Region:Middle East

Author(s):Dev

Product Code:KRAC0967

Pages:92

Published On:December 2025

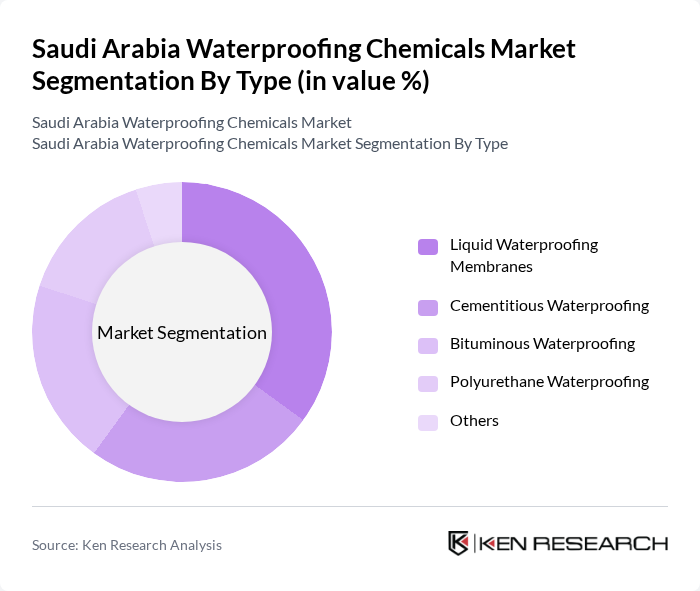

By Type:The waterproofing chemicals market in Saudi Arabia is segmented into various types, including Liquid Waterproofing Membranes, Cementitious Waterproofing, Bituminous Waterproofing, Polyurethane Waterproofing, and Others. Among these, Liquid Waterproofing Membranes are gaining traction due to their ease of application and effectiveness in providing a seamless barrier against water ingress. The increasing focus on sustainable construction practices is also driving the demand for eco-friendly waterproofing solutions, particularly in urban development projects.

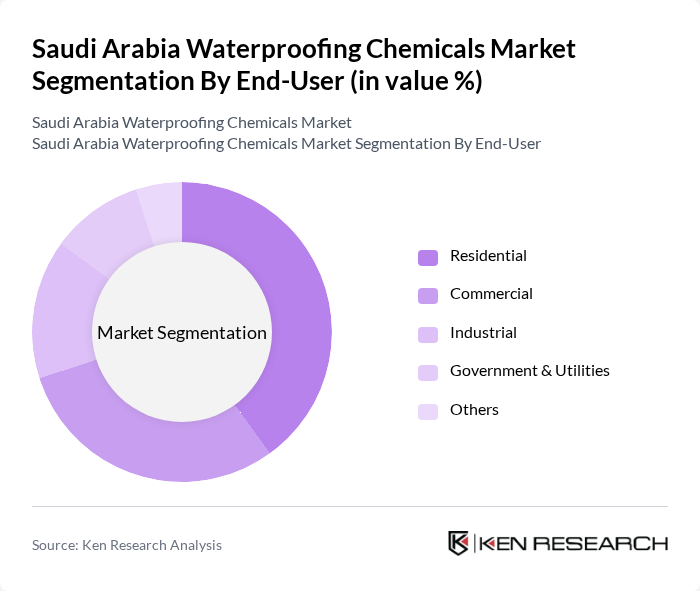

By End-User:The end-user segmentation of the waterproofing chemicals market includes Residential, Commercial, Industrial, Government & Utilities, and Others. The Residential segment is currently leading the market, driven by the rapid growth in housing projects and the increasing awareness of waterproofing solutions among homeowners. The demand for waterproofing in commercial and industrial applications is also on the rise, particularly in sectors such as construction and infrastructure development.

The Saudi Arabia Waterproofing Chemicals Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Sika AG, Mapei S.p.A., Pidilite Industries Ltd., Dow Chemical Company, Saint-Gobain, GCP Applied Technologies Inc., RPM International Inc., Fosroc International Ltd., Tremco Incorporated, Ardex Group, Koster Bauchemie AG, Bostik, Ceresit, Soudal N.V. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia waterproofing chemicals market appears promising, driven by ongoing mega-projects such as NEOM, which is valued at USD 500 billion, and a strong push towards sustainable construction practices. The integration of smart technologies in construction, alongside the growth of green building initiatives, is expected to create a robust demand for advanced waterproofing solutions. As the market evolves, companies that adapt to these trends will likely find significant opportunities for growth and innovation.

| Segment | Sub-Segments |

|---|---|

| By Type | Liquid Waterproofing Membranes Cementitious Waterproofing Bituminous Waterproofing Polyurethane Waterproofing Others |

| By End-User | Residential Commercial Industrial Government & Utilities Others |

| By Application | Roof Waterproofing Basement Waterproofing Water Tank Waterproofing Bridge & Tunnel Waterproofing Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Stores Others |

| By Region | Central Region Eastern Region Western Region Southern Region |

| By Product Formulation | Water-Based Solvent-Based Polymer-Based Others |

| By Performance Characteristics | High Durability Quick Setting UV Resistance Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Waterproofing Solutions | 100 | Homeowners, Contractors, Architects |

| Commercial Waterproofing Applications | 80 | Project Managers, Facility Managers, Engineers |

| Industrial Waterproofing Chemicals | 70 | Procurement Managers, Plant Managers, Safety Officers |

| Waterproofing Product Innovations | 60 | R&D Managers, Product Development Specialists |

| Market Trends and Consumer Preferences | 90 | Industry Analysts, Market Researchers, Trade Association Members |

The Saudi Arabia Waterproofing Chemicals Market is valued at approximately USD 435 million, driven by extensive infrastructure and urban development initiatives aimed at enhancing durability and energy efficiency in construction projects.