Indonesia Aramid Fiber Market Overview

- The Indonesia Aramid Fiber Market is valued at USD 120 million, based on a five-year historical analysis. This valuation reflects Indonesia’s share within the Asia-Pacific market, which is estimated at over USD 1.2 billion, with Indonesia being a significant but not leading contributor in the region. Growth is primarily driven by the increasing demand for high-performance, lightweight, and durable materials across automotive, aerospace, defense, and construction industries. The adoption of aramid fibers is further propelled by the need for enhanced safety, emission reduction, and heat resistance in end-use applications, especially in automotive and protective equipment manufacturing .

- Key regions dominating the market include Java and Sumatra, where industrial activities are concentrated. Java, as the economic hub, hosts numerous manufacturing facilities, automotive assemblers, and research institutions, fostering innovation and production. Sumatra’s abundant natural resources and proximity to industrial ports contribute to the aramid fiber supply chain, making these regions pivotal in the national market landscape .

- The Regulation of the Minister of Industry of the Republic of Indonesia Number 22 of 2023 on the Use of Domestic Products in the Construction and Manufacturing Sectors, issued by the Ministry of Industry, mandates increased utilization of advanced materials—including aramid fibers—in government and public infrastructure projects. The regulation provides fiscal incentives and procurement preferences for companies integrating advanced materials, aiming to enhance safety standards, promote local production, and reduce environmental impact.

Indonesia Aramid Fiber Market Segmentation

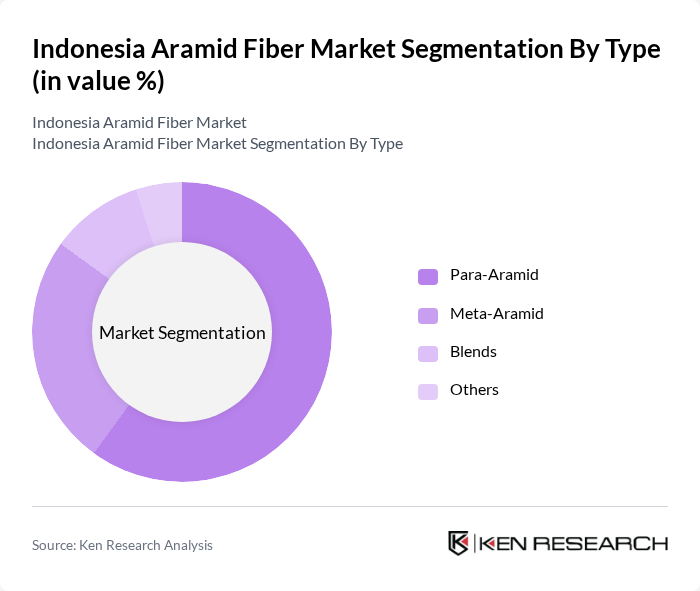

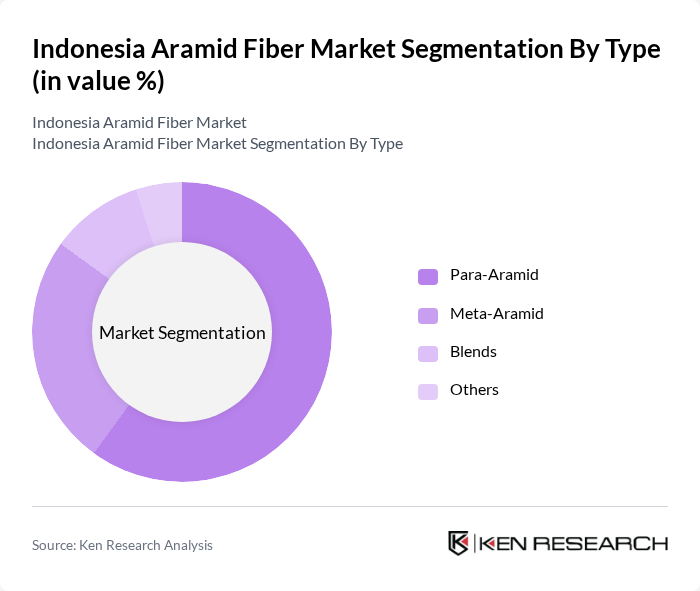

By Type:The market is segmented into Para-Aramid, Meta-Aramid, Blends, and Others. Para-Aramid fibers are widely used due to their exceptional tensile strength, lightweight nature, and thermal stability, making them the leading sub-segment for applications such as ballistic protection, automotive reinforcement, and industrial filtration. Meta-Aramid fibers, while also strong, are primarily utilized in applications requiring superior heat and flame resistance, such as protective apparel and electrical insulation. Blends and other types address niche requirements, but their overall market impact remains limited compared to Para-Aramid .

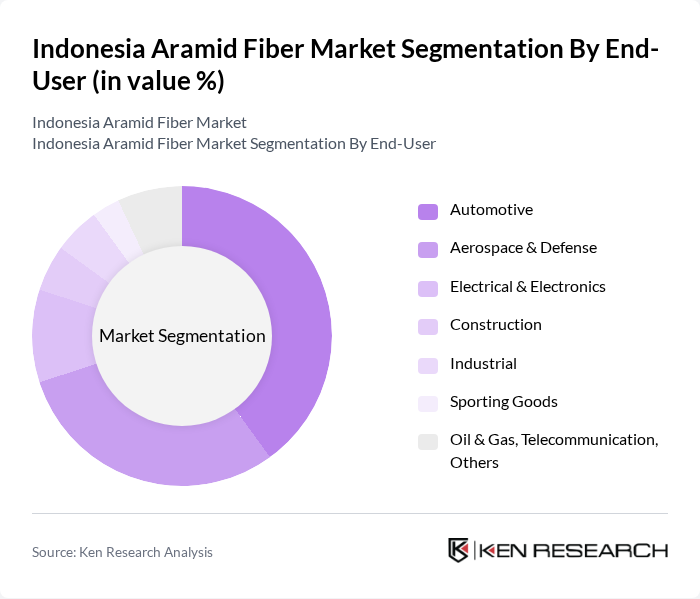

By End-User:The end-user segments include Automotive, Aerospace & Defense, Electrical & Electronics, Construction, Industrial, Sporting Goods, Oil & Gas, Telecommunication, and Others. The automotive sector is the largest consumer of aramid fibers, driven by the increasing use of lightweight and durable materials for emission reduction and safety enhancements in brake pads, tires, and composites. Aerospace & Defense follows, with high-performance materials critical for ballistic protection, aircraft components, and personal armor. Other sectors, including electrical insulation, construction, and industrial filtration, are experiencing steady growth but remain smaller in scale compared to automotive and defense applications .

Indonesia Aramid Fiber Market Competitive Landscape

The Indonesia Aramid Fiber Market is characterized by a dynamic mix of regional and international players. Leading participants such as DuPont de Nemours, Inc., Teijin Limited, Teijin Aramid, Kolon Industries, Inc., Hyosung Corporation, Yantai Tayho Advanced Materials Co., Ltd., Kermel, SGL Carbon SE, Toray Industries, Inc., Jiangsu Dazheng Group, Hubei Huitian New Material Co., Ltd., Zhaoda Special Materials Co., Ltd., Kordsa Teknik Tekstil A.?., Jushi Group Co., Ltd., Aramid HPM, Huvis Corp., Solvay S.A. contribute to innovation, geographic expansion, and service delivery in this space.

Indonesia Aramid Fiber Market Industry Analysis

Growth Drivers

- Increasing Demand from Automotive Sector:The automotive sector in Indonesia is projected to produce over 1.5 million vehicles in future, driving the demand for aramid fibers due to their lightweight and high-strength properties. As manufacturers seek to enhance fuel efficiency and reduce emissions, the use of aramid fibers in components such as tires and body panels is expected to rise significantly. This trend aligns with Indonesia's commitment to sustainable automotive practices, further boosting aramid fiber consumption.

- Rising Need for Lightweight Materials:The Indonesian construction industry is anticipated to grow by 6.5% in future, increasing the demand for lightweight materials like aramid fibers. These materials are essential for improving structural integrity while minimizing weight, which is crucial for modern construction projects. As urbanization accelerates, the need for innovative materials that enhance energy efficiency and reduce costs will further propel the adoption of aramid fibers in various applications.

- Growth in Defense and Aerospace Applications:Indonesia's defense budget is projected to reach USD 10 billion in future, reflecting a growing focus on enhancing military capabilities. This increase will likely drive demand for aramid fibers, which are critical in manufacturing bulletproof vests, helmets, and aircraft components. The aerospace sector is also expanding, with plans for new aircraft manufacturing, further solidifying aramid fibers' role in high-performance applications within these industries.

Market Challenges

- High Production Costs:The production costs of aramid fibers in Indonesia are significantly high, averaging around USD 30 per kilogram. This is primarily due to the complex manufacturing processes and the need for specialized equipment. As a result, local manufacturers face challenges in competing with cheaper alternatives, which can hinder market growth. The high costs also limit the accessibility of aramid fibers for smaller enterprises, impacting overall market penetration.

- Limited Awareness Among End-Users:Many potential end-users in Indonesia remain unaware of the benefits of aramid fibers, particularly in sectors like construction and automotive. A survey indicated that only 40% of manufacturers are familiar with aramid fiber applications. This lack of awareness can lead to underutilization of these materials, stifling market growth. Educational initiatives and marketing strategies are essential to increase understanding and drive adoption across various industries.

Indonesia Aramid Fiber Market Future Outlook

The future of the aramid fiber market in Indonesia appears promising, driven by increasing investments in technology and infrastructure. As industries prioritize sustainability, the shift towards eco-friendly materials will likely enhance the demand for aramid fibers. Additionally, the government's support for local production and innovation will foster a conducive environment for growth. With the rising focus on advanced applications in defense and aerospace, the market is poised for significant expansion in the coming years.

Market Opportunities

- Technological Advancements in Fiber Production:Innovations in fiber production technology are expected to reduce costs and improve the quality of aramid fibers. This advancement can enhance competitiveness and open new applications in various sectors, including automotive and construction, thereby increasing market share and profitability for local manufacturers.

- Collaborations with Local Manufacturers:Strategic partnerships between aramid fiber producers and local manufacturers can facilitate knowledge transfer and enhance production capabilities. Such collaborations can lead to the development of customized solutions tailored to specific industry needs, driving demand and expanding market reach in Indonesia's growing sectors.