Region:Middle East

Author(s):Shubham

Product Code:KRAA1147

Pages:97

Published On:August 2025

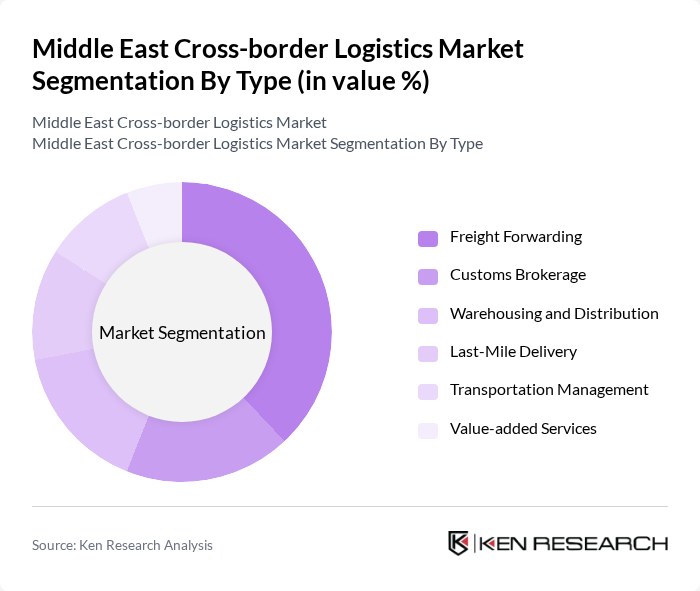

By Type:

The types of services in the Middle East cross-border logistics market include Freight Forwarding, Customs Brokerage, Warehousing and Distribution, Last-Mile Delivery, Transportation Management, and Value-added Services. Freight Forwarding remains the leading sub-segment, driven by the growing volume of international trade and the need for reliable, efficient transportation solutions. The surge in e-commerce and increasing consumer expectations for rapid delivery have further accelerated demand for Freight Forwarding and Last-Mile Delivery services. Customs Brokerage is also critical, ensuring regulatory compliance and facilitating seamless customs clearance, which is especially important given the region's complex trade environment .

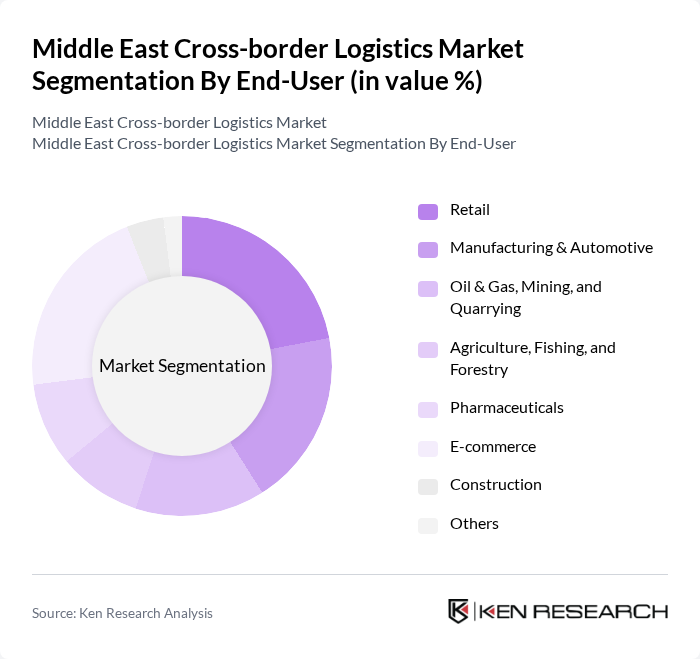

By End-User:

The end-users in the Middle East cross-border logistics market include Retail, Manufacturing & Automotive, Oil & Gas, Mining, and Quarrying, Agriculture, Fishing, and Forestry, Pharmaceuticals, E-commerce, Construction, and Others. E-commerce is the fastest-growing and dominant end-user segment, propelled by the rapid adoption of online shopping, high smartphone penetration, and a shift toward digital payments. Retail and Manufacturing & Automotive also hold significant shares, as both sectors increasingly rely on advanced logistics to meet evolving customer expectations and support regional supply chain integration .

The Middle East Cross-border Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Aramex, DHL Supply Chain, FedEx, UPS, DB Schenker, Kuehne + Nagel, Agility Logistics, CEVA Logistics, Maersk, Bolloré Logistics, Hellmann Worldwide Logistics, DSV, Noon, Amazon (Middle East), and AliExpress contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Middle East cross-border logistics market appears promising, driven by technological advancements and increasing regional trade. As e-commerce continues to expand, logistics providers are expected to adopt innovative solutions, enhancing efficiency and customer satisfaction. Additionally, the integration of AI and automation will streamline operations, while sustainability initiatives will shape logistics practices. The region's strategic location will further bolster its role as a logistics hub, attracting investments and partnerships that enhance cross-border trade capabilities.

| Segment | Sub-Segments |

|---|---|

| By Type | Freight Forwarding Customs Brokerage Warehousing and Distribution Last-Mile Delivery Transportation Management Value-added Services |

| By End-User | Retail Manufacturing & Automotive Oil & Gas, Mining, and Quarrying Agriculture, Fishing, and Forestry Pharmaceuticals E-commerce Construction Others |

| By Distribution Mode | Road Transport Air Freight Sea Freight Rail Transport Multimodal Transport Others |

| By Service Type | Full Truck Load (FTL) Less than Truck Load (LTL) Intermodal Services Expedited Shipping Others |

| By Payment Method | Prepaid Collect Credit Terms Digital Wallets Others |

| By Customer Type | B2B B2C C2C Others |

| By Region | GCC Countries (Saudi Arabia, UAE, Qatar, Kuwait, Oman, Bahrain) Levant Region (Jordan, Lebanon, Israel) North Africa (Egypt, Morocco, Tunisia) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cross-border Freight Forwarding | 120 | Logistics Coordinators, Operations Managers |

| Customs Brokerage Services | 60 | Customs Compliance Officers, Trade Specialists |

| Regional E-commerce Logistics | 50 | E-commerce Operations Managers, Supply Chain Analysts |

| Cold Chain Logistics for Pharmaceuticals | 40 | Pharmaceutical Supply Chain Managers, Quality Assurance Leads |

| Automotive Parts Logistics | 45 | Procurement Managers, Logistics Directors |

The Middle East Cross-border Logistics Market is valued at approximately USD 12 billion, reflecting a significant segment within the broader logistics market, driven by cross-border e-commerce growth and regional trade facilitation initiatives.