Region:Asia

Author(s):Dev

Product Code:KRAB3030

Pages:83

Published On:October 2025

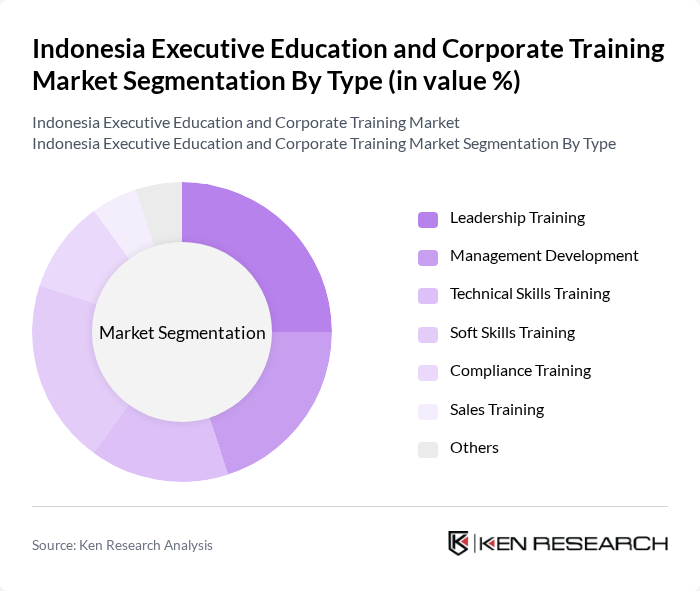

By Type:The market is segmented into various types of training programs, including Leadership Training, Management Development, Technical Skills Training, Soft Skills Training, Compliance Training, Sales Training, and Others. Each of these sub-segments caters to specific organizational needs and employee development goals.

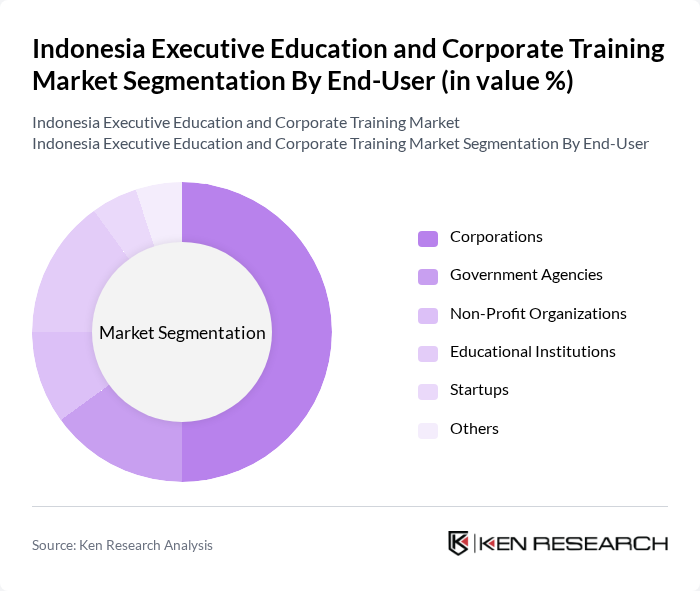

By End-User:The end-user segmentation includes Corporations, Government Agencies, Non-Profit Organizations, Educational Institutions, Startups, and Others. Each segment reflects the diverse clientele seeking executive education and corporate training services tailored to their specific operational requirements.

The Indonesia Executive Education and Corporate Training Market is characterized by a dynamic mix of regional and international players. Leading participants such as Universitas Gadjah Mada, Prasetiya Mulya Business School, Indonesia Institute for Corporate Training, Binus University, Jakarta International College, Executive Education Center, PPM Manajemen, Telkom University, Swiss German University, Universitas Pelita Harapan, SEAMOLEC, Lembaga Pengembangan Sumber Daya Manusia, Universitas Kristen Satya Wacana, Universitas Airlangga, Universitas Diponegoro contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Indonesian executive education and corporate training market appears promising, driven by technological advancements and a growing emphasis on workforce development. As companies increasingly adopt digital learning solutions, the demand for customized training programs will rise. Furthermore, partnerships with international institutions are likely to enhance the quality and credibility of local training offerings, positioning Indonesia as a competitive player in the global education landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Leadership Training Management Development Technical Skills Training Soft Skills Training Compliance Training Sales Training Others |

| By End-User | Corporations Government Agencies Non-Profit Organizations Educational Institutions Startups Others |

| By Delivery Mode | Online Learning In-Person Training Hybrid Learning Workshops and Seminars Others |

| By Duration | Short Courses (1-3 days) Medium Courses (1-4 weeks) Long Courses (1-6 months) Others |

| By Certification Type | Accredited Programs Non-Accredited Programs Professional Certifications Others |

| By Industry | Finance and Banking Information Technology Manufacturing Healthcare Retail Others |

| By Geographic Focus | Urban Areas Rural Areas Regional Focus (Java, Sumatra, etc.) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Training Providers | 100 | CEOs, Program Directors, Marketing Managers |

| HR Departments in Large Corporations | 150 | HR Managers, Learning & Development Specialists |

| Participants of Executive Education Programs | 80 | Mid to Senior-Level Executives, Team Leaders |

| Industry Associations and Regulatory Bodies | 50 | Policy Makers, Education Consultants |

| Academic Institutions Offering Executive Programs | 70 | Deans, Program Coordinators, Faculty Members |

The Indonesia Executive Education and Corporate Training Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the demand for skilled professionals and the rapid digital transformation in various sectors.