023, the European Union implemented the Construction Products Regulation (CPR) (Regulation (EU) No 305/2011, amended in 2023 by the European Commission), which mandates that all construction products, including waterproofing chemicals, must meet specific performance criteria related to mechanical resistance, safety in case of fire, hygiene, health, environmental protection, and sustainable use of resources. This regulation requires manufacturers to provide CE marking and Declaration of Performance, ensuring products are safe, reliable, and environmentally friendly, thereby enhancing the overall quality of construction in the region.

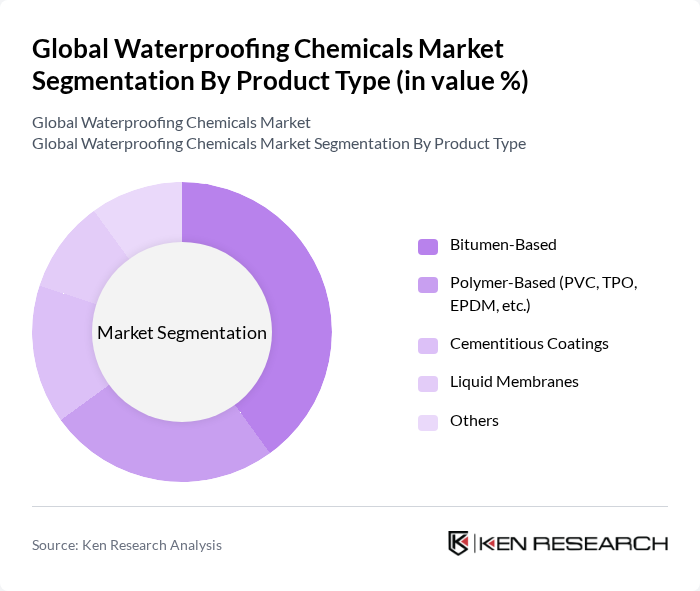

Global Waterproofing Chemicals Market Segmentation

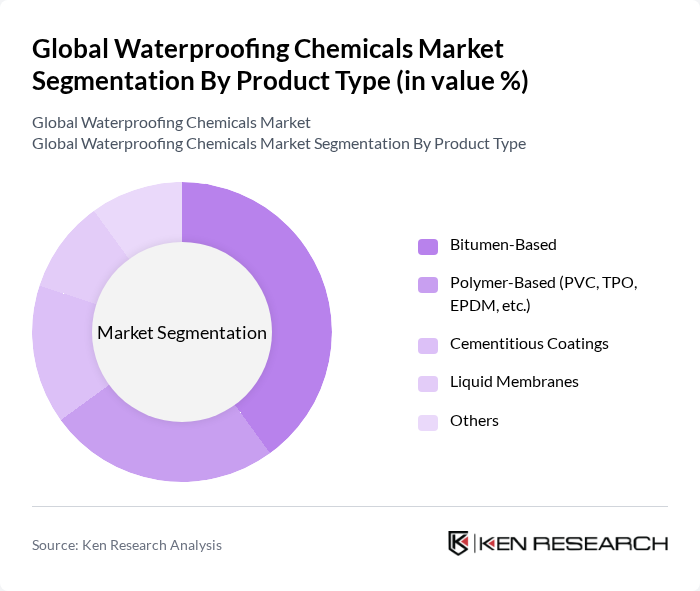

By Product Type:The product types in this market include Bitumen-Based, Polymer-Based (PVC, TPO, EPDM, etc.), Cementitious Coatings, Liquid Membranes, and Others. Bitumen-Based products continue to lead due to their cost-effectiveness, proven waterproofing properties, and widespread use in roofing and infrastructure projects. Polymer-Based solutions, such as PVC, TPO, and EPDM, are gaining traction for their flexibility, durability, and suitability for sustainable construction, while cementitious coatings and liquid membranes are preferred for specialized applications requiring seamless coverage and chemical resistance.

