Region:Central and South America

Author(s):Shubham

Product Code:KRAA0944

Pages:83

Published On:August 2025

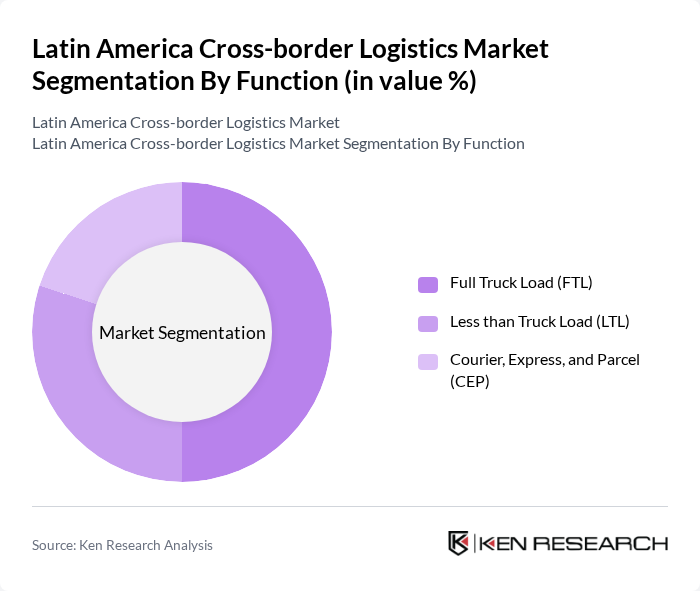

By Function:The cross-border logistics market is segmented into three main functions: Full Truck Load (FTL), Less than Truck Load (LTL), and Courier, Express, and Parcel (CEP). Among these, the Full Truck Load (FTL) segment leads the market, supported by the efficiency of transporting large volumes over long distances and the growing manufacturing sector. LTL is gaining traction as businesses seek cost-effective solutions for smaller shipments, while CEP is expanding rapidly due to the surge in online shopping and rising consumer expectations for fast delivery services .

By End-User:The end-user segmentation of the cross-border logistics market includes Manufacturing and Automotive, Chemicals, Agriculture, Fishing, and Forestry, Construction, Distributive Trade, Pharmaceutical and Healthcare, Food and Beverage, Telecommunications, and Others. The Manufacturing and Automotive sector is the dominant end-user, driven by the need for efficient supply chains and just-in-time delivery systems. Chemicals and Pharmaceutical sectors also contribute significantly due to regulatory requirements and specialized logistics needs. The rise in e-commerce has notably boosted demand in the Food and Beverage and Telecommunications sectors, increasing the need for tailored logistics solutions .

The Latin America Cross-border Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain, FedEx Logistics, UPS Supply Chain Solutions, Kuehne + Nagel, DB Schenker, Maersk Logistics, CEVA Logistics, DSV, Geodis, Rhenus Logistics, LATAM Cargo, Mercado Libre (Mercado Envios), Correios (Brazil), Estafeta, and Blue Logistics contribute to innovation, geographic expansion, and service delivery in this space.

The future of cross-border logistics in Latin America appears promising, driven by the continued growth of e-commerce and technological advancements. As businesses increasingly adopt digital logistics solutions, the demand for efficient and reliable cross-border services will rise. Additionally, ongoing investments in infrastructure development and trade facilitation measures will enhance logistics capabilities. Companies that embrace innovation and form strategic partnerships will be well-positioned to capitalize on emerging opportunities in this dynamic market landscape.

| Segment | Sub-Segments |

|---|---|

| By Function | Full Truck Load (FTL) Less than Truck Load (LTL) Courier, Express, and Parcel (CEP) |

| By End-User | Manufacturing and Automotive Chemicals Agriculture, Fishing, and Forestry Construction Distributive Trade Pharmaceutical and Healthcare Food and Beverage Telecommunications Others |

| By Geography | Mexico Brazil Argentina Chile Colombia Rest of Latin America |

| By Distribution Mode | Road Transport Air Freight Sea Freight Rail Transport Multimodal Transport Others |

| By Service Type | Standard Shipping Expedited Shipping Same-Day Delivery Scheduled Delivery Others |

| By Customer Type | B2B B2C C2C Others |

| By Payment Method | Prepaid Postpaid Cash on Delivery Others |

| By Packaging Type | Bulk Packaging Retail Packaging Custom Packaging Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cross-border E-commerce Logistics | 80 | Logistics Coordinators, E-commerce Managers |

| Automotive Supply Chain Management | 60 | Supply Chain Directors, Procurement Managers |

| Pharmaceuticals Distribution | 40 | Regulatory Affairs Managers, Distribution Managers |

| Consumer Goods Import/Export | 70 | Operations Managers, Trade Compliance Officers |

| Technology and Electronics Logistics | 50 | Warehouse Managers, Logistics Analysts |

The Latin America Cross-border Logistics Market is valued at approximately USD 33 billion, driven by the increasing demand for efficient supply chain solutions, e-commerce growth, and strengthened trade agreements like MERCOSUR and the Pacific Alliance.