Region:Asia

Author(s):Shubham

Product Code:KRAA8954

Pages:99

Published On:November 2025

By Component:The market is segmented intoSoftwareandServices. The software segment is experiencing robust growth, driven by the increasing demand for AI-powered image processing applications in healthcare diagnostics, retail analytics, and industrial automation. The services segment remains essential for providing integration, support, and maintenance to enterprise and government users .

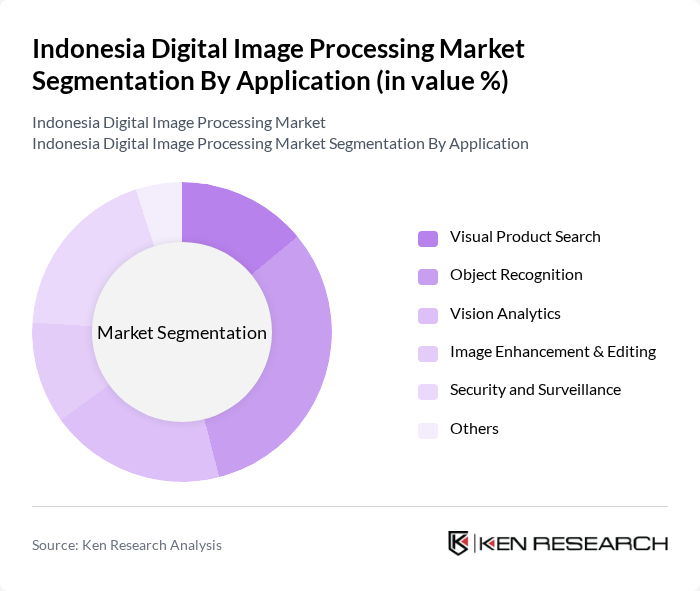

By Application:The applications of digital image processing in Indonesia includeVisual Product Search, Object Recognition, Vision Analytics, Image Enhancement & Editing, Security and Surveillance,andOthers. TheObject Recognitionsegment leads due to its widespread adoption in retail, security, and smart city initiatives. Vision analytics and security applications are also expanding rapidly, supported by government and enterprise investments in surveillance and automation .

The Indonesia Digital Image Processing Market is characterized by a dynamic mix of regional and international players. Leading participants such as PT. Datascrip, PT. DCI Indonesia Tbk, PT. Visionet Data Internasional (OVO), PT. Nodeflux Teknologi Indonesia, PT. Qlue Performa Indonesia, PT. Medikaloka Hermina Tbk (Hermina Hospitals – Medical Imaging), PT. Kimia Farma Diagnostika, PT. Telkom Indonesia (Telkomsigma), PT. Solusi247, PT. Mitra Integrasi Informatika (Metrodata Group), PT. Indocyber Global Teknologi, PT. Elitery Teknologi Indonesia, PT. Synnex Metrodata Indonesia, PT. Inovasi Informatika Indonesia (i3), and PT. Gamatechno Indonesia contribute to innovation, geographic expansion, and service delivery in this space.

The future of the digital image processing market in Indonesia appears promising, driven by technological advancements and increasing consumer demand. As businesses continue to embrace digital transformation, the integration of innovative imaging solutions will become essential. The anticipated growth in mobile imaging applications and the healthcare sector's adoption of image processing technologies will likely create new avenues for market expansion. Furthermore, collaborations with tech startups are expected to foster innovation, enhancing the overall competitive landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Component | Software Services |

| By Application | Visual Product Search Object Recognition Vision Analytics Image Enhancement & Editing Security and Surveillance Others |

| By End-Use Industry | Healthcare Automotive & Transportation Retail & E-Commerce Banking, Financial Services, and Insurance (BFSI) Media and Entertainment Education Government & Public Sector Others |

| By Technology | Machine Learning Deep Learning Computer Vision D Imaging Others |

| By Deployment Model | On-Premises Cloud-Based Hybrid |

| By Region | Java Sumatra Kalimantan Sulawesi Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Imaging Solutions | 100 | Radiologists, Medical Imaging Technologists |

| Security and Surveillance Systems | 60 | Security Managers, IT Security Analysts |

| Manufacturing Quality Control | 50 | Quality Assurance Managers, Production Supervisors |

| Entertainment and Media Applications | 40 | Media Producers, Digital Content Creators |

| Research and Development in Image Processing | 70 | R&D Managers, Software Engineers |

The Indonesia Digital Image Processing Market is valued at approximately USD 410 million, reflecting significant growth driven by the increasing adoption of digital technologies across various sectors, including healthcare, retail, and automotive.