Region:Asia

Author(s):Geetanshi

Product Code:KRAB5814

Pages:93

Published On:October 2025

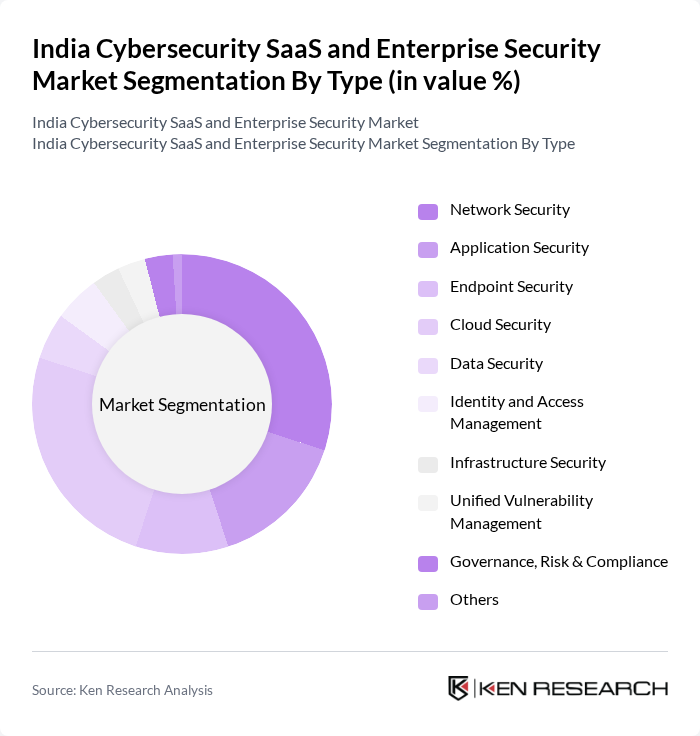

By Type:The market is segmented into Network Security, Application Security, Endpoint Security, Cloud Security, Data Security, Identity and Access Management, Infrastructure Security, Unified Vulnerability Management, Governance, Risk & Compliance, and Others. Network Security and Cloud Security are particularly prominent, reflecting the rising adoption of cloud platforms and the critical need to secure network infrastructures against advanced cyber threats. AI-driven security and integrated threat management are emerging trends, with organizations prioritizing solutions that enable real-time detection and automated response .

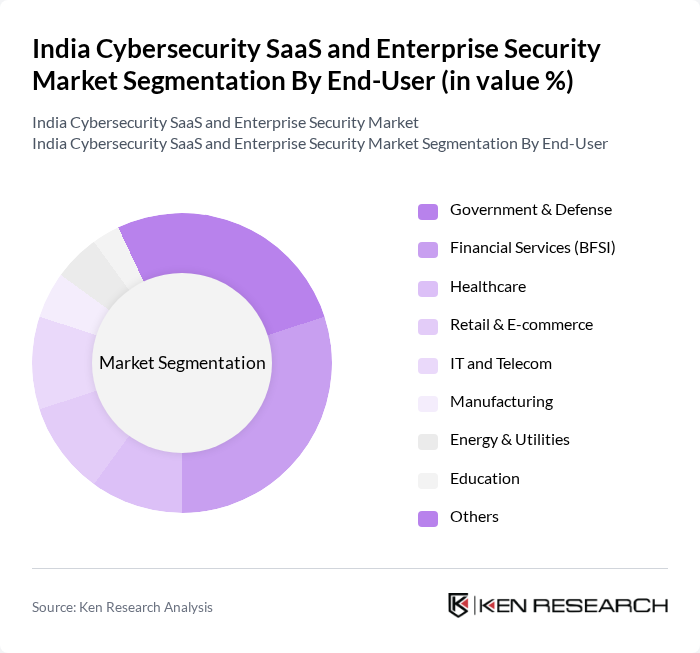

By End-User:The end-user segmentation includes Government & Defense, Financial Services (BFSI), Healthcare, Retail & E-commerce, IT and Telecom, Manufacturing, Energy & Utilities, Education, and Others. The BFSI sector is a major contributor, driven by strict regulatory requirements and the imperative to safeguard sensitive financial data. Government and defense agencies are also expanding investments in cybersecurity to address national security and critical infrastructure risks. The IT and Telecom sector is rapidly increasing adoption due to the proliferation of digital services and remote work models .

The India Cybersecurity SaaS and Enterprise Security Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tata Consultancy Services, Infosys, Wipro, HCL Technologies, Tech Mahindra, Paladion Networks (an Atos company), Quick Heal Technologies, K7 Computing, Seqrite, IBM Corporation, Microsoft, Cisco Systems, Palo Alto Networks, Fortinet, Check Point Software Technologies, Trend Micro, CrowdStrike, Sophos, McAfee, Symantec (Broadcom) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the India cybersecurity SaaS and enterprise security market appears promising, driven by increasing digitalization and the need for robust security frameworks. As organizations prioritize cybersecurity, the integration of advanced technologies like AI and machine learning will become essential. Additionally, the shift towards managed security services will enable businesses to leverage expert solutions without the burden of high implementation costs, fostering a more secure digital landscape in India.

| Segment | Sub-Segments |

|---|---|

| By Type | Network Security Application Security Endpoint Security Cloud Security Data Security Identity and Access Management Infrastructure Security Unified Vulnerability Management Governance, Risk & Compliance Others |

| By End-User | Government & Defense Financial Services (BFSI) Healthcare Retail & E-commerce IT and Telecom Manufacturing Energy & Utilities Education Others |

| By Industry Vertical | BFSI Energy and Utilities Education Transportation and Logistics Government and Public Sector Automotive IT & Telecom Healthcare Retail Others |

| By Deployment Model | On-Premises Cloud-Based Hybrid |

| By Service Type | Managed Services Professional Services |

| By Pricing Model | Subscription-Based Pay-As-You-Go |

| By Policy Support | Compliance Support Regulatory Guidance Security Frameworks |

| By Enterprise Size | Small and Medium Enterprises (SMEs) Large Enterprises |

| By Component | Solutions/Software Services |

| By Type of Threat | Malware Denial-of-Service (DoS) & DDoS Zero-Day Exploits Man-in-the-Middle (MITM) Attacks Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Enterprise Security Solutions | 120 | Chief Information Security Officers, IT Managers |

| Cybersecurity SaaS Adoption | 90 | IT Directors, Procurement Officers |

| Regulatory Compliance in Cybersecurity | 60 | Compliance Officers, Risk Management Executives |

| Incident Response Strategies | 50 | Security Analysts, Incident Response Team Leaders |

| Threat Intelligence Services | 70 | Cybersecurity Consultants, Threat Analysts |

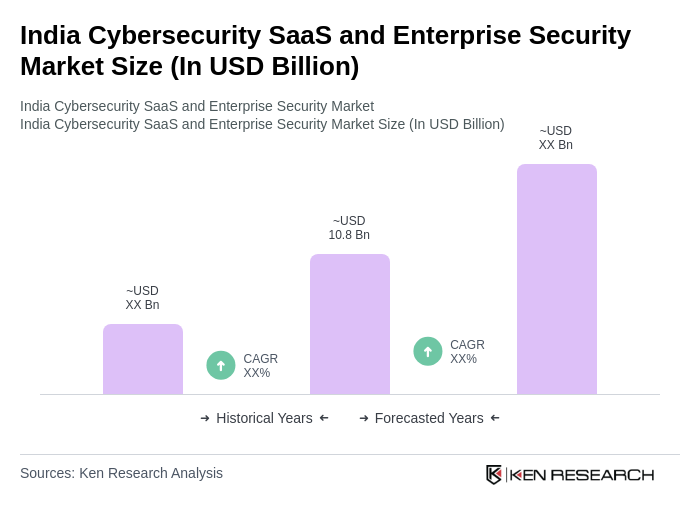

The India Cybersecurity SaaS and Enterprise Security Market is valued at approximately USD 10.8 billion, reflecting significant growth driven by increasing cyber threats, digital transformation, and heightened awareness of data privacy regulations.