Region:Asia

Author(s):Geetanshi

Product Code:KRAA5008

Pages:92

Published On:September 2025

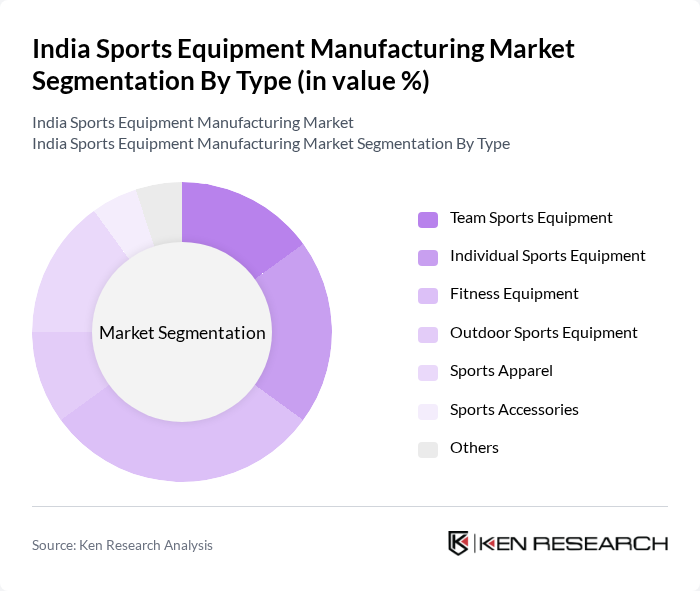

By Type:The market is segmented into various types of sports equipment, including Team Sports Equipment, Individual Sports Equipment, Fitness Equipment, Outdoor Sports Equipment, Sports Apparel, Sports Accessories, and Others. Among these, Fitness Equipment has emerged as a dominant segment due to the growing trend of home workouts and fitness awareness among consumers. The increasing number of fitness centers and gyms has also contributed to the rising demand for fitness-related products.

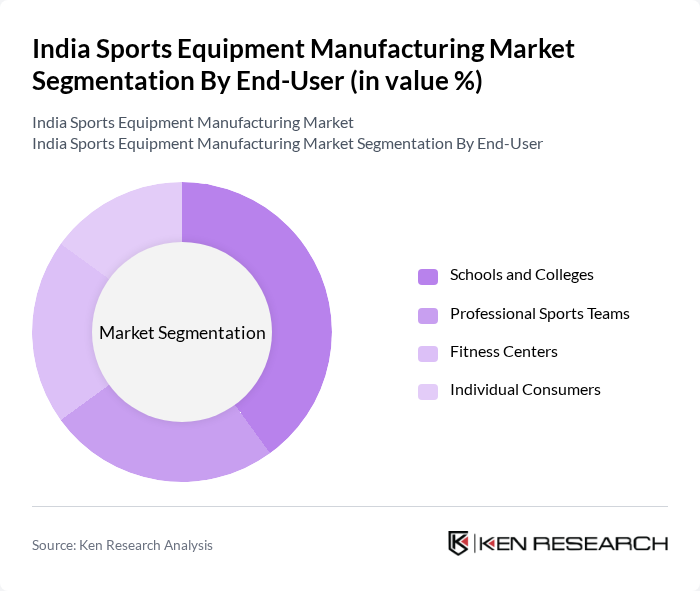

By End-User:The end-user segmentation includes Schools and Colleges, Professional Sports Teams, Fitness Centers, and Individual Consumers. The segment of Schools and Colleges is currently leading the market, driven by the increasing emphasis on sports education and extracurricular activities in educational institutions. This trend is further supported by government initiatives promoting sports in schools, leading to higher investments in sports equipment.

The India Sports Equipment Manufacturing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nivia Sports, Cosco India Ltd., Adidas India, Nike India, Puma India, Reebok India, Yonex Sunrise India, Decathlon Sports India, Kookaburra Sports India, SG Cricket, Head Sports, Wilson Sporting Goods, Babolat India, Li-Ning India, TATA Sports contribute to innovation, geographic expansion, and service delivery in this space.

The future of the India sports equipment manufacturing market appears promising, driven by increasing health consciousness and government support for sports initiatives. As urbanization continues, more individuals are expected to engage in fitness activities, further boosting demand for sports equipment. Additionally, advancements in technology will likely lead to innovative products that cater to evolving consumer preferences. The market is poised for growth, with local manufacturers adapting to trends and enhancing their competitive edge through quality and customization.

| Segment | Sub-Segments |

|---|---|

| By Type | Team Sports Equipment Individual Sports Equipment Fitness Equipment Outdoor Sports Equipment Sports Apparel Sports Accessories Others |

| By End-User | Schools and Colleges Professional Sports Teams Fitness Centers Individual Consumers |

| By Region | North India South India East India West India |

| By Distribution Channel | Online Retail Offline Retail Direct Sales |

| By Price Range | Budget Mid-Range Premium |

| By Material | Metal Plastic Composite |

| By Brand Positioning | Luxury Brands Mid-Tier Brands Value Brands |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Manufacturers of Fitness Equipment | 100 | Production Managers, Quality Control Officers |

| Retailers of Team Sports Gear | 80 | Store Managers, Sales Executives |

| Distributors of Individual Sports Equipment | 70 | Distribution Managers, Logistics Coordinators |

| Importers of Sports Goods | 60 | Import Managers, Compliance Officers |

| Government Sports Promotion Agencies | 50 | Policy Makers, Program Coordinators |

The India Sports Equipment Manufacturing Market is valued at approximately INR 12,000 crore, reflecting a significant growth trend driven by increased participation in sports and fitness activities, as well as rising disposable incomes among consumers.