Region:Europe

Author(s):Dev

Product Code:KRAB3046

Pages:99

Published On:October 2025

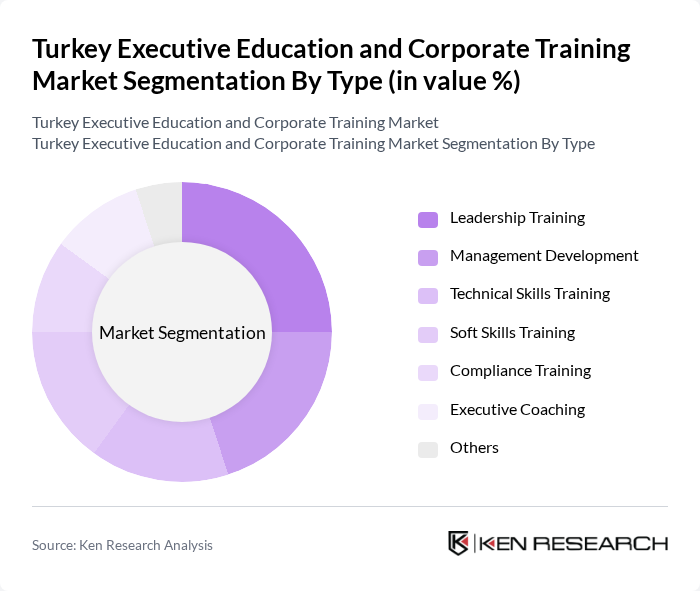

By Type:The market is segmented into various types of training programs, including Leadership Training, Management Development, Technical Skills Training, Soft Skills Training, Compliance Training, Executive Coaching, and Others. Leadership Training is gaining traction as organizations recognize the importance of developing effective leaders to drive business success. Management Development focuses on enhancing managerial skills, while Technical Skills Training addresses the need for specialized knowledge in various industries. Soft Skills Training is increasingly prioritized to improve interpersonal skills, and Compliance Training ensures adherence to regulations. Executive Coaching is also becoming popular for personalized development.

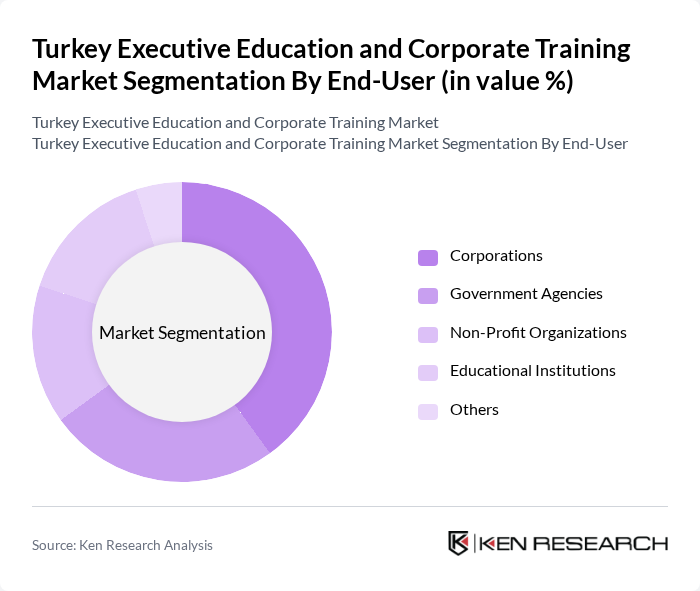

By End-User:The market is segmented by end-users, including Corporations, Government Agencies, Non-Profit Organizations, Educational Institutions, and Others. Corporations are the largest segment, driven by the need for workforce development and competitive advantage. Government Agencies invest in training to enhance public service efficiency, while Non-Profit Organizations focus on capacity building. Educational Institutions are increasingly offering executive education programs to cater to adult learners, and other sectors also contribute to the market.

The Turkey Executive Education and Corporate Training Market is characterized by a dynamic mix of regional and international players. Leading participants such as Koç University Executive Education, Sabanc? University Executive Development Unit, Istanbul Business School, Bo?aziçi University Lifelong Learning Center, Özye?in University Executive Education, Istanbul Technical University Executive Education, Yeditepe University Executive Education, Hacettepe University Continuing Education Center, Bilkent University Executive Education, Anadolu University Executive Education, Ekol E?itim, TEGV (Turkish Educational Volunteers Foundation), MEB (Ministry of National Education), TEG (Turkish Education Group), EBSO (Aegean Region Chamber of Industry) contribute to innovation, geographic expansion, and service delivery in this space.

The Turkey Executive Education and Corporate Training Market is poised for significant transformation as organizations increasingly embrace digital learning and innovative training methodologies. In the future, the integration of artificial intelligence in training programs is expected to enhance personalized learning experiences, while the focus on soft skills development will address the evolving needs of the workforce. As companies prioritize leadership training, the market will likely see a shift towards experiential learning approaches, fostering a more agile and skilled workforce ready to meet future challenges.

| Segment | Sub-Segments |

|---|---|

| By Type | Leadership Training Management Development Technical Skills Training Soft Skills Training Compliance Training Executive Coaching Others |

| By End-User | Corporations Government Agencies Non-Profit Organizations Educational Institutions Others |

| By Delivery Mode | In-Person Training Online Training Hybrid Training On-the-Job Training Others |

| By Duration | Short Courses (1-3 days) Medium Courses (1-4 weeks) Long Courses (1-6 months) Others |

| By Certification Type | Professional Certifications Academic Certifications Industry-Specific Certifications Others |

| By Industry Focus | Finance and Banking Healthcare Information Technology Manufacturing Others |

| By Pricing Model | Subscription-Based Pay-Per-Course Corporate Packages Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Training Providers | 100 | CEOs, Program Directors, Business Development Managers |

| HR Departments in Large Enterprises | 150 | HR Managers, Learning & Development Specialists |

| Participants of Executive Education Programs | 80 | Mid to Senior-Level Executives, Team Leaders |

| Industry Associations and Regulatory Bodies | 50 | Policy Makers, Education Consultants, Industry Analysts |

| Small and Medium Enterprises (SMEs) | 70 | Business Owners, Operations Managers, Training Coordinators |

The Turkey Executive Education and Corporate Training Market is valued at approximately USD 1.2 billion, reflecting a growing demand for skilled professionals and continuous learning in a competitive business environment.