Region:Asia

Author(s):Shubham

Product Code:KRAB5657

Pages:91

Published On:October 2025

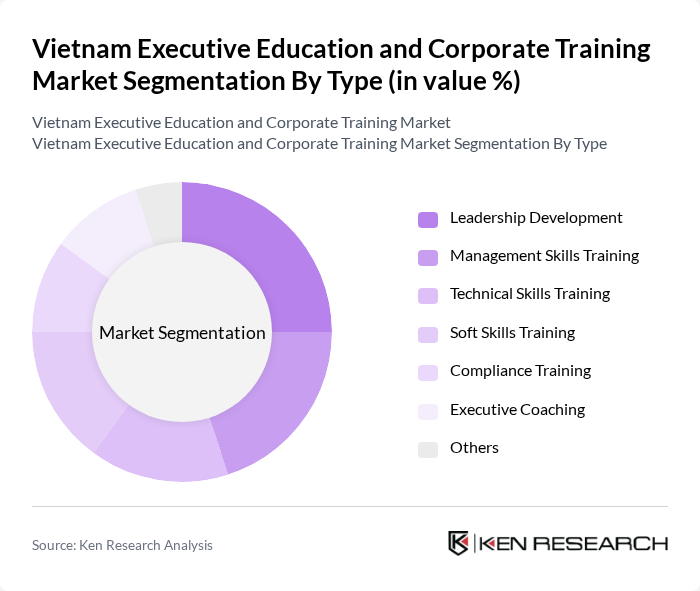

By Type:The market is segmented into various types of training programs, including Leadership Development, Management Skills Training, Technical Skills Training, Soft Skills Training, Compliance Training, Executive Coaching, and Others. Each of these sub-segments caters to specific needs within organizations, focusing on enhancing different skill sets among employees.

The Leadership Development sub-segment is currently dominating the market due to the increasing emphasis on cultivating effective leaders within organizations. Companies recognize that strong leadership is crucial for driving performance and fostering a positive workplace culture. As a result, there is a growing trend towards investing in leadership programs that equip individuals with the necessary skills to lead teams effectively and navigate complex business environments.

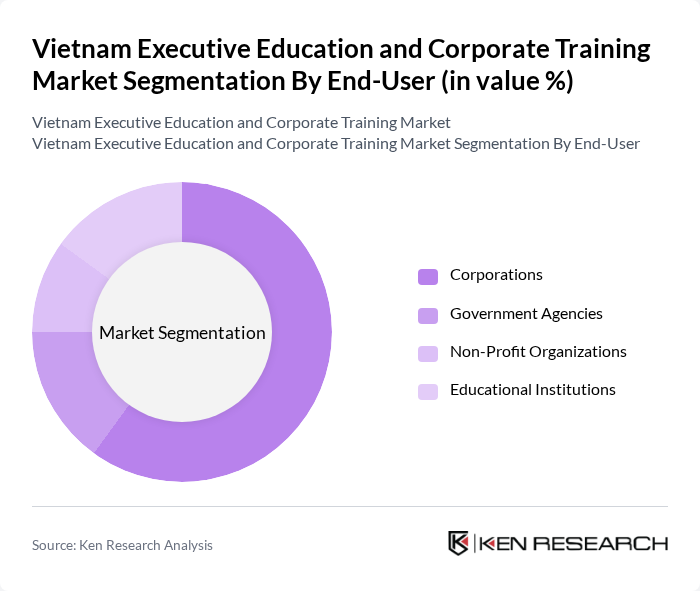

By End-User:The market is segmented by end-users, including Corporations, Government Agencies, Non-Profit Organizations, and Educational Institutions. Each of these segments has unique training needs and objectives, influencing the types of programs they seek.

Corporations are the leading end-user segment, accounting for a significant portion of the market. This dominance is attributed to the increasing need for organizations to upskill their workforce in response to technological advancements and competitive pressures. Corporations are investing heavily in training programs to enhance employee productivity and ensure alignment with strategic business goals.

The Vietnam Executive Education and Corporate Training Market is characterized by a dynamic mix of regional and international players. Leading participants such as FPT University, RMIT University Vietnam, Vietnam National University, Hoa Sen University, British University Vietnam, Talentnet Corporation, Navigos Group, KPMG Vietnam, PwC Vietnam, Deloitte Vietnam, ManpowerGroup Vietnam, Adecco Vietnam, Vietnam Chamber of Commerce and Industry, CMC Institute, HCM City University of Technology contribute to innovation, geographic expansion, and service delivery in this space.

The Vietnam Executive Education and Corporate Training Market is poised for significant transformation, driven by technological advancements and evolving workforce needs. As organizations increasingly adopt hybrid learning models, the demand for customized training solutions tailored to local contexts will rise. Furthermore, partnerships with international institutions will enhance program quality and credibility, fostering a culture of continuous learning. These trends indicate a robust future for the market, with opportunities for innovation and growth in executive education.

| Segment | Sub-Segments |

|---|---|

| By Type | Leadership Development Management Skills Training Technical Skills Training Soft Skills Training Compliance Training Executive Coaching Others |

| By End-User | Corporations Government Agencies Non-Profit Organizations Educational Institutions |

| By Delivery Mode | In-Person Training Online Training Hybrid Training |

| By Duration | Short Courses (1-3 days) Medium Courses (1-4 weeks) Long Courses (1-6 months) |

| By Certification Type | Accredited Programs Non-Accredited Programs |

| By Industry Focus | Technology Finance Healthcare Manufacturing |

| By Investment Source | Corporate Funding Government Grants Private Investments Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Training Providers | 100 | CEOs, Program Directors |

| HR Managers in Large Enterprises | 150 | HR Directors, Training Managers |

| Participants of Executive Education Programs | 80 | Mid to Senior-Level Executives |

| Government Officials in Education Sector | 50 | Policy Makers, Education Administrators |

| Industry Experts and Consultants | 60 | Consultants, Academic Researchers |

The Vietnam Executive Education and Corporate Training Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the demand for skilled professionals and the rapid pace of economic development in the country.