Region:Asia

Author(s):Rebecca

Product Code:KRAA9273

Pages:93

Published On:November 2025

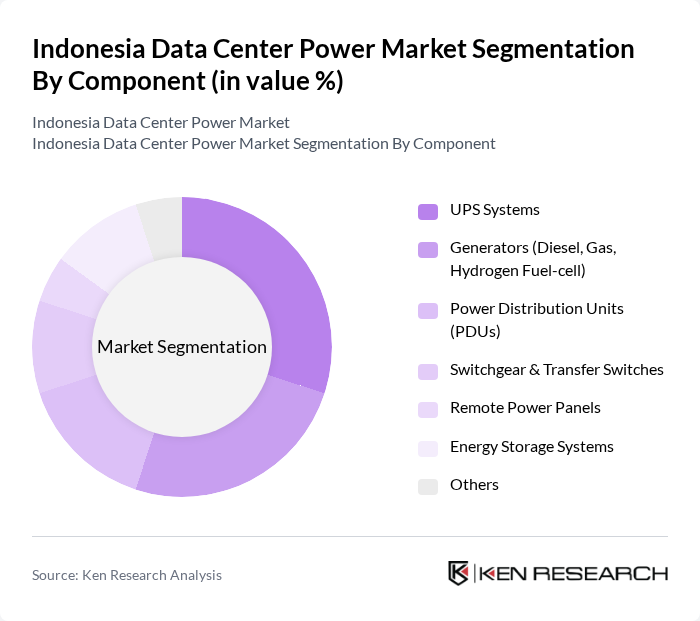

By Component:The components of the market include various essential technologies that support data center operations. The primary subsegments are UPS Systems, Generators (Diesel, Gas, Hydrogen Fuel-cell), Power Distribution Units (PDUs), Switchgear & Transfer Switches, Remote Power Panels, Energy Storage Systems, and Others. Among these, UPS Systems are particularly crucial as they ensure uninterrupted power supply, which is vital for data center reliability. UPS Systems held a market share of 28.4 percent in 2024, reflecting their critical role in mitigating grid volatility and ensuring seamless fail-over. Power Distribution Units are also gaining traction due to rising demand for intelligent, high-density power distribution in AI and hyperscale environments .

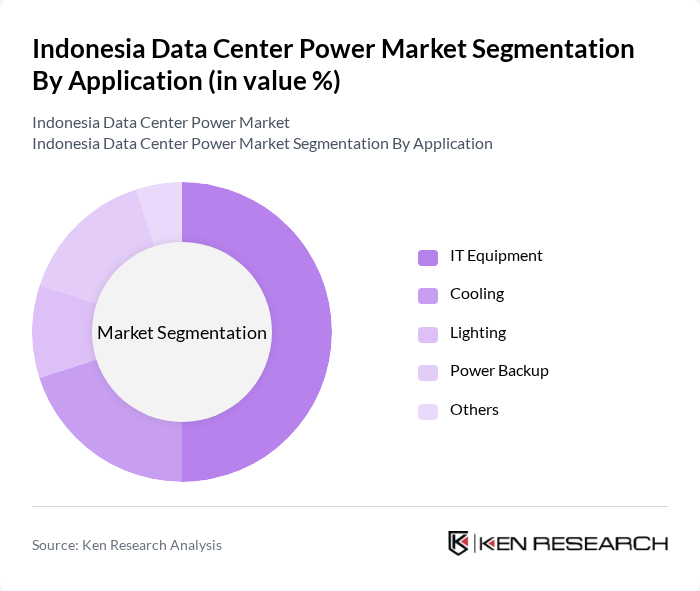

By Application:The applications of data center power solutions encompass various operational needs, including IT Equipment, Cooling, Lighting, Power Backup, and Others. IT Equipment is the dominant application, as it requires substantial power for servers, storage devices, and networking equipment, which are critical for data processing and management. The IT Equipment segment held a market share of 50 percent in 2024, driven by the rapid expansion of hyperscale and colocation data centers, as well as the growing demand for cloud computing and AI-driven workloads .

The Indonesia Data Center Power Market is characterized by a dynamic mix of regional and international players. Leading participants such as PT DCI Indonesia Tbk, PT Telkom Data Ekosistem (NeutraDC), PT Indosat Tbk (Indosat Ooredoo Hutchison), PT XL Axiata Tbk, PT NTT Indonesia, PT Cyber CSF, PT Lintasarta, PT CBN Data Utama, PT Biznet Data Center (Biznet Gio), PT Princeton Digital Group Indonesia, PT Equinix Indonesia, PT EdgeConneX Indonesia, PT SpaceDC Indonesia, PT Elitery Data Center, PT Vantage Data Centers Indonesia contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Indonesia Data Center Power Market appears promising, driven by increasing digitalization and technological advancements. As businesses continue to embrace cloud computing and e-commerce, the demand for data center power is expected to rise. Additionally, the government's commitment to enhancing digital infrastructure will likely create a favorable environment for investment. However, addressing energy costs and regulatory challenges will be crucial for sustainable growth, ensuring that the market can meet the evolving needs of the digital economy.

| Segment | Sub-Segments |

|---|---|

| By Component | UPS Systems Generators (Diesel, Gas, Hydrogen Fuel-cell) Power Distribution Units (PDUs) Switchgear & Transfer Switches Remote Power Panels Energy Storage Systems Others |

| By Application | IT Equipment Cooling Lighting Power Backup Others |

| By End-User | Colocation Providers Hyperscale/Cloud Service Providers Enterprise/Corporate Government Telecom & IT Healthcare Others |

| By Tier Level | Tier I Tier II Tier III Tier IV |

| By Geography | Java (including Jakarta) Sumatra Kalimantan Sulawesi Bali & Nusa Tenggara Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hyperscale Data Centers | 100 | Energy Managers, Facility Directors |

| Colocation Providers | 80 | Operations Managers, Technical Leads |

| Enterprise Data Centers | 70 | IT Managers, Infrastructure Architects |

| Energy Efficiency Consultants | 40 | Consultants, Sustainability Officers |

| Government Energy Regulators | 40 | Policy Makers, Regulatory Analysts |

The Indonesia Data Center Power Market is valued at approximately USD 350 million, reflecting significant growth driven by increasing demand for data storage and processing capabilities across various sectors, including e-commerce, finance, and telecommunications.