Region:Europe

Author(s):Shubham

Product Code:KRAB4413

Pages:80

Published On:October 2025

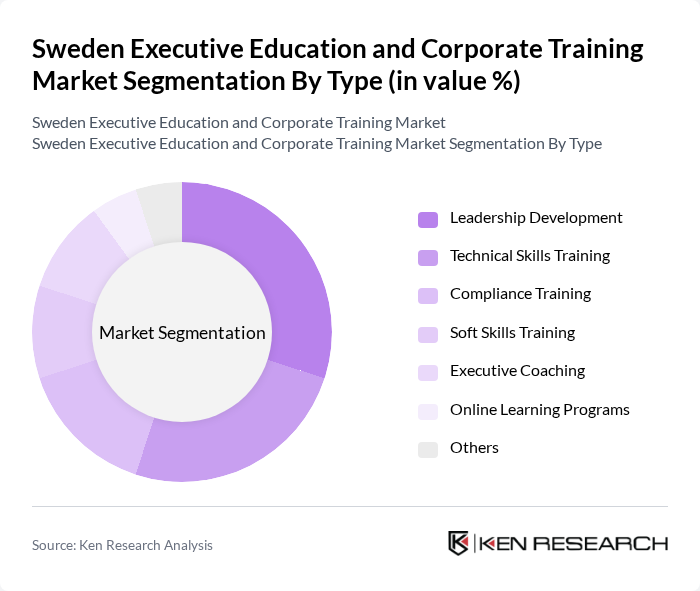

By Type:The market is segmented into various types of training programs, including Leadership Development, Technical Skills Training, Compliance Training, Soft Skills Training, Executive Coaching, Online Learning Programs, and Others. Leadership Development is currently the dominant segment, driven by the increasing need for effective leadership in organizations facing rapid changes. Technical Skills Training follows closely, as companies prioritize equipping their employees with the latest technical competencies to remain competitive.

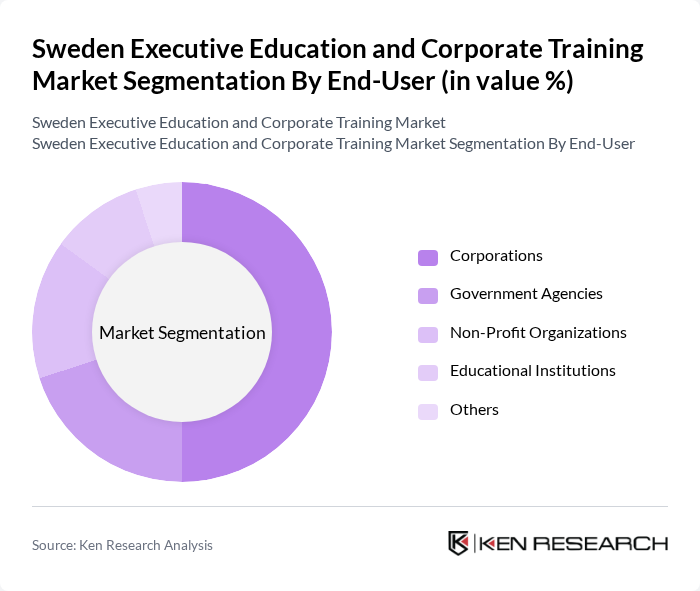

By End-User:The end-user segmentation includes Corporations, Government Agencies, Non-Profit Organizations, Educational Institutions, and Others. Corporations are the leading end-users, as they invest heavily in training programs to enhance employee skills and drive organizational performance. Government Agencies also play a significant role, focusing on workforce development initiatives to improve public sector efficiency.

The Sweden Executive Education and Corporate Training Market is characterized by a dynamic mix of regional and international players. Leading participants such as Stockholm School of Economics, Karolinska Institutet, Uppsala University, Lund University, Chalmers University of Technology, KTH Royal Institute of Technology, Hyper Island, Berghs School of Communication, IHM Business School, Medborgarskolan, Sigtuna Foundation, Stockholm Business School, Mälardalen University, Jönköping University, Umeå University contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Sweden executive education and corporate training market appears promising, driven by the increasing integration of technology in learning environments. As organizations prioritize employee development, the demand for innovative training solutions is expected to rise. Furthermore, the focus on personalized learning experiences will likely lead to the emergence of new training methodologies that cater to individual learning preferences, enhancing overall effectiveness and engagement in corporate training programs.

| Segment | Sub-Segments |

|---|---|

| By Type | Leadership Development Technical Skills Training Compliance Training Soft Skills Training Executive Coaching Online Learning Programs Others |

| By End-User | Corporations Government Agencies Non-Profit Organizations Educational Institutions Others |

| By Delivery Mode | In-Person Training Online Training Hybrid Training On-the-Job Training Others |

| By Duration | Short Courses (1-3 days) Medium Courses (1-4 weeks) Long Courses (1-6 months) Others |

| By Certification Type | Accredited Certifications Non-Accredited Certifications Professional Development Units (PDUs) Others |

| By Industry | Information Technology Healthcare Finance Manufacturing Others |

| By Pricing Model | Subscription-Based Pay-Per-Course Corporate Packages Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Training Programs | 150 | HR Managers, Training Coordinators |

| Executive Education Institutions | 100 | Program Directors, Academic Deans |

| Industry-Specific Training Needs | 80 | Operations Managers, Learning & Development Specialists |

| Digital Learning Platforms | 70 | IT Managers, E-learning Developers |

| Corporate Leadership Development | 90 | Senior Executives, Leadership Coaches |

The Sweden Executive Education and Corporate Training Market is valued at approximately USD 1.5 billion, reflecting a significant investment in upskilling and reskilling initiatives to enhance employee performance and adaptability in a rapidly evolving job market.