Region:Asia

Author(s):Geetanshi

Product Code:KRAA6019

Pages:91

Published On:September 2025

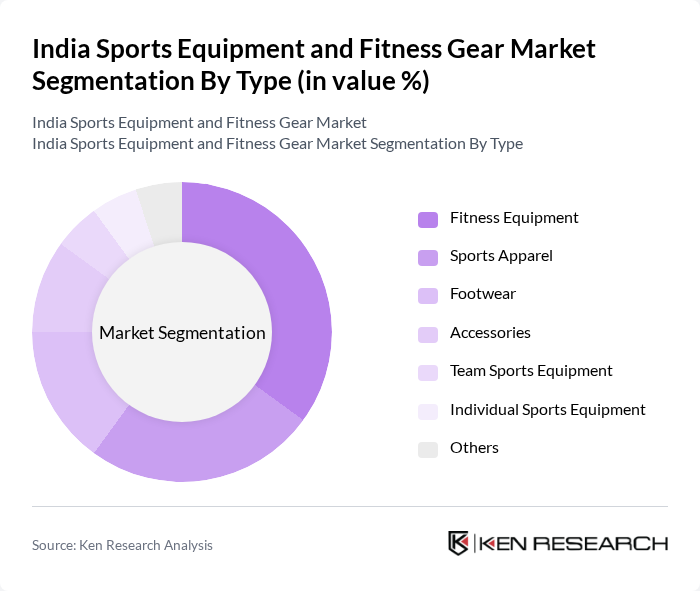

By Type:The market is segmented into various types of products, including fitness equipment, sports apparel, footwear, accessories, team sports equipment, individual sports equipment, and others. Among these, fitness equipment has emerged as a dominant segment due to the increasing number of fitness enthusiasts and the growing trend of home workouts. The demand for high-quality fitness gear, such as treadmills, exercise bikes, and weights, has surged as consumers prioritize health and wellness.

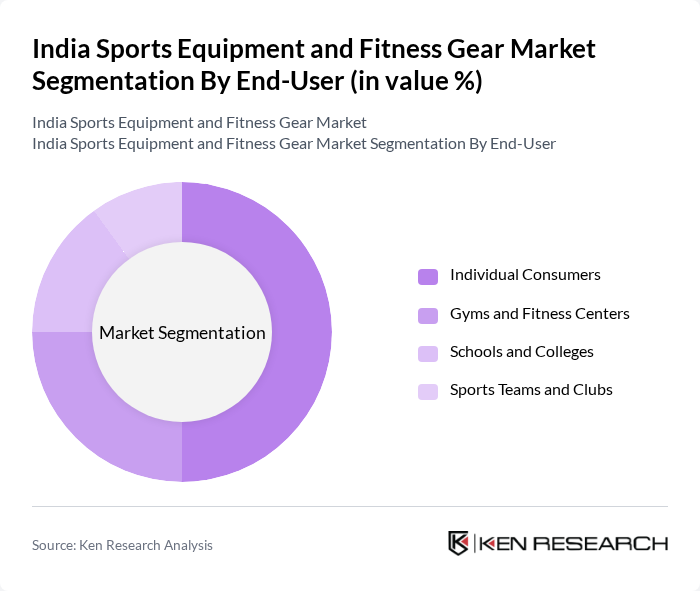

By End-User:The end-user segmentation includes individual consumers, gyms and fitness centers, schools and colleges, and sports teams and clubs. Individual consumers represent the largest segment, driven by the increasing trend of personal fitness and home workouts. The rise of online fitness classes and the growing awareness of health benefits have led to a significant increase in purchases of fitness gear by individuals.

The India Sports Equipment and Fitness Gear Market is characterized by a dynamic mix of regional and international players. Leading participants such as Decathlon Sports India Pvt. Ltd., Nike India Pvt. Ltd., Adidas India Pvt. Ltd., Puma Sports India Pvt. Ltd., Reebok India Company, Wildcraft India Pvt. Ltd., Nivia Sports Pvt. Ltd., Cosco (India) Ltd., Kookaburra Sports India Pvt. Ltd., Yonex Sunrise India Pvt. Ltd., Li-Ning India Pvt. Ltd., Head Sports India Pvt. Ltd., BSA Motors Ltd., Speedo India Pvt. Ltd., Skechers India Pvt. Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the India sports equipment and fitness gear market appears promising, driven by technological advancements and a growing emphasis on health. The integration of smart technology in fitness products is expected to enhance user experience, while the rise of home fitness solutions will cater to the increasing demand for convenience. Additionally, the market is likely to see a surge in eco-friendly products as sustainability becomes a priority for consumers and manufacturers alike.

| Segment | Sub-Segments |

|---|---|

| By Type | Fitness Equipment Sports Apparel Footwear Accessories Team Sports Equipment Individual Sports Equipment Others |

| By End-User | Individual Consumers Gyms and Fitness Centers Schools and Colleges Sports Teams and Clubs |

| By Region | North India South India East India West India |

| By Sales Channel | Online Retail Offline Retail Direct Sales |

| By Price Range | Budget Mid-range Premium |

| By Brand Loyalty | Brand Loyal Customers Price-sensitive Customers First-time Buyers |

| By Product Lifecycle Stage | Introduction Stage Growth Stage Maturity Stage Decline Stage |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Fitness Equipment Retailers | 150 | Store Managers, Sales Executives |

| Fitness Trainers and Coaches | 100 | Personal Trainers, Gym Instructors |

| Consumers of Fitness Gear | 200 | Fitness Enthusiasts, Casual Users |

| Sports Equipment Manufacturers | 80 | Product Development Managers, Marketing Heads |

| Health and Fitness Influencers | 50 | Bloggers, Social Media Influencers |

The India Sports Equipment and Fitness Gear Market is valued at approximately INR 30,000 million, reflecting a significant growth trend driven by increasing health consciousness, rising disposable incomes, and a growing interest in fitness and sports participation among the population.