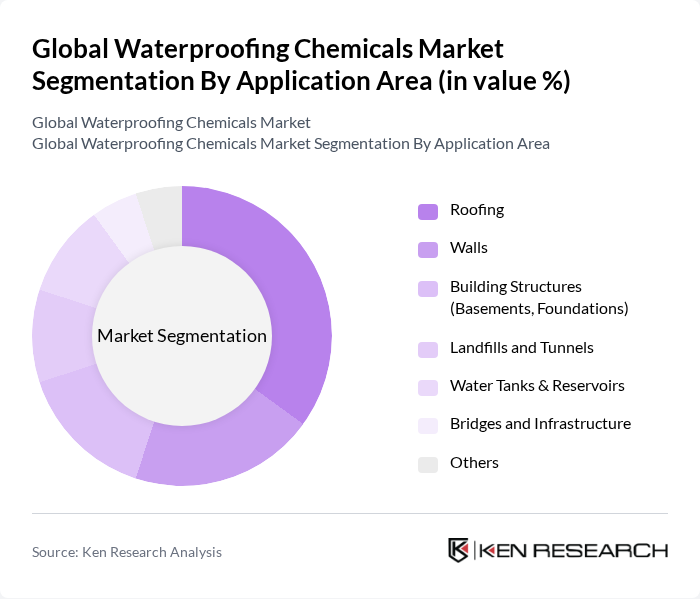

By Application Area:The application areas for waterproofing chemicals include Roofing, Walls, Building Structures (Basements, Foundations), Landfills and Tunnels, Water Tanks & Reservoirs, Bridges and Infrastructure, and Others. Roofing applications dominate the market, driven by the increasing demand for energy-efficient, durable, and weather-resistant roofing solutions in both residential and commercial sectors. The use of waterproofing chemicals in walls, basements, and foundations is also expanding due to the need for enhanced structural integrity and protection against moisture ingress.

Global Waterproofing Chemicals Market Competitive Landscape

The Global Waterproofing Chemicals Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Sika AG, GAF Materials Corporation, Carlisle Companies Incorporated, RPM International Inc. (Tremco, Carboline), Saint-Gobain S.A. (Saint-Gobain Weber), Dow Inc., Fosroc International Limited, Mapei S.p.A., Tremco Incorporated, Pidilite Industries Limited, Bostik SA (Arkema Group), AkzoNobel N.V., Henkel AG & Co. KGaA, GCP Applied Technologies Inc., Asian Paints Limited, Jotun Group, Ardex GmbH, Kryton International Inc., Soudal NV, Wacker Chemie AG, Kemper System America, Inc., Kerakoll S.p.A., H.B. Fuller Company, Huntsman Corporation, Soprema Group contribute to innovation, geographic expansion, and service delivery in this space.

Global Waterproofing Chemicals Market Industry Analysis

Growth Drivers

- Increasing Demand for Sustainable Construction Materials:The global construction industry is projected to reach $11 trillion, with a significant shift towards sustainable materials. In the future, the market for eco-friendly construction materials was valued at $1.4 trillion, reflecting a 16% increase from the previous year. This trend is driven by rising consumer awareness and government initiatives promoting green building practices, which directly boosts the demand for waterproofing chemicals that meet sustainability criteria.

- Rising Urbanization and Infrastructure Development:According to the United Nations, urban populations are expected to grow by 2.5 billion by 2050, necessitating extensive infrastructure development. In the future, global infrastructure spending is anticipated to reach $5 trillion, with a significant portion allocated to waterproofing solutions. This surge in urbanization creates a robust demand for waterproofing chemicals to protect buildings and infrastructure from water damage, thereby driving market growth.

- Technological Advancements in Waterproofing Solutions:The waterproofing chemicals sector is witnessing rapid technological innovations, with investments in R&D projected to exceed $600 million. Innovations such as self-healing materials and advanced liquid membranes are gaining traction, enhancing the performance and longevity of waterproofing solutions. These advancements not only improve product efficacy but also cater to the growing demand for high-performance materials in construction, further propelling market growth.

Market Challenges

- High Cost of Advanced Waterproofing Materials:The cost of advanced waterproofing solutions can be prohibitive, with premium products priced up to 30% higher than traditional options. This high cost can deter small and medium-sized enterprises from adopting these technologies, limiting market penetration. In the future, the average price of high-performance waterproofing materials is expected to remain elevated, posing a significant challenge for widespread adoption in cost-sensitive markets.

- Stringent Environmental Regulations:Increasingly stringent environmental regulations are impacting the waterproofing chemicals market. In the future, compliance costs related to environmental standards are projected to rise by 25%, affecting manufacturers' operational expenses. These regulations often require extensive testing and certification processes, which can delay product launches and increase costs, thereby challenging market players in maintaining competitiveness while adhering to compliance requirements.

Global Waterproofing Chemicals Market Future Outlook

The future of the waterproofing chemicals market appears promising, driven by ongoing urbanization and a heightened focus on sustainability. As infrastructure projects continue to expand globally, the demand for innovative waterproofing solutions is expected to rise. Additionally, the integration of smart technologies and IoT in construction will likely enhance product functionality, creating new avenues for growth. Companies that prioritize eco-friendly practices and invest in R&D will be well-positioned to capitalize on emerging trends and consumer preferences in the coming years.

Market Opportunities

- Expansion in Emerging Markets:Emerging markets, particularly in Asia-Pacific and Africa, are experiencing rapid urbanization, with construction spending projected to reach $2 trillion. This growth presents significant opportunities for waterproofing chemical manufacturers to establish a foothold in these regions, catering to the increasing demand for effective water management solutions in new construction projects.

- Development of Eco-Friendly Waterproofing Products:The market for eco-friendly waterproofing products is expected to grow significantly, with a projected value of $400 million. This growth is driven by consumer demand for sustainable building materials and government incentives promoting green construction practices. Companies that innovate and offer environmentally friendly solutions will likely gain a competitive edge in this evolving market landscape.