Region:Africa

Author(s):Shubham

Product Code:KRAB5558

Pages:100

Published On:October 2025

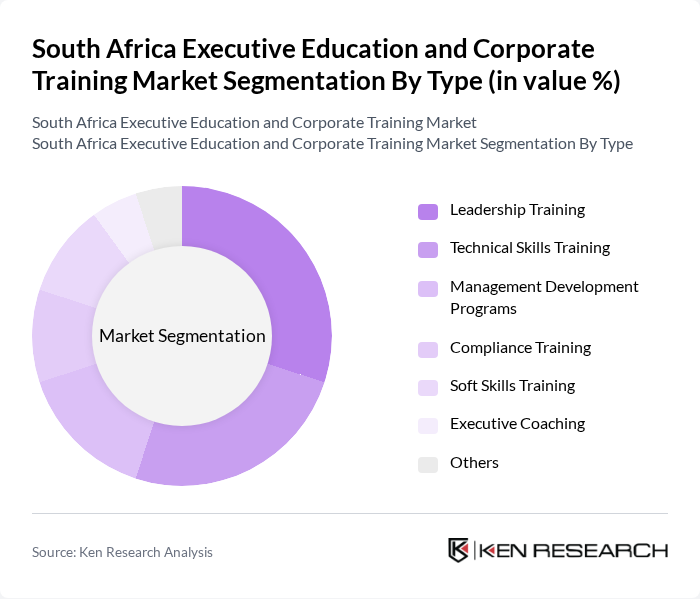

By Type:The market is segmented into various types of training programs that cater to the diverse needs of professionals and organizations. Leadership Training, Technical Skills Training, Management Development Programs, Compliance Training, Soft Skills Training, Executive Coaching, and Others are the primary categories. Among these, Leadership Training is currently the most sought-after segment, driven by the increasing emphasis on effective leadership in organizations.

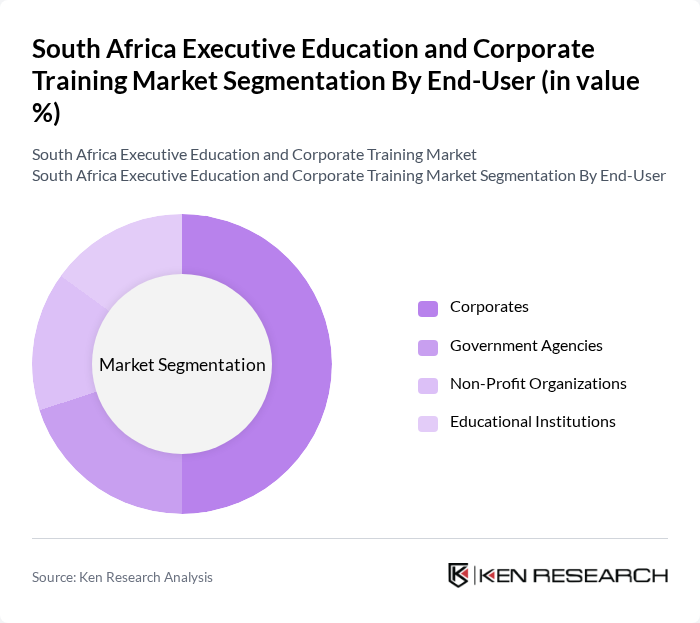

By End-User:The market is also segmented based on the end-users of training programs, which include Corporates, Government Agencies, Non-Profit Organizations, and Educational Institutions. Corporates are the leading end-users, as they increasingly recognize the importance of continuous employee development to maintain competitiveness and adapt to changing market demands.

The South Africa Executive Education and Corporate Training Market is characterized by a dynamic mix of regional and international players. Leading participants such as University of Cape Town Graduate School of Business, Wits Business School, Gordon Institute of Business Science, Henley Business School, Milpark Education, GetSmarter, The Da Vinci Institute, University of Stellenbosch Business School, MANCOSA, Regenesys Business School, UCT GSB Solution Space, LearnSmart, DQ Institute, The Business School at the University of Cape Town, The Institute of People Development contribute to innovation, geographic expansion, and service delivery in this space.

The future of the South African executive education and corporate training market appears promising, driven by the ongoing digital transformation and the increasing emphasis on employee development. As organizations continue to prioritize skills enhancement, the demand for innovative training solutions is expected to rise. Furthermore, the integration of advanced technologies, such as artificial intelligence and data analytics, will likely reshape training methodologies, making them more effective and tailored to individual needs, thus fostering a culture of continuous learning.

| Segment | Sub-Segments |

|---|---|

| By Type | Leadership Training Technical Skills Training Management Development Programs Compliance Training Soft Skills Training Executive Coaching Others |

| By End-User | Corporates Government Agencies Non-Profit Organizations Educational Institutions |

| By Delivery Mode | Online Learning In-Person Training Hybrid Learning |

| By Duration | Short Courses (Less than 1 month) Medium Courses (1-3 months) Long Courses (More than 3 months) |

| By Certification Type | Accredited Certifications Non-Accredited Certifications |

| By Industry Focus | Finance and Banking Information Technology Healthcare Manufacturing |

| By Geographic Reach | National Regional International |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Executive Education Programs | 150 | HR Directors, Learning and Development Managers |

| Industry-Specific Training Initiatives | 100 | Training Coordinators, Operations Managers |

| Online Learning Platforms for Corporates | 80 | IT Managers, E-learning Specialists |

| Leadership Development Programs | 70 | Executive Coaches, Program Directors |

| Workshops and Seminars | 90 | Participants, Facilitators, Industry Experts |

The South Africa Executive Education and Corporate Training Market is valued at approximately USD 1.2 billion, reflecting a significant growth trend driven by the demand for skilled professionals and the rise of digital learning platforms.