Region:Central and South America

Author(s):Dev

Product Code:KRAB3147

Pages:93

Published On:October 2025

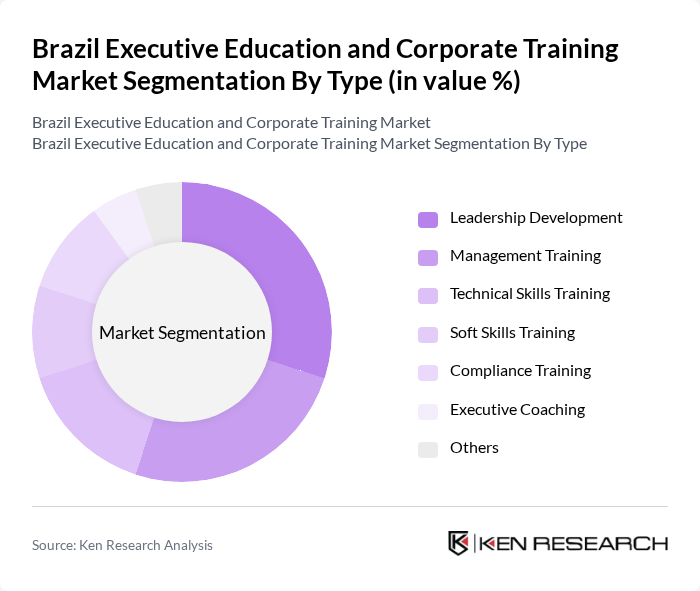

By Type:The market is segmented into various types of training programs, including Leadership Development, Management Training, Technical Skills Training, Soft Skills Training, Compliance Training, Executive Coaching, and Others. Among these, Leadership Development and Management Training are particularly prominent, as organizations prioritize developing effective leaders and managers to drive business success.

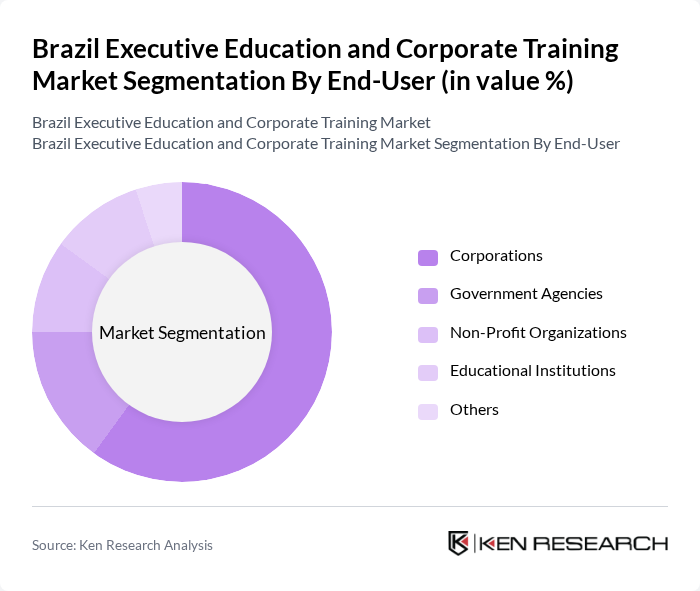

By End-User:The end-user segmentation includes Corporations, Government Agencies, Non-Profit Organizations, Educational Institutions, and Others. Corporations are the leading end-users, as they invest heavily in training programs to enhance employee skills and maintain a competitive edge in the market.

The Brazil Executive Education and Corporate Training Market is characterized by a dynamic mix of regional and international players. Leading participants such as Fundação Getulio Vargas (FGV), Insper, Dom Cabral Foundation, HSM Educação, ESPM (Escola Superior de Propaganda e Marketing), PUC-Rio (Pontifícia Universidade Católica do Rio de Janeiro), FIA (Fundação Instituto de Administração), SENAC (Serviço Nacional de Aprendizagem Comercial), ABERJE (Associação Brasileira de Comunicação Empresarial), Grupo de Ensino Superior (GES), Trevisan Escola de Negócios, Escola de Negócios da PUCRS, Escola de Administração de Empresas de São Paulo (EAESP), Escola de Negócios da UFMG, Escola de Negócios da UFRJ contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Brazilian executive education and corporate training market appears promising, driven by technological advancements and a growing emphasis on continuous learning. As organizations increasingly adopt hybrid learning models, the demand for innovative training solutions is expected to rise. Furthermore, the focus on soft skills development will likely gain traction, as companies recognize the importance of interpersonal skills in enhancing team dynamics and overall productivity. This evolving landscape presents opportunities for local providers to adapt and thrive.

| Segment | Sub-Segments |

|---|---|

| By Type | Leadership Development Management Training Technical Skills Training Soft Skills Training Compliance Training Executive Coaching Others |

| By End-User | Corporations Government Agencies Non-Profit Organizations Educational Institutions Others |

| By Delivery Mode | In-Person Training Online Training Hybrid Training Workshops and Seminars Others |

| By Duration | Short Courses (1-3 days) Medium Courses (1-4 weeks) Long Courses (1-6 months) Others |

| By Certification Type | Accredited Programs Non-Accredited Programs Professional Development Certificates Others |

| By Industry Focus | Finance and Banking Healthcare Technology Manufacturing Others |

| By Price Range | Low-End (Under $500) Mid-Range ($500 - $2000) High-End (Above $2000) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Training Providers | 100 | CEOs, Program Directors |

| Executive Education Participants | 150 | Mid to Senior-Level Managers, HR Professionals |

| Industry Experts and Consultants | 80 | Training Consultants, Educational Researchers |

| Corporate HR Departments | 120 | HR Managers, Learning and Development Specialists |

| Government Education Officials | 50 | Policy Makers, Education Program Administrators |

The Brazil Executive Education and Corporate Training Market is valued at approximately USD 2.5 billion, reflecting a significant investment by companies in training programs to enhance employee skills and adapt to technological advancements